Silver COMEX – Speculators Net Short

News

|

Posted 27/05/2019

|

8068

At the end of April we reported when the net Speculators (non commercials) position on COMEX hit zero and the historic correlation of price increases soon after such an occurrence. Since then the silver price in USD has continued to fall (albeit up in local terms due to the falling AUD). That has been because the Speculators have continued to shed their long positions to actually end up net short last week per the Commitment of Traders report released on Saturday.

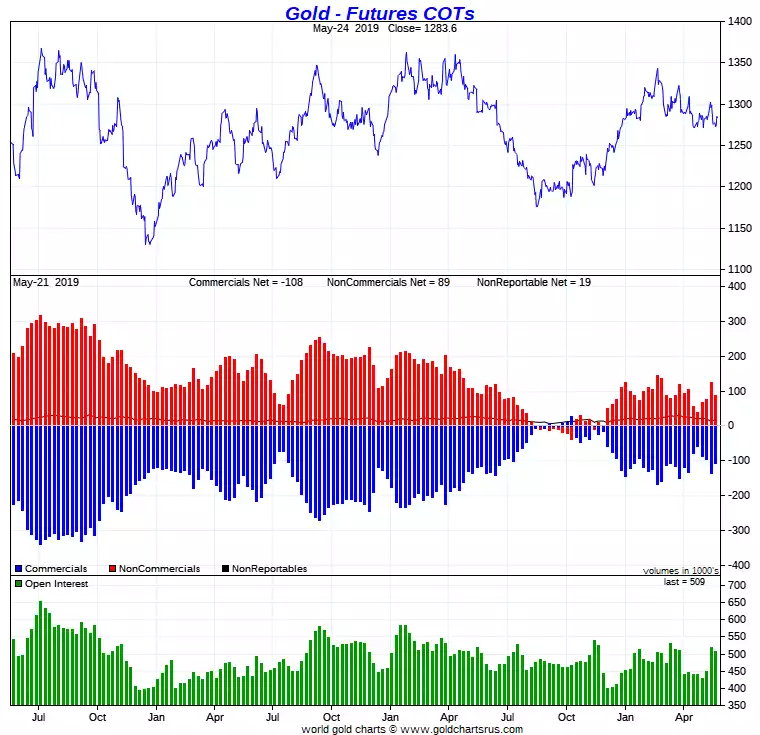

Speculators have a track record of being wrong at big turning points and are now short, or betting on more falls, whilst the big commercials (ala JP Morgan et al) are usually right at turning points and have dramatically reduced their net short positions. The Commercials are often used for hedging by miners etc so it is highly unusual for them to be anywhere near being long. The set up for gold is not as convincing right now but that of course shouldn’t be a surprise to any follower of the Gold:Silver Ratio as we discussed last week.