Silver Technical Breakout Confirmed

News

|

Posted 08/07/2024

|

2590

Just before the last market close, silver successfully followed through with a breakout from its recent downtrend. Both the S&P 500 and the Nasdaq also surged to new highs. This strength was fueled by a rally in megacap stocks and a jobs report, which the markets interpreted as a signal for potential rate cuts sooner than originally expected.

-Silver's breakout followed by a re-test and bounce upward

-Gold is touching a major price ceiling. Look for a rejection or possible significant breakout similar to silver

All three major U.S. stock indices ended the day with gains and the Nasdaq was the leader. The "magnificent seven" megacap momentum stocks saw robust gains, but Nvidia had a rest. Growth stocks closed in the green, while value stocks lost some ground.

The June employment report last week looked great on the surface, but revealed underlying signs of economic cooling. The report hinted at slower wage growth and a slight rise in unemployment. It also showed major downward revisions to the data from April and May. Financial markets welcomed this weak data, viewing it as a potential catalyst for earlier-than-expected rate cuts from the Federal Reserve. This sentiment pushed gold and silver higher, as well as stocks.

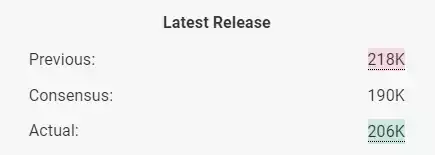

-The number was a great print, but the previous months was revised 54K lower

It's important to remember that gold and silver do not automatically move opposite of stock prices. The recent gain in most stocks is not the companies doing well, it is just the currency they are measured in being devalued, that means gold and silver also benefit as they are also measured in dollars. Stronger prospects of easy money have provided fuel for both stocks and precious metals to rise.

If there is a gentle pushback from more upcoming data releases, this could dampen both gold and stocks. A real safe haven breakaway would happen if high interest rates finally choked markets into an extended downtrend or crash. That would potentially cause a clear breakaway of precious metals and lead to them rising due to competition for timeless assets and a flight from risk.

Looking ahead, next week's Consumer Price Index (CPI) report will be crucial, providing the Federal Reserve with more data to consider for future rate decisions. Investors will closely monitor this report for insights into inflation trends from a consumer perspective. If more weak data is to come, it could increase the likelihood of a rate cut in September.