Silver Surges 3.5% on More Signs of Coming Liquidity

News

|

Posted 28/05/2024

|

2249

Silver had yet another epic rally last night, up over 3.5% in the single session before settling slightly, but still holding at US$31.62 at the time of writing or $47.50 in AUD terms. After reaching a record high AU$48 a week ago the silver price peeled back along with gold on the U.S. fed minutes indicating they will stay tighter for longer. Last night we saw U.S. and UK markets closed but the Euro Central Bank (ECB) indicated they may start dropping rates sooner than expected as the economy struggles, and silver (and gold) rallied as more signs appear that liquidity is coming back.

ECB voting member Villeroy said they have significant room for rate cuts with the Deposit Facility rate at 4% and barring a surprise, a rate cut in June is a done deal.

There is a lot of talk at the moment around stagflation – high inflation and weak growth. Those that follow and subscribe to our ainslieresearch.com will know that is typical of a late cycle market whereas we are, in most measures, coming out of or early into mid cycle where you would see rising growth and inflation. So what is missing? We have just exited a liquidity ‘air pocket’ that saw US$1 trillion removed from global liquidity but now appears to have returned. The next monthly update on this drops this Friday so keep an eye out or subscribe for free via the link above.

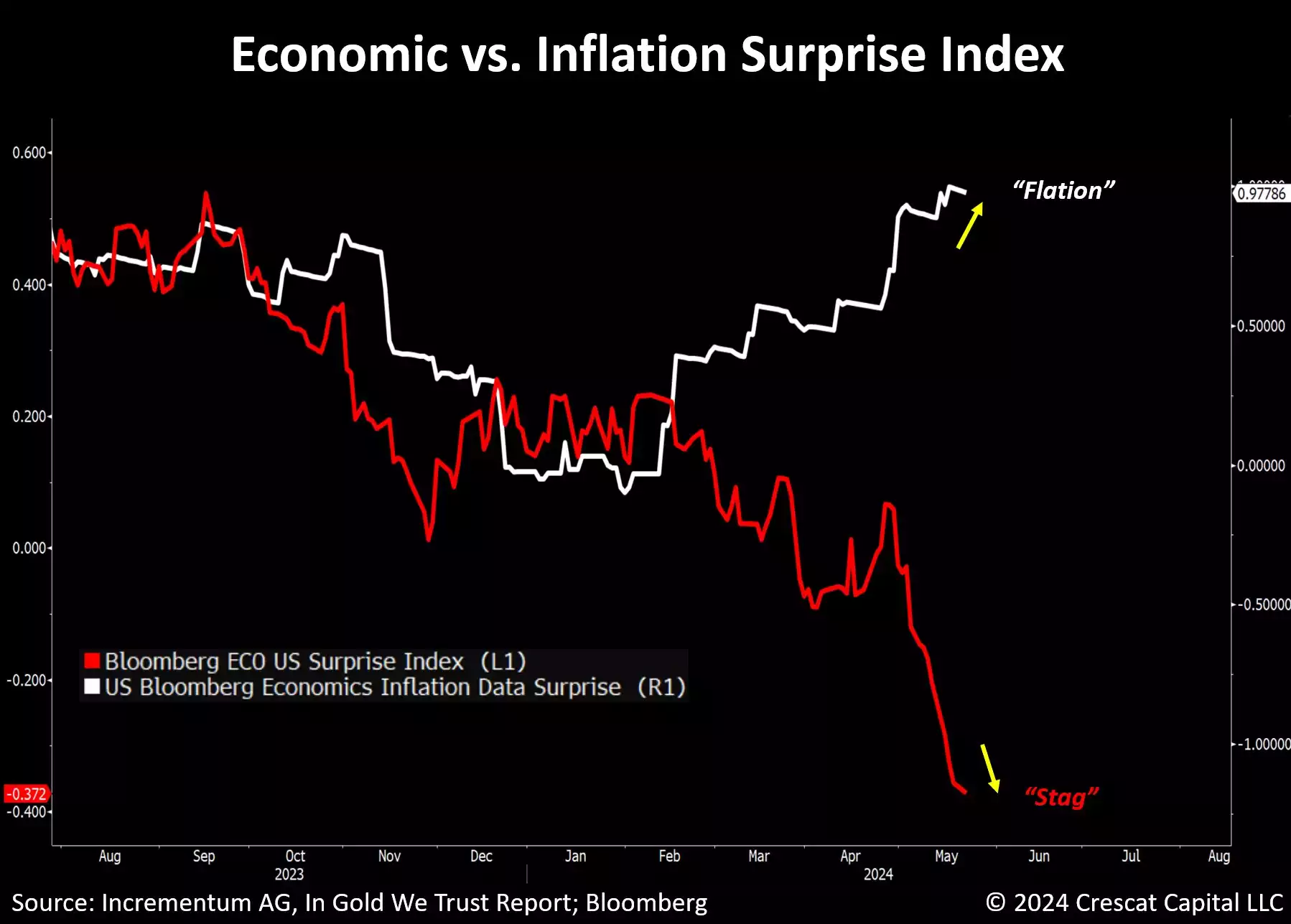

The chart below (courtesy of Crescat Capital and In Gold We Trust report) shows very clearly the situation in the world’s biggest economy, the U.S. As we discussed last week, Bloomberg’s U.S. Macro Surprise Index has collapsed further this week to a 5 year low. At the same time their Inflation Data Surprise index continues to track upwards. Very clearly the former is the ‘stag’ and the latter the ‘flation’ piece at a time when they can ill afford that.

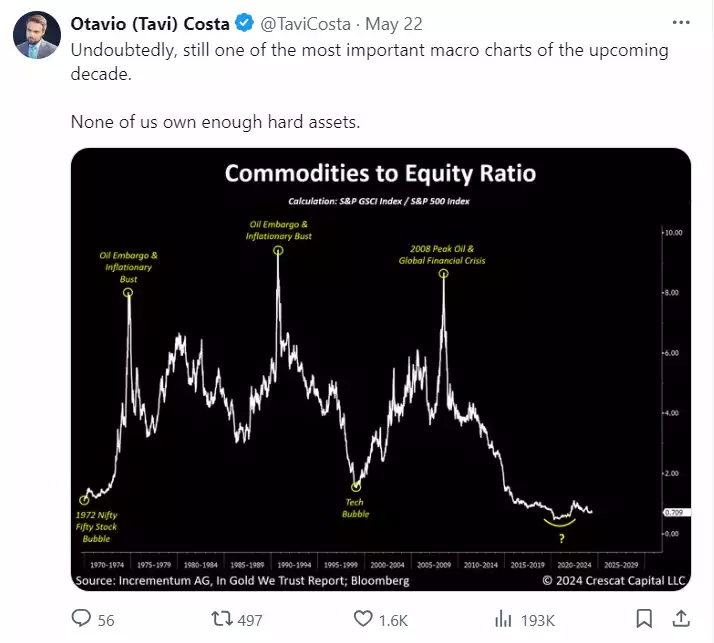

Crescat are calling for an imminent financial top or crisis of sorts as their Otavio Costa submits below:

“I know most bears have thrown in the towel already, but the last time we saw a similar disconnect between these two indices was in mid-2021, near a market peak.”

That may well be the case, and yes it would be lovely for gold and silver, but we would argue that before that happens we will (and already are, hence the rally last night) see a wave of monetary (central bank) and fiscal (government) liquidity flood in to ‘save the day’.

To be fair both scenarios are constructive for precious metals and commodities in general as hard assets against monetary debasement.

Silver has its feet in both camps. It is a monetary metal like gold but half of supply is as a commodity used in industrial applications, most prominently in solar panels and electronics, both of which are seeing quite massive demand expansions. That is a perfect setup in the context of above.

As Costa puts it simply above – “None of us own enough hard assets.”