Silver- ‘The world’s most undervalued commodity’

News

|

Posted 08/10/2021

|

14686

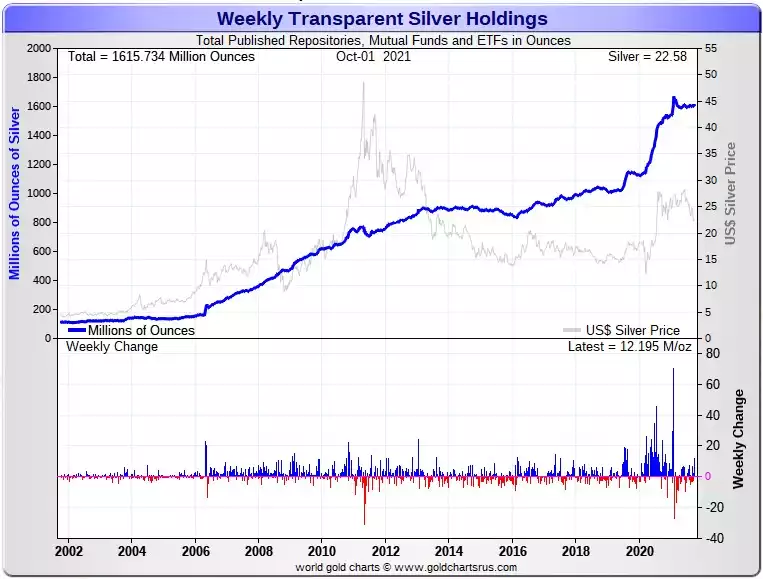

Yesterday we queried when silver may get caught up in the global supply chain squeeze affecting so many commodities right now. Unlike gold, silver is heavily used in industry, with around half of annual production used in things like solar panels, electronics and medical equipment.

Despite this and the aforementioned supply chain disruptions we haven’t really seen signs of a supply squeeze play out in the price.

The chart below shows the current disconnect between price and demand for silver. It shows demand from all known registered repositories and funds etc for silver.

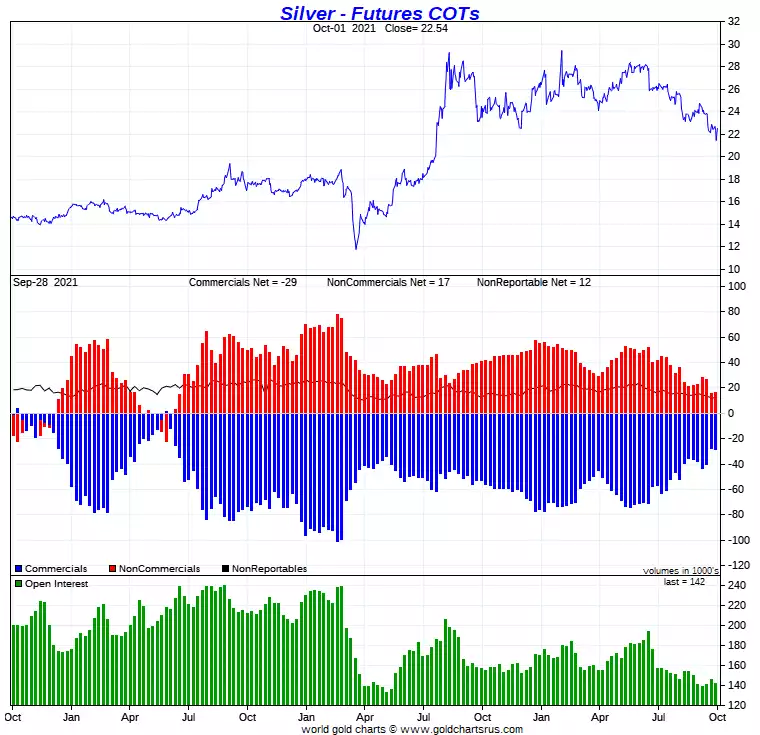

Now look at the latest Commitment of Traders Report from COMEX for silver…

EVERY time we see a ‘bottom’ in the Commercial’s short positions like we are seeing now, the price rallies afterwards. That the wily Commercial’s, the big bullion banks etc, are so historically ‘not short’ right now cannot be ignored. Whether this is due to supply chain shortages or just ‘smart money’ quietly accumulating is unknown. COT analyst Ed Steer puts in plainly:

“We're at the bottom of the barrel to the downside from a COT futures market perspective -- and the remaining longs in the Managed Money, Other Reportables and small trader categories are long-term value investors that are just sitting and waiting for the inevitable repricing of silver.

And to put it in simpler terms, it's impossible to put into words just how outrageously bullish the set-up is for a price explosion in silver based on its current configuration in the COMEX futures market.”

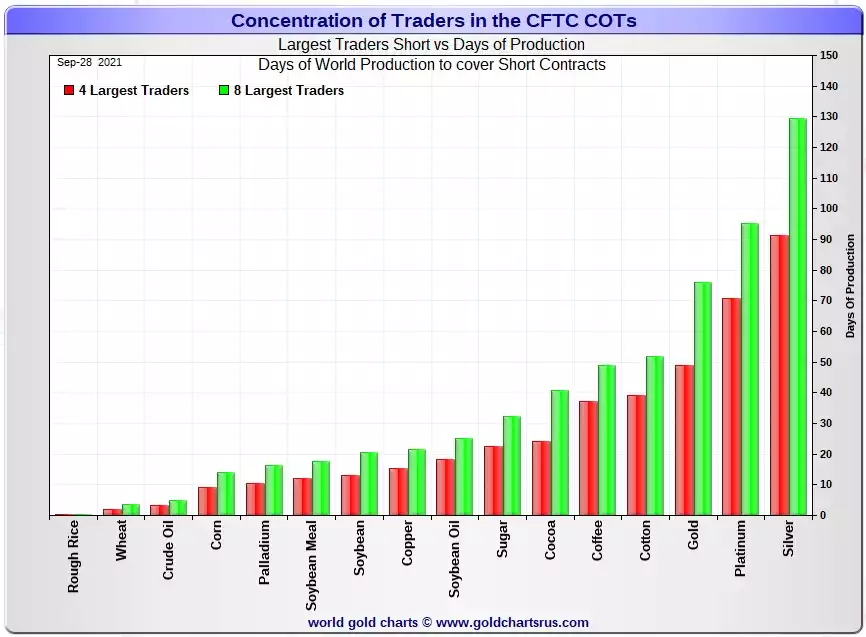

To make that even more enticing, as low as that net entire commercial position might be now, for context, the following chart shows the short positions held by both the top 4 and top 8 largest traders. You can see why, then, that silver is often referred to as the most undervalued commodity in the world… Consider that just 4 commercial traders are short 90 days of global silver production. That seems like one giant coiled silver spring….

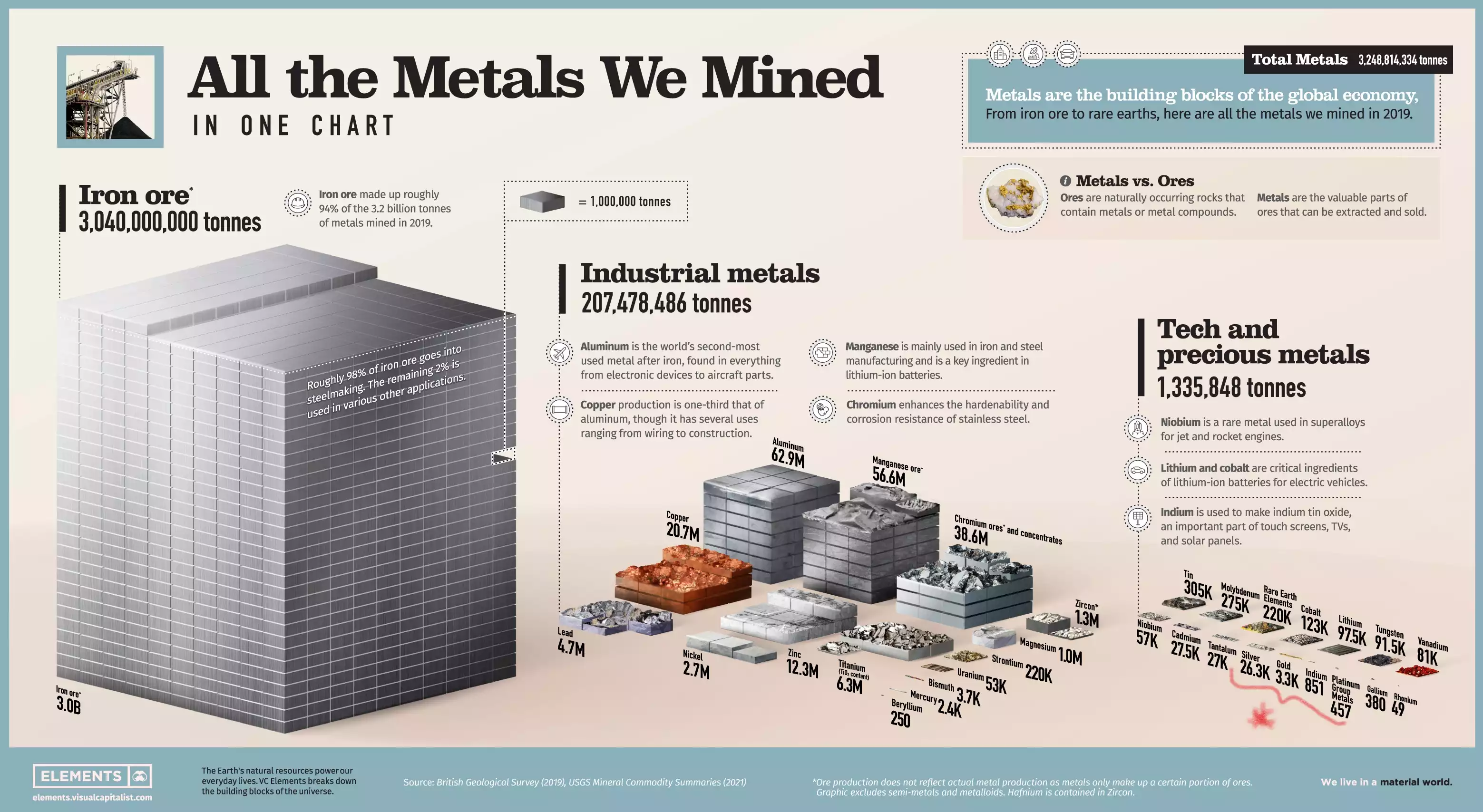

Finally, for further context the info graphic below from Visual Capitalist puts the supply of silver (and gold and platinum even more so) into perspective when looking at the grotesque paper contract positions in futures markets. You can click on it to get the original enlarged version.