Silver Outperforming Gold – Is This Just the Beginning?

News

|

Posted 16/07/2025

|

2535

The Gold-to-Silver Ratio (GSR, green) has dropped from 102 to 87 over the past 2.5 months, highlighting silver’s outperformance against gold since 31 March.

As we progress through the final phase of the macro 18.6-year land cycle—historically a period where most assets rally before a broad-based financial crash—precious metals have shown resilience. In these late-cycle stages, gold and silver have tended to outperform while most other assets falter. Looking to past cycles helps us frame expectations for silver’s potential to continue outperforming gold.

The past cycles, while this final phase has recorded silver has outperforming gold, amid a gradual downtrend in the GSR, it is after the crash, in the recovery phase where silver's outperformance truly takes hold. That’s when the GSR typically declines more steeply. For instance, following the 2008 Global Financial Crisis, equities (pink) and property (blue) took years to recover, while both gold and silver enjoyed strong bull markets—silver especially, pushing the GSR from around 70 to 35.

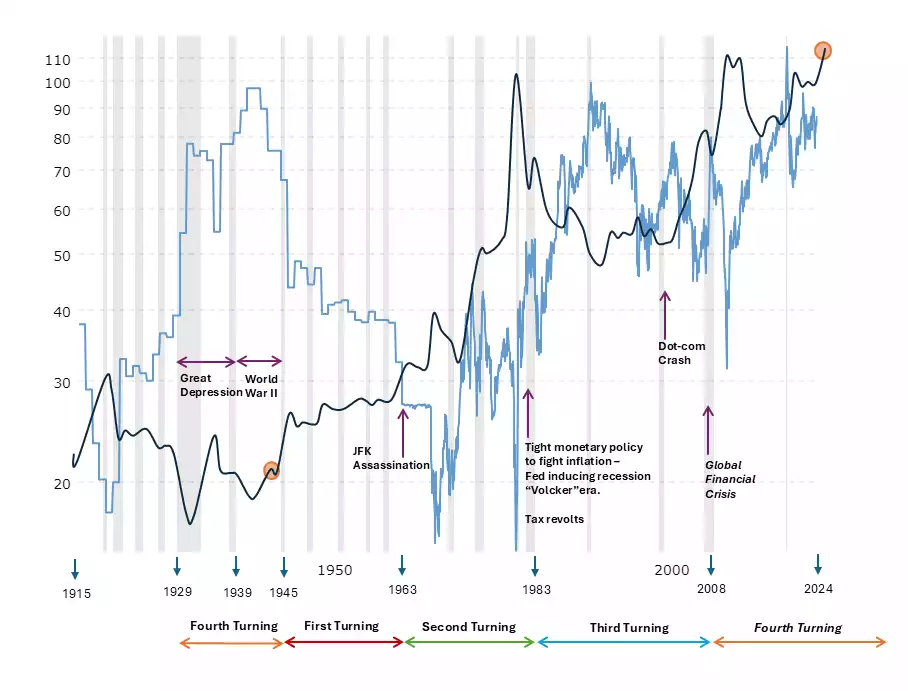

Now, as we approach the culmination of the current 18.6-year land cycle, it’s also worth noting that we’re nearing the end of a broader 80-year socio-economic cycle, often referred to as “The Fourth Turning.” This long-term cycle is made up of four roughly 20-year phases, each defined by distinct societal and economic characteristics. The previous Fourth Turning was marked by the Great Depression and World War II. The First Turning that followed saw the creation of a new global financial structure, including the IMF and the gold standard.

As we again transition from a Fourth to a First Turning, we're witnessing the early stages of another global financial reset. In the lead-up to the last transition, the GSR remained in the 70–90 range for decades, much like today. But once the new financial system emerged, the GSR collapsed and then remained in the 20–40 range for decades, as both gold and silver entered a multi-decade bull market, with silver strongly outperforming.

Given this dual transition from one land cycle to the next, and from one 80-year cycle to the next, we may be witnessing a generational setup for silver and the GSR on a centennial scale.

While the recent drop in the GSR and silver’s outperformance have caught some attention, taking a broader view suggests this may be just the beginning.

Watch the insights video inspired by this article here: https://www.youtube.com/watch?v=22pj4_5abZs