Silver Surges on WallStreetBets ‘GameStop’ Call

News

|

Posted 29/01/2021

|

11644

Silver surged by over 5% last night helped, it seems, in no small part by the now infamous WSB or WallStreetBets reddit group that saw the likes of GameStop shares surge by 1700% in days. Their headline is “THE BIGGEST SHORT SQUEEZE IN THE WORLD $SLV Silver $25 to $1000”. Trade in our Silver Standard (AGS) silver backed tokens last night on CoinSpot was huge. So what is WSB about?

WSB are a reddit community of over 2m who both capitalistically and simultaneously altruistically bid in a coordinated manner heavily shorted shares such as GameStop. Loved by participants and cheerleaders for the ‘little guy’ and equally loathed by Wall St hedge fund managers getting whacked and their guardian SEC, they have proven the power of the internet forum and use of platforms like Robinhood. When we say ‘altruistically’, they have tended to favour companies dear to their heart like GameStop or hurt by COVID like AMC movie theatres. Silver, rather than gold, is often the preferred metal for such investors given the relative technical upside potential and it being the ‘everyday person’s metal’ along with the added background narrative of its price being suppressed by the Wall Street short sellers.

So how does it work? Simply there are certain heavily shorted shares where hedge funds and other short sellers have placed short bets through put options in the belief the shares will go down based on their analysis of that company’s ‘fundamentals’. For instance, GameStop is a mall based seller of video games that are now largely available online. Its like shorting Blockbuster some years ago or dare we say it, soon banks with the advent of cryptocurrency and DeFi… (what, too soon?...). As the coordinated buying of the WSB crowd drives up the share price, all those short sellers need to cover their positions by buying the shares which, in itself, adds momentum to the price rise and hence the name a ‘short squeeze’. It locks in heavy losses for the short sellers and even higher gains for those going long.

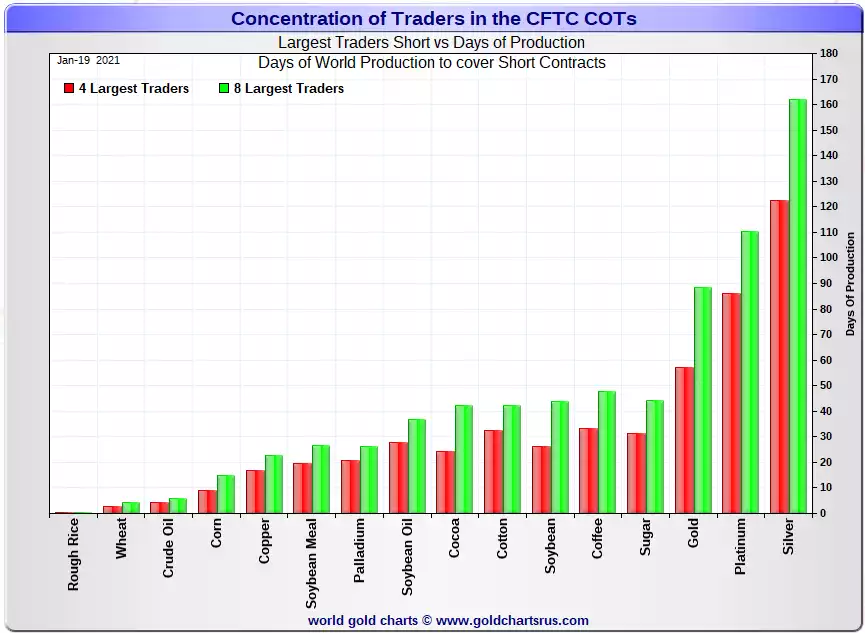

Fast forward to yesterday and WSB are now targeting silver. Why silver? Well as most readers will know, silver is one of the most heavily shorted commodities in the world. The theories on why vary from it simply being miners legitimately hedging production through the bullion banks; to the bigger bullion banks such as J P Morgan using client paper/futures shorts to suppress the price whilst loading up on (now) cheap physical silver on their own account; through to the theory of government sponsored shorting of all precious metals to effectively hide the relative debasement of all the new paper currency they have printed. After all gold and silver are real money. Irrespective the chart below illustrates clearly the sheer size of those shorts for the big bullion banks and commercial traders:

You can see the short sellers represent a bit under five and a half months of world silver production, or about 378 million troy ounces of paper silver held short by the Big 8 commercial traders. Outside of that 8, the 26 odd small commercial traders are net long silver by that amount.

To be honest, the narrative matters little in this case because a coordinated attack on such a small market like silver with such massive short positions in place could be spectacular in its outcome for the price. The one caveat on this is that whilst the silver market is relatively small amongst all assets, it still dwarfs a small company like GameStop and so we are yet to see how far the reach of this phenomena that is WallStreetBets can go. Last night would indicate that it can indeed move the market.

One final note, and a very important one. GameStop and the like were probably legitimately shorted due to poor business models or challenging market positions etc. Natural value may be restored after the WSB pump. Few could argue the shorts on silver are about its fundamental weakness. We are in an extraordinarily bullish set up for silver right now. If it is the miners hedging, then that is simply miners being miners and not speculators. They have produced their silver and that came at a real cost. They want to lock in the profit now through ‘selling it’ (shorting) on the futures market. That has nothing to do with whether they THINK it will go up or down. They are miners. If it is the bullion banks using client accounts to short and suppress the price to load up on their own physical bullion, well then, giddyup and go hard because that can only mean that one day the price will rocket when they ‘take their foot off’ when they are ready to profit from this practice. With the recent convictions against them and the tools they have used to do so, you’d have to think their days are numbered. Either that or on the next big financial crisis they may use their stash as their insurance.

Let’s hope the headline “THE BIGGEST SHORT SQUEEZE IN THE WORLD $SLV Silver $25 to $1000” comes even partly true. Go hard guys!