Singapore In Top Spot For Gold

News

|

Posted 10/03/2023

|

12580

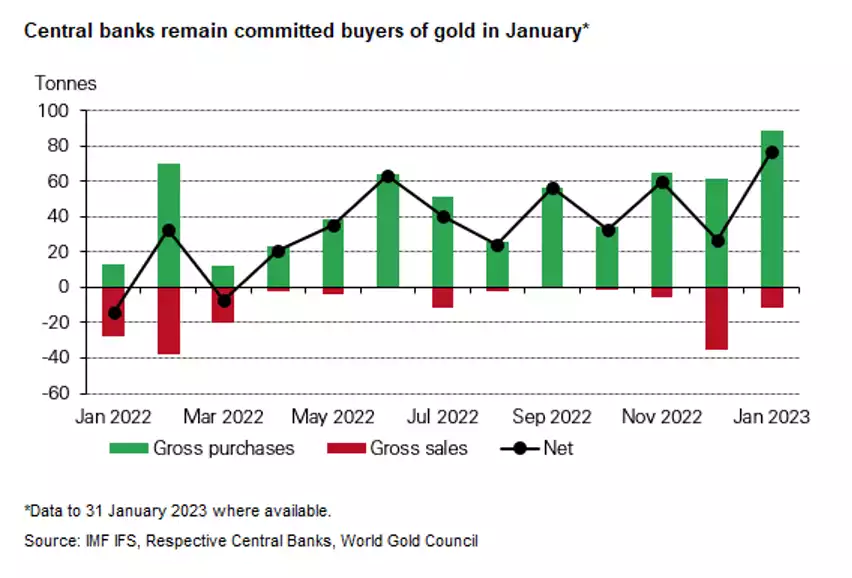

Based on data from the Monetary Authority of Singapore website, Singapore added 44.6 tonnes of gold to its official reserves in January. With their official stockpile now sitting at 198.4t, this represents an increase of 29%. This is the first increase since June 2021, and the highest monthly purchase on record (back to Aug 2000). The World Gold Council hadn’t included these purchases in their previous quarter numbers as the Monetary Authority of Singapore announced the purchase in January ‘23.

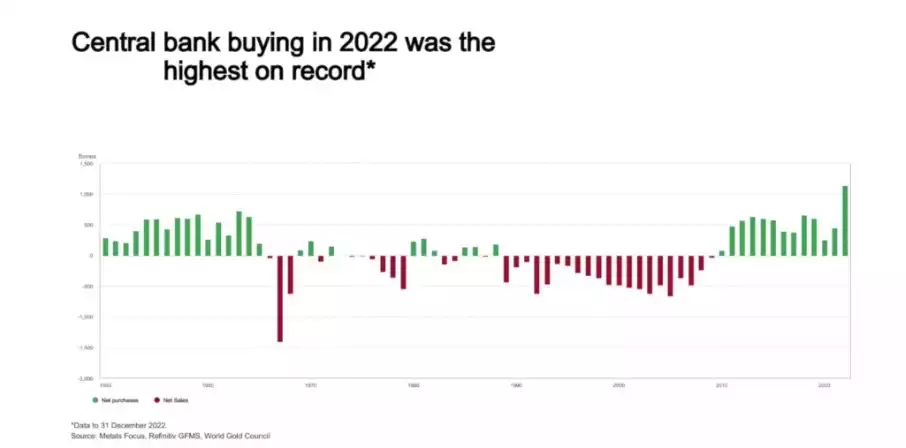

As we covered at the time, 2022 central bank purchases were the highest on record with records going back to 1950. Initially it was thought that purchases had been the highest since 1967, when the world was still operating on a recognised gold standard, but it turns out that the 1,337 tonnes of gold was an all time high since the records have been kept. In particular Q3 and Q4 were blockbusters, both crossing the +400t per quarter mark.

Looking at that high water mark in 1967, it’s highly probable that TPTB (the powers that be) would have seen the writing on the wall for the fixed USD to gold ratio and were loading up ahead of the closing of the gold window. The fact that we see purchases ramping up amidst the increasing spectre of sovereign defaults and geopolitical turmoil, we are likely in a similar position now to 1967. Those in the know, know that gold is set to be revalued and a new monetary reality won’t be far away.

Singapore was the number one official gold buyer in January, pushing Turkey into the second spot. Turkey bought 23 tonnes of gold, which brought its total gold reserves to 565 tonnes. A number of articles have suggested that 2023 won’t keep up the record pace of 2022. With Singapore leading the way, all indications are that Q1 2023 will continue to keep pace with 77 tonne in January alone.

There is potentially some significance in Singapore coming out as a major buyer. Over the last decade the majority of the big purchasers have been a part of the BRICS coalition (think China, Russia, India etc). As we have covered previously, Britain and Canada have both sold all of their gold and have no reserves, Australia is hardly any better (just shy of 80 tonne sitting in vaults in London) although we have quite a few tonnes in the ground. The US claims to have huge reserves at Fort Knox but these haven’t been audited since 1957. While France and Germany have repatriated their reserves in recent years they haven’t been particularly big buyers. Germany actually sold some of their reserves in 2022. As a generalisation, we have seen much more enthusiastic purchasing from non-NATO aligned countries.

Singapore as an ex-British colony has generally been perceived as in the West and the NATO countries. Being located in Asia, they have also sought to play both sides of the US/China superpower race. Seeing them move more to gold may be a signal that bellwether countries are choosing to vote with their feet. When faced with a choice, more countries such as Turkey and now Singapore are hedging their bets - literally. What are they choosing between? The emerging showdown is between the euro-dollar legacy system transitioning to a CBDC and an emerging BRICS commodity-based system transitioning to a gold standard.

We certainly know which team we’re barracking for…