Silver's Shining Moment is Coming, and the Solar Energy Sector is Soaking Up Plenty of the Spotlight

News

|

Posted 02/07/2024

|

3824

Another Year, Another Supply Shortage

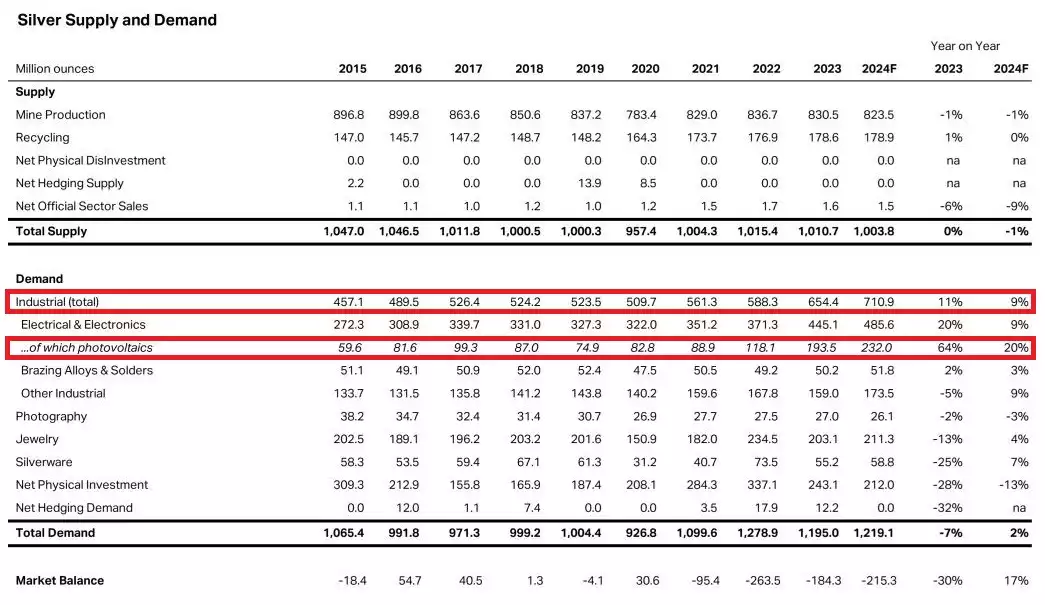

In 2023, worldwide industrial demand for silver set an all-time high of 654.4 million ounces, driving total demand to outstrip supply for the third straight year. When combined with supply shortfalls in 2022 and 2021, last year’s supply deficit of 184.3 million ounces offsets the cumulative surpluses of the prior decade, according to the Silver Institute. The good news for silver investors is set to continue with another record level of industrial demand tipped to occur again this year, setting the stage for a potential supply squeeze and reaction in price that favours us that are long silver.

Source: Silverinstitute.org

Changing Demand Dynamics For Solar Panel Tech

The key factor driving this surge in demand is the so-called Green Economy, specifically, the increasing use of silver in solar panel manufacturing. Silver is considered the best conductor of electricity at room temperature, which makes it an essential input to the green technology. On average, only a small amount of silver is used in each panel (approximately 0.643 ounces) however the accelerated rate of adoption of this power source has resulted in 100 million ounces of demand form the solar industry last year – around 14% of total silver demand.

But, here’s the kicker – not only are we creating more and more silver-reliant solar panels, we are using more and more silver in each unit. Analysts previously assumed that less silver would be required per unit over time as the technology progressed but the opposite has been case. The reality is that substitute metals have been found to be less reliable and have shorter lifespans than silver panels, affecting their viability for widespread adoption. In addition, the evolution of the technology this decade has resulted in more efficient panels using 20%–120% more silver. Analysts predict solar panel production will require increasingly large amounts of silver in the future and a recent research paper from the University of New South Wales predicts that manufacturers will need over 20% of the current annual silver supply by 2027.

A Recipe For Upside Potential?

We have come to understand silver as the volatile sibling of gold when it comes to investing. It often moves directionally with gold but those moves tend to be larger on a percentage basis in both directions. While there exists silver stock available for manufacturing right now, these supplies look set to eventually deplete and we believe the supply and demand dynamics present a compelling picture for fans of silver. With the increasing industrial demand, supply deficit, and an uncertain macroeconomic and geopolitical landscape brewing, it’s not hard to see the future as bright (and shiny) for silver investors.