Stock Market Crashes Keep Happening

News

|

Posted 22/04/2024

|

5939

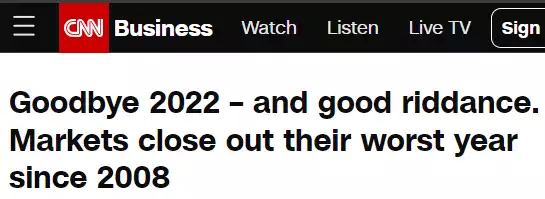

Why were these ignored? A "stock market crash" refers to a drop of 20% or more from the recent high. This chart shows how many have been ignored only recently.

The chart above shows the 2020 market crash, which most should be aware of. The white box highlighting the crash has been placed on crashes happening from 2021-2022, within 2022, and also on the most recent aggressive dip in price. Although, just in percentage terms, these boxes would be smaller drops since the market was higher, they did continue on to be 20%+ drops, or "crashes".

So where was the extensive coverage and reshuffling of portfolios? How many investors bailed out of falling stocks and then bought the dip? The extensive market tumbles went largely ignored.

Why focus on a market crash when there was plenty of other news to consume. Johnny Depp's court case performed much of the heavy lifting during the initial crash, and Russia/Ukraine swooped in later to carry the torch.

-CNN

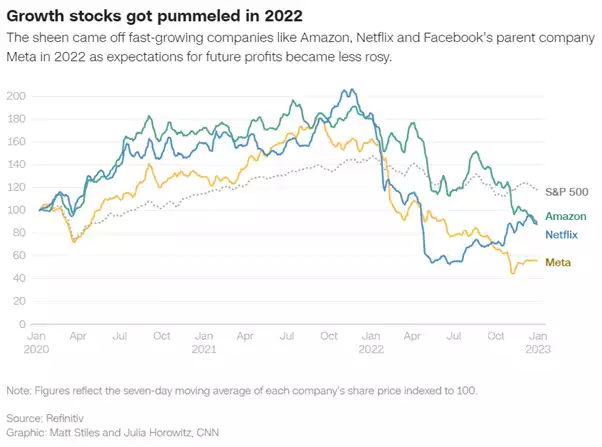

As covered by CNN, in 2022 a series of disruptive events, including Russia’s invasion of Ukraine, disruptions in supply chains, and the ongoing challenges posed by Covid, profoundly impacted global markets. Inflation soared worldwide, prompting central banks to implement unprecedented rate hikes to curb the risk of runaway price increases. China occasionally imposed city-wide shutdowns to manage the pandemic, further complicating economic dynamics. Energy supplies faced disruptions, and despite recessionary concerns, demand waned in the latter half of the year.

Against this backdrop, investors found few secure options to safeguard their investments. Stocks got hammered, while bonds faced even greater challenges. Inflationary pressures, substantial interest rate hikes, and a strengthening dollar rendered bonds unattractive to investors seeking stable returns.

-CNN

So, are we currently in the makings of another crash? If so, you can see on the 1st chart at the top of the article that we are one-third of the way there already. One of the biggest mental traps in relation to market crashes is "avoidance". This is where investors decide to avoid thinking about or addressing the problem in hopes that it will not affect them. This can be helpful if the investor wishes to weather the storm without thinking but can be damaging if they are hunting for selling highs and buying lows.

The only way to know if the current aggressive dip becomes a crash is to wait and see. If it does keep crashing, one must wonder if it will heavily register in popular media, or if we will receive a new narrative to focus on. Perhaps Israel/Iran is already carrying the torch?