‘Splash’ Landing – Why Liquidity Is All That Matters & Great for Gold

News

|

Posted 20/02/2023

|

11391

Last week we wrote to the new scenario of ‘No Landing’ amid the market trying to figure out if we are in for a Hard Landing or Soft Landing when it comes to the end result of this tightening cycle. But do all these theories completely miss the point? Recently Michael Howell, a liquidity expert and founder of CrossBorder Capital spoke convincingly to the importance of global liquidity and arguably why it’s the ONLY thing you need to look at. So forget, hard, soft, or no landing; if the liquidity is sloshing around, bet on a splash landing.

First for a little pre context, on Friday we saw China’s PBOC central bank inject $121billion in one day, the biggest cash injection since records began in 2004. In the above article we also spoke to China having just injected around $1trillion in January alone as it looks to spur its post Covid economy back into life. If one zooms back on sharemarkets, bitcoin and gold, you can see the early stages of an up trend off a low with each reaching that low late last year. The correction this last couple of weeks is still only that in the broader trend. Hardly the crash so many are expecting or is this just a false rally?

Howell argues that the liquidity cycle drives financial markets, which then leads the real economy as money flows through the system. He argues that the current global liquidity environment supports the need to invest in risk assets while ignoring the noise unless underlying trends change. Howell's global liquidity index, which covers 90 central banks worldwide, bottomed in October 2022 and is now beginning to rise. You can see in the chart below this is very early but looks definitive.

This is positive for asset prices, and factors such as the Federal Reserve, Bank of Japan and the People's Bank of China putting money back into the system are the key reasons. Other factors contributing to rising liquidity include decreasing bond market volatility, a weaker US dollar, and lower oil prices.

Howell points out that central banks have a mandate to tackle inflation, create employment growth, and stabilize the sovereign debt market. The reason for the recent market turmoil was due to volatility in the sovereign debt market, and if there had been volatility in the US treasury market, it would have been devastating as it is the most crucial component in the world financial markets. Central banks need to control collateral flows or at least stabilize collateral. Bank Reserves in the US need to be about $1.9 trillion, but they are currently at $3 trillion, and the monetary authorities are fixated on the bond market due to the collateral question.

The very fundamental reason all this liquidity is being injected is the now over $300 trillion of global debt that continually needs refinancing and refinancing now at much much higher interest rates. They simply cannot allow this to fail and hence need to prop up bank liquidity via the reverse repo market. As rates go up and more debt comes due to rollover, the more that needs to be put into the banking system to ensure it can be. That, quite simply, is more liquidity and it finds its way through the broader economy via financial markets.

He gave the excellent analogy that if your home mortgage is due for refinancing you will do everything in your power to do so, in essence not caring about rates, rather than end up homeless. Poignantly relevant for millions of Aussies this year as they come off fixed rates.

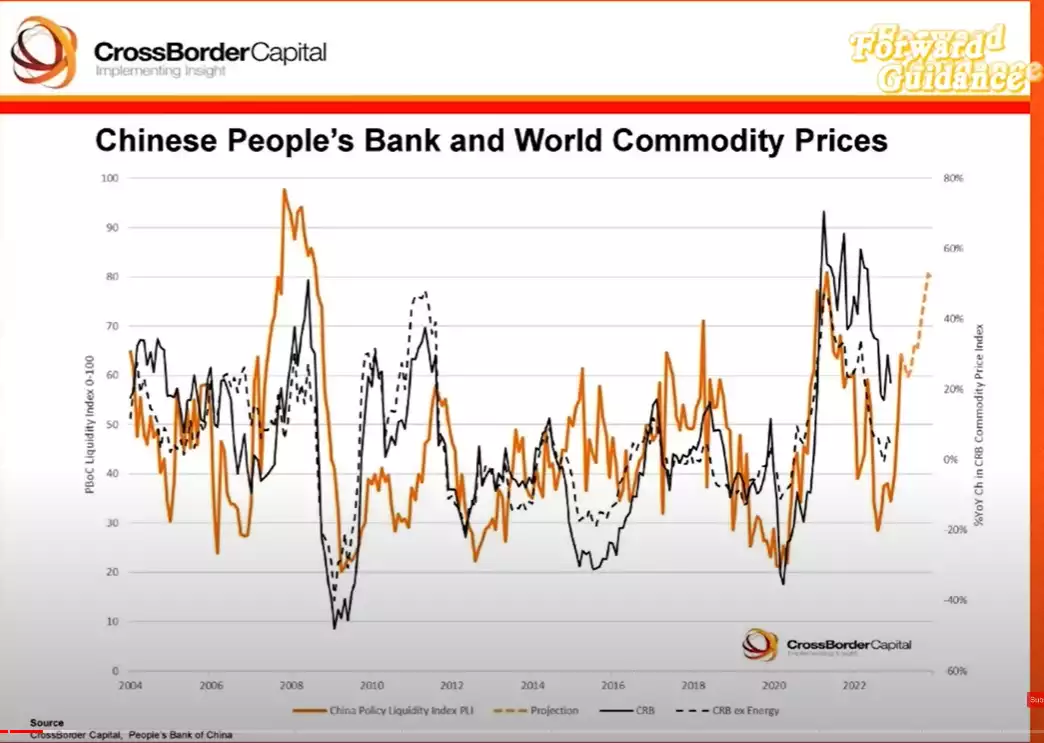

Everyone is looking at the Fed but China too is an essential player in the world financial system. As mentioned above, with the Covid reopening, the People's Bank of China has begun to spur the economy with liquidity injections, and commodity markets are likely to continue picking up on the back of it. There is a strong correlation between Chinese People's Bank liquidity injections and commodity prices as you can see below:

Whilst that might be very constructive for silver and platinum prices as well as gold, he notes that the pure monetary assets of gold and bitcoin are excellent monetary barometers, acting as a hedge against monetary inflation, and if one believes that the liquidity cycle is turning, then gold and crypto prices are going to rise.

So where are we in this cycle? Howell says we are in the early stages of the rebound phase per the chart below, with the bottom last October. Whilst not listed in the examples below, he was repeatedly bullish on gold and bitcoin throughout the interview, with this rebound phase the ‘buy low’ phase before Calm and Speculation phases.

Just remember that fundamentally liquidity is the crucial measure of cash flow and how easy it is to enter and exit a position – it is the oil for the whole system – and the system is carrying an unprecedented amount of debt that needs refinancing at higher rates. Central banks need to stabilize collateral, and China is an essential player in the world financial system, spurring the economy with liquidity injections at the same time that Bank of Japan are doing the same. The US Fed are quietly also injecting liquidity via the reverse repo market whilst looking like tightening to the world through higher rates and QT as they try desperately to tame inflation.

Liquidity is important for the value of assets, and despite all projections for recessions and hard landings, Howell argues the global liquidity environment supports investing in risk assets while ignoring that noise unless underlying trends change. The relationship between liquidity and the stock market is particularly interesting, and the liquidity cycle drives financial markets, which then leads the real economy as money flows through the system. Many have this in reverse.

Finally, Howell states there is no more direct correlation with liquidity then gold and bitcoin. This makes complete sense when you remind yourself that this new liquidity is just newly printed fiat currency. Such ‘money’ is in stark contrast to real money – money constrained in supply with resulting intrinsic value through rarity, fungibility, portability, and exchangeability. Debate may rage over bitcoin meeting these but 5000 years of history has established gold as the very definition of it.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************