Socialism Leads to Feudalism

News

|

Posted 12/06/2024

|

2487

The taxation strategies that governments around the world keep employing to ‘spread the wealth’, otherwise known as socialism, arguably are doing the exact opposite of what they are intended to do. Arguably these socialist ‘fair’ taxes are driving the end outcome of feudalism of the masses by corporations and the wealthy.

With no incentive to be an entrepreneur or invest, individuals will see the only way of getting ahead is a ‘good job’ not to own your own company stifling entrepreneurialism. The wealthy and corporations do not need to sell their assets and pay CGT tax, so they sit on the asset, driving asset bubbles higher and concentrating assets in the few. This will drive assets prices higher in the long term (unless there’s complete abandonment of the country due to higher taxes and a collapse in asset bubbles) and means the rich get richer, stoking inflation, the hidden government tax and the poor get poorer as there is no way out of their serfdom with all incentives taxed to near 0.

Socialism has been proven time and time again to fail, and the more governments try to make everything fair the bigger the wealth gap becomes. They disincentivise anyone to even try to get above the average, by increasing capital gains tax on businesses and investments, so nobody tries to start something, whilst also encouraging the already wealthy never to divest assets driving asset bubbles and scarcity of these assets even higher.

Higher CGT, High Inflation – leads to no gain

Canada has recently proposed increasing Capital Gains Tax to 67% - you read that right – 67%, add to that inflation and you’ll understand why it’s not worth getting out of bed. If you invested $1 million 5 years ago into an asset now worth $2million you are taxed 34% for the first $250k and then 67%, above that $590k in CGT plus the inflation tax of 20% on $2 million now worth $1.7 million. After taking into account inflation this leaves you with $30k. All that effort and risk for $110k, what if the asset had devalued would the government give you the credit?

In fact, applying this logic, the higher inflation the lower CGT needs to be to encourage both investment, risk taking and entrepreneurs – but only if you have to sell. The wealthy do not need to sell, they can choose to keep the assets and continue to gain an income from these assets. This means Capital Gains Tax will impact more people who cannot afford it or are forced to sell assets for things like retirement.

Inflation is a poor mans tax

The current inflation environment was created through government money printing or deficit borrowing. As an investor you become poorer due to inflation and then you are taxed on whatever is left. Interestingly, looking at the current asset bubbles, and the application of CGT, this tax is actually taking the inflation benefits away from the owner, inflation has already eroded your purchasing power, and CGT takes the rest.

If inflation is a tax, why does the government need the rest?

As Nayib Bukele, Ecuador’s President recently put it ‘If the government can print unlimited money out of air’ why do they need taxes?’ ‘We pay high taxes only to uphold the illusion that you are funding the government – which you are not – shocking but it is true – the government is funded by money printing paper backed with paper a bubble that will inevitably burst’

Capital Gains Tax Creates Asset Bubbles – A UK solution?

In Australia (and other CGT countries) if you own a house and haven’t lived in it for 6 years you will have to pay around 50% CGT on its sale. By having this tax in place these sellers are unlikely to want to sell if they can keep it, drying up available houses for owner occupiers. Interestingly the Conservative Party in the UK have recognized this conundrum and if they win are offering 100% tax breaks to landlords selling to their tenants within a limited period. They hope that by offering this tax break, owners are more likely to sell their property easing the housing supply issues and as the properties are only available to the current tenants, giving these tenants more bargaining power and therefore driving down the asset bubble.

Whether the UK tax break works time will tell, but in the meantime governments around the world continue to erode your wealth through inflation and whatever is left, they will grab through capital gains. The Feudal lords will turn us all into serfs unless you own (and don’t have to sell) your assets.

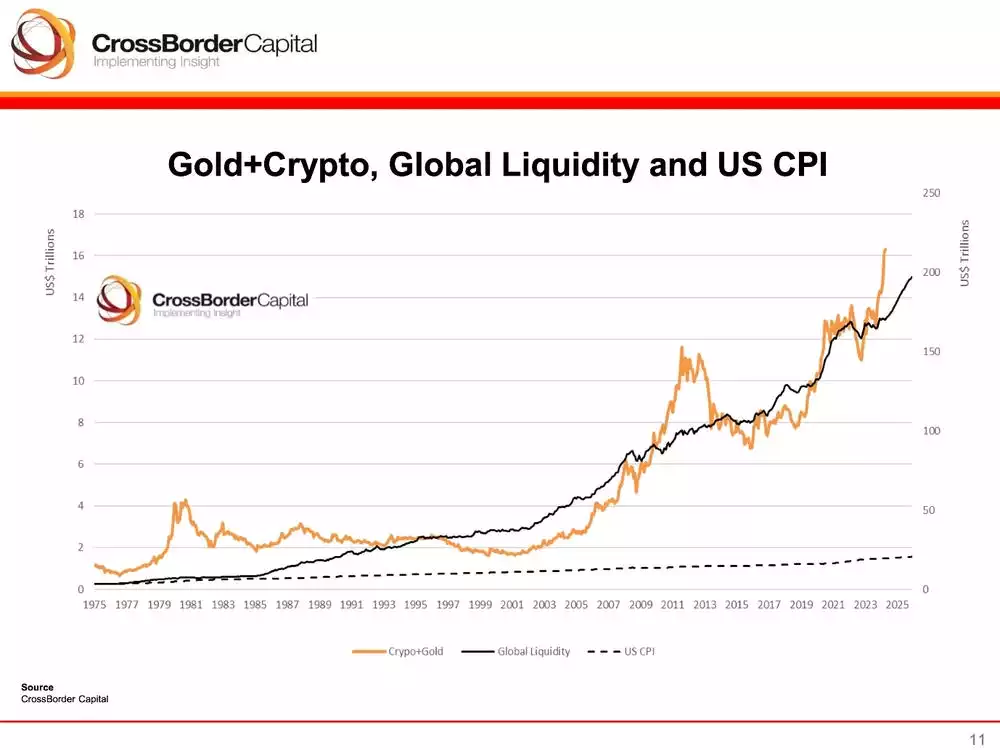

It is not only the CPI type ‘basket of goods’ inflation that is leaving you behind. Moreover, it is the monetary inflation (via Global Liquidity) that is really bifurcating society into haves and have nots. We speak often to the following chart that shows how the hard monetary assets of gold and bitcoin allow you to keep up whereas if your wage tracks CPI (that dotted line how the bottom) you are left horribly behind…