Silver Industrial Demand v Investment

News

|

Posted 08/12/2017

|

11636

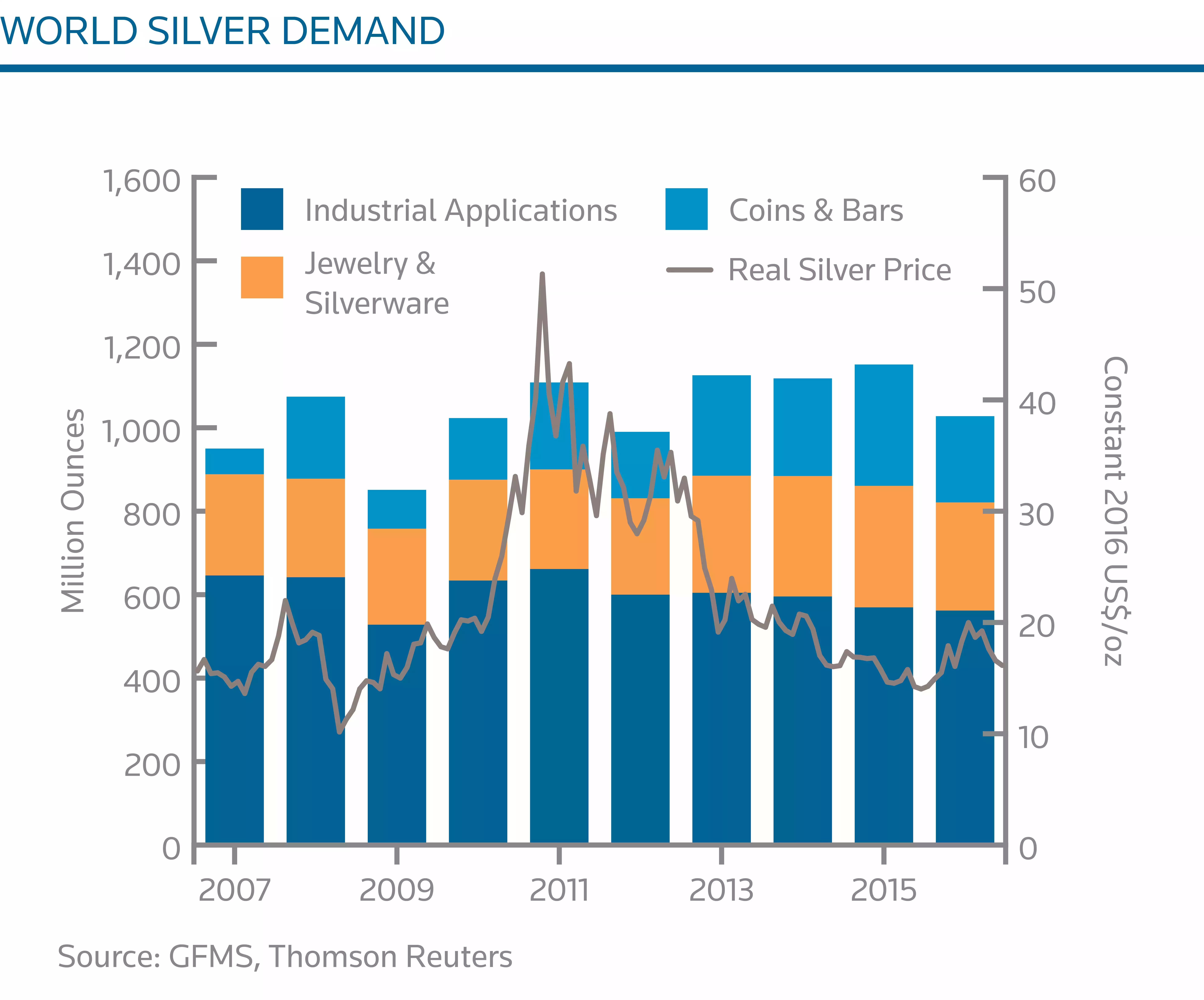

Yesterday we wrote about the growing, though still relatively small, demand for gold in industry and specifically electronics. Silver is likewise seeing steady industrial demand however unlike gold, industrial demand equates to over half of all silver produced being used in industry.

Two of the main uses for silver are electronics and solar panels. Silver is second only to gold for electrical conductivity and the use of it in the form of paste also allows it to be applied very thinly. This makes it perfect for smart phones, RFID’s and the like. In 2016 around 234m oz of silver was consumed, over 7250 tonne of it, in electronics alone.

This same excellent conductivity and application as a paste sees silver as the essential element to PV cells used for solar power generation. As the world moves to clean energy this looks set to only increase.

Keith Neumeyer, CEO of First Majestic Silver Corp recently knocked it on the head - “To go green, to do all the things we want to do as the human race gets off oil and gas, we need a ton of silver,”

In 2016 solar PV demand increased a whopping 43% over the year before to nearly 2400 tonne. The projections depicted below are staggering.

A less known but growing use is silver as a catalyst and in particular for the production of ethylene oxide and formaldehyde. From The Silver Institute:

“More than 10 million ounces of silver are used each year to produce ethylene oxide. Ethylene oxide is the foundation for plastics including polyester, a textile used in both mainstream fashion and specialty clothing. This same substance is an ingredient in molded items such as insulating handles for stoves, key tops for computers, electrical control knobs, domestic appliance components, and electrical connector housings. About 25% of ethylene oxide production is used to manufacture antifreeze coolant for automobiles and other vehicles.”

Throw in brazing and soldering (55m oz), bearings, medical equipment and drugs, water purifications and of course there is still significant use for its past champion, ‘old school’ photography.

You will note in the first graph above that industrial and jewellery demand are relatively stable. The fluctuating piece is of course investment bars and coins. Interestingly, whilst you would expect the 2017 numbers to decline in this sense as everyone flocks into the ‘everything is awesome’ share market and cryptos, and that most certainly will be the case for bars and coins, the chart below shows the flow into the ETF‘s, mutual funds, etc, is actually still consistently on the up despite the weak price action. Wall St is still wary of the ‘everything is awesome’ narrative and parking more and more into these paper trades of gold and silver as their insurance hedge.