Silver Leading Next Leg Up

News

|

Posted 18/06/2025

|

6504

Gold has broken out, having put in a retest of the downward-sloping resistance and resumption of the uptrend. A short-lived consolidation appears to be gearing up for the next leg up.

Silver, however, has been leading the way and looks primed for a catch-up trade to gold, likely outperforming in this next leg higher, closing the gold-to-silver ratio (GSR) gap, for now.

In the last 3 weeks, silver is up an impressive 12% while gold is up 2.5%. The GSR now sits at 91.

While the GSR will continue trending down, if silver continues to outperform in this next leg up for precious metals, we are likely to see a final spike in the GSR down the track before silver’s long-term outperformance of gold finally kicks into gear.

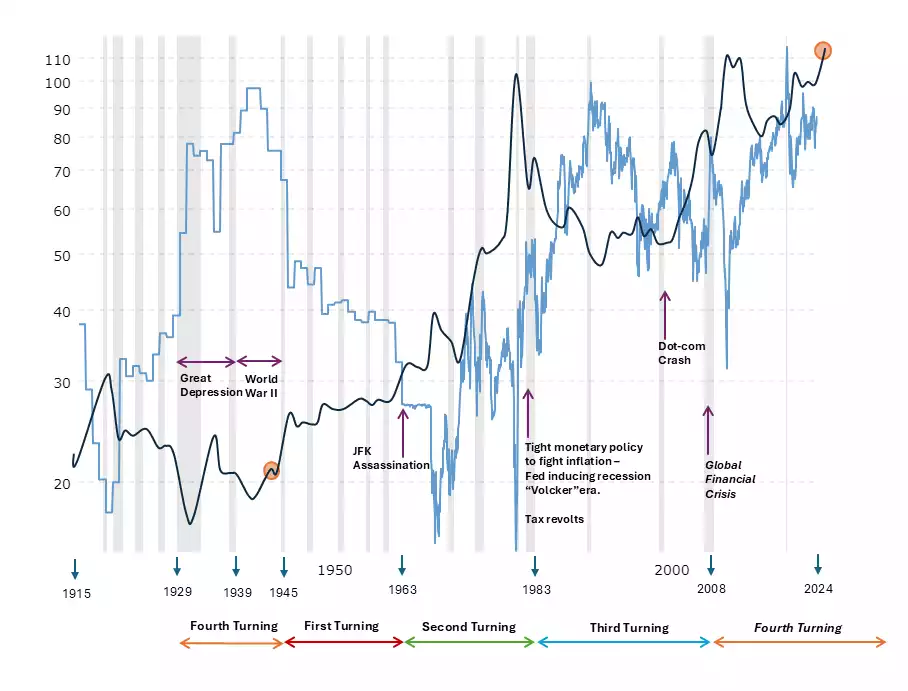

As we lead into the macro-18.6-year land cycle peak (the last one was the 2008 Global Financial Crisis), we note that leading into the crash. Stocks (pink), gold (yellow) and silver (white) trend upwards together, however after the crash stocks and land spend years recovering, while gold and silver continue with strong uptrends. We can observe the GSR (green) trends down leading into the crash, with one final spike during the crash, after which it significantly falls off. During the recovery phase, silver outperforms gold sustainably.

In the previous recovery phase, when silver truly outperformed gold, the GSR dropped from the 80s to below 40, recording an impressive 2x outperformance of gold by silver, during this time.

Similar to last time, we are currently witnessing the GSR start to drop off leading into the crash, however it would be reasonable to expect a final spike in the GSR during the crash (when gold is the ultimate flight to safety), after which it finally falls off more significantly.

Although the upcoming crash is cyclically similar to the 2008 GFC (the previous 18.6-year land cycle), it is also cyclically similar to the Great Depression (the previous ‘fourth turning’).

GSR and Silver

GSR (light blue) Silver/USD (dark blue)

After this crash, the GSR fell off from the 80s to below 20 and spent a decade in the sub-50 region, while gold and silver embarked on a multi-decade bull run.

While this next leg up could likely see the GSR trend down, it is just a taste of what is to come in the long term — if history is any indication.

Watch the insights video inspired by this article here: https://www.youtube.com/watch?v=GPTp8I1QOWA