Silver Is Remarkably Underappreciated Despite Approaching Supply Constraints

News

|

Posted 19/06/2023

|

9755

Today we look at the underappreciated protagonist in the precious metals market, silver, which holds significant potential amid an impending supply shortage. Rising demand from the photovoltaic industry, resilient green energy investments, coupled with a constrained mining scenario are aligning to create an interesting market dynamic.

Conventional arguments for silver's potential usually circle around inflation, and there's no doubt that the stubborn persistence of inflation, along with the Federal Reserve's struggle to keep it in check, bolsters the case for precious metals.

Yet, a topic that's often missed is the imminent supply shortage in the silver market. Given the escalating demand from burgeoning sectors, a considerable strain on silver supplies in the coming years is inevitable. Despite this, the current pricing of silver seems to be blissfully ignorant of this imminent reality.

The scarcity is not just an intriguing future prospect but is already beginning to manifest. In 2022, demand for silver peaked across all sectors, while the supply only plateaued, with mining output falling by 0.6%. This led to a market deficit of 237.7 million ounces in the same year. Such a deficit, noted as "possibly the most significant deficit on record" by the Silver Institute, has comfortably outpaced the cumulative surpluses of the preceding 11 years.

This trend, rather disconcertingly, isn't expected to reverse anytime soon. Falling silver mine production is a result of underinvestment, and it's a problem that can't be hastily rectified given the significant lead time—often over 10 years—to kickstart new mining operations.

Meanwhile, the demand for solar power—and consequently, silver—is surging. The International Energy Association (IEA) projects that in 2023, investment in solar power will surpass investments in oil production.

Why is this relevant to silver? Silver's superior electrical conductivity makes it an indispensable component of solar panels, helping conduct electrical charges from the solar cells to the rest of the system. Although the quantity of silver used in each solar panel is minuscule, the cumulative demand, given the exponential growth in solar panels, is anything but insignificant.

Researchers from the University of New South Wales estimated that by 2027, solar manufacturers will need over 20% of the current annual silver supply. Fast forward to 2050, and it's estimated that solar panel production will consume a whopping 85–98% of the existing global silver reserves.

Contrary to past projections that the use of silver in solar panels would decline, more recent research suggests a reversal of this trend. Newer, more efficient 'N-type' technologies require even more silver than the current 'PERC' cells which dominate more than 80% of the market. This could potentially drive a significant surge in silver demand.

Although there's an ongoing effort to find cheaper alternatives to silver, the study concludes that the current rate of silver usage reduction won't prevent an increase in demand. It further posits that transitioning to high-efficiency technologies could significantly inflate the demand for silver, posing serious price and supply risks.

One might argue that economic recessions might stifle the industrial demand for silver. However, with global efforts to combat climate change gaining momentum, sectors such as the photovoltaic industry have essentially become recession-resistant. Governments worldwide are increasingly supporting green energy technologies, so investment in solar power is unlikely to wane, even in the face of an economic downturn.

All these factors underscore a rapid increase in silver demand amidst a restrained supply environment. Basic economics dictates that escalating demand without a corresponding rise in supply inevitably results in a hike in prices. Strangely enough, the current price of silver does not factor in this impending market dynamic.

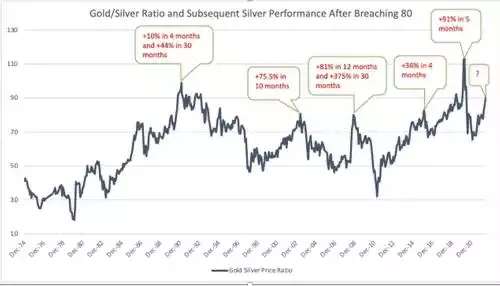

Moreover, when we compare silver to gold, the undervaluation becomes even more glaring. The present silver-gold ratio stands at over 81-1, which means it requires more than 81 ounces of silver to purchase one ounce of gold. When put into perspective, this ratio significantly deviates from the historical average that fluctuates between 40:1 and 50:1.

Historically, this widespread has consistently corrected itself, not gradually, but abruptly and forcefully. It fell to 30-1 in 2011 and below 20-1 in 1979. When silver has the opportunity to shine, it doesn't just outperform gold; it races ahead, leading to a massive appreciation within a relatively short timeframe. We've observed this phenomenon four times since the turn of the millennium.

It's only a matter of time before mainstream discourse catches up to the developments in the silver market.

In conclusion, as we approach a future marked by silver shortages driven by a booming photovoltaic industry, the impact on silver pricing is something we cannot afford to overlook. Once the mainstream media picks up on these significant shifts, a substantial price surge in the silver market may shortly follow.