Silver up 4.5% overnight. US Not So Great Again

News

|

Posted 04/09/2019

|

11059

Silver exploded last night, up 4.5% over night, platinum up 3.1%, gold up 1.3% and Bitcoin 1.5% as well. On the other side we saw US shares down around 1%.

It seems the world’s shining light economy, the mighty USA, is struggling more than people thought. Last night saw the release of manufacturing PMI’s and they confirmed that the US manufacturing is on the ropes. To add salt to the wound the trade war tensions, arguably much of the catalyst, rose between China and the US.

The ISM PMI slipped into contraction for the first time since January 2016 and the Markit PMI remained at a low not seen since the GFC.

From the Chief Business Economist at IHS Markit:

"The August PMI indicates that US manufacturers are enduring a torrid summer, with the main survey gauge down to its lowest since the depths of the financial crisis in 2009. Output and order book indices are both among the lowest seen for a decade, indicating that manufacturing is likely to have again acted as a significant drag on the economy in the third quarter, dampening GDP growth.

At current levels, the survey indicates that manufacturing production is falling at an annualised rate of approximately 3%.

Deteriorating exports are the key to the downturn, with new orders from foreign markets dropping at the fastest rate since 2009. Many companies blame slower global economic growth for weakened order books, but also point the finger at rising trade war tensions and tariffs.

Hiring has stalled as companies worry about the outlook: optimism about the year ahead is at its lowest since comparable data were first available in 2012. Similarly, price pressures are close to a three-year low, as crumbling demand has removed firms’ pricing power.”

On ‘dampening GDP growth’, UBS last night also downgraded their expectations on GDP to see just 0.3% by Q2 next year and issue this clear message (importantly from a bank that routinely over estimates growth as they even admit):

“This forecast puts the specter of a recession front and center. If we consider that 2018 Q4 real GDP was revised from 2.6% on the initial print to 1.1% now, our forecast of below 0.5% for the first half of the year is hard to differentiate from contraction. Moreover, with global growth slowing, there is a clear risk that oil prices drop. We have estimated that the collapse in oil in 2014 could have taken off over a percentage point from real GDP in 2015 and 2016. Such a collapse is not in our baseline, but makes a recession a clear possibility. Similarly, a faster or sharper consolidation in the retail sector could cause mass layoffs, pushing us into recession. Indeed, the slower the growth of the economy, the smaller the shock of any kind is needed to tip an economy into a recession. Our forecast skirts a recession, but the risks abound.”

Interestingly they have CPI at 2.8% (well above their 2% line in the sand) at the same time as a 0.3% GDP. Low growth + high inflation is a stagflationary timebomb, so you wouldn’t want to add more inflationary pressure through stimulus, no?

Cue the Fed’s own Bullard last night calling for “aggressive” action to counteract the falling bond yields and the aforementioned impacts of the trade war, venturing that a 50bp cut would be appropriate. Here comes the stimulus people…

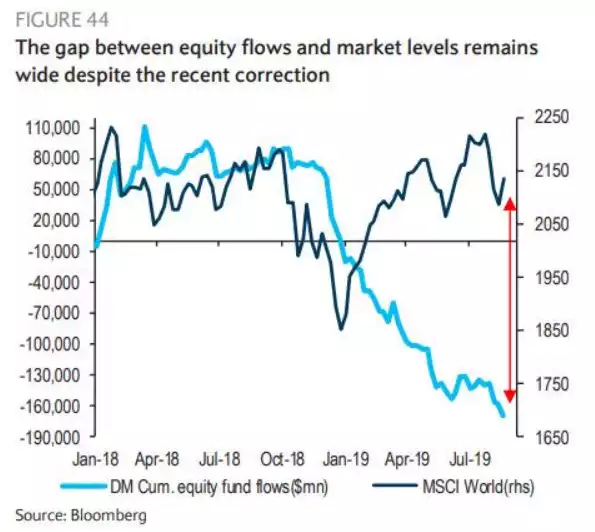

So it should be no surprise that precious metals popped last night, the penny is continually dropping for more and more people. As a little test though, ask around your friends and colleagues today whether they think we are on the verge of a financial crisis and ask whether they own gold or silver. That exercise, whilst a very small sample, may reinforce to you just how much more is left in this precious metals bull market. Lord knows the big funds are offloading their shares on to this same unsuspecting crowd:

Finally, because it is so damned exciting… Here is an update on that dropping Gold Silver Ratio:

Remember the current 80 is still nearly TWICE the 100 year average… Mean reversion may be your best friend soon.