Silver Supply & Demand

News

|

Posted 03/04/2014

|

4889

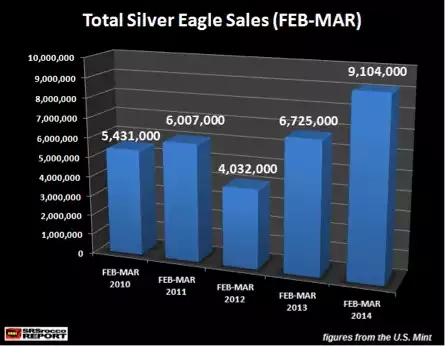

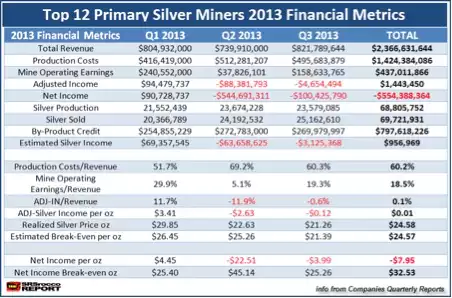

Normal market dynamics would see volume increase as prices firm, people buying up on the next rising star. As you know the opposite happened last year where gold and silver sales broke all sorts of records despite a circa 30% decline in price. It was buyers of physical metal who knew the COMEX futures set price was not real, a bargain, and the fundamentals for ownership were stronger than ever. The graph and table below tell a similar story for 2014. The ‘silver barometer’, the US Silver Eagle coin sales shows silver sales in Feb and March were not only c20% higher than last year, they were higher than the heady silver price days of 2011 as well. And supply? Well look at the table below and ask yourself how long production will continue at these $19-20/oz silver prices…