Signs of Cracks in the Lucky Country

News

|

Posted 10/07/2023

|

7482

The global economy is wrestling with the aftermath of numerous overlapping shocks, as aptly outlined by NAB's Chief Economist, Ivan Colhoun. From a global pandemic and geopolitical tensions to seismic shifts in monetary policies, these events are constantly reshaping the world's economic landscapes. Australia, amidst this maelstrom, has managed to prove its resilience with surprising strength.

Ever since the COVID-19 crisis began to stir up the Australian economic milieu back in 2020, we have been on a rollercoaster ride of unexpected turns. Powered by over half a trillion dollars in combined state and federal government stimulus and pandemic-induced demand, our economy has showcased a remarkable capacity to rebound.

However, the recent rapid surge in mortgage rates – the most significant in Australian history – has cast shadows over our economic prosperity. We're witnessing an economy contracting in per capita terms and a retail sector where the actual volume of goods sold is dwindling, despite substantial population growth.

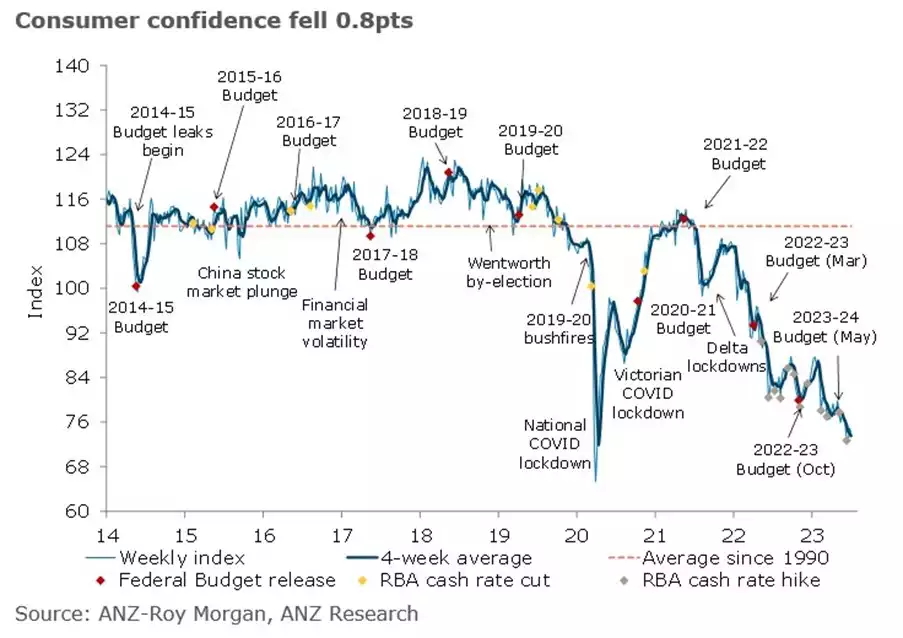

Alarmingly, consumer confidence echoes the despair we last experienced during the 1990-1991 recession. Yet, amidst these looming threats, a silver lining has emerged for our workforce.

Around this time last year, anxiety loomed over the potential deterioration of the labour market and the fear that increasing interest rates could culminate in substantial job losses. But against the odds, the Australian job market has shown tenacity. According to the ABS's recent reports, May saw the creation of 39,800 jobs, while the unemployed ranks fell by 14,500 - a remarkable performance considering the overarching economic backdrop and the low consumer confidence.

This resilience begs the question: how can the labour market maintain such durability, and how long until these cracks begin to widen? To understand this, we need to delve a bit deeper into our economic chronicles.

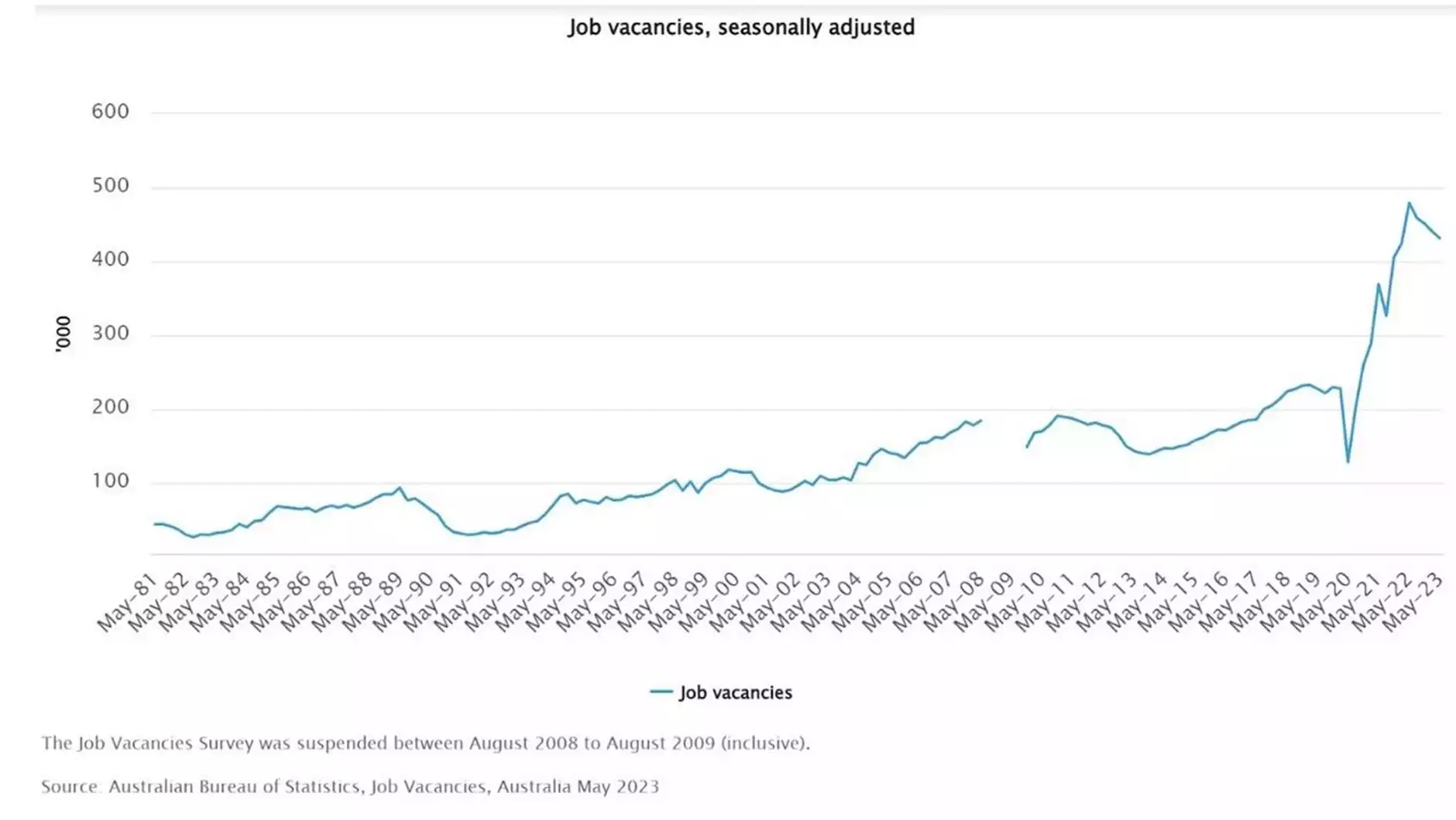

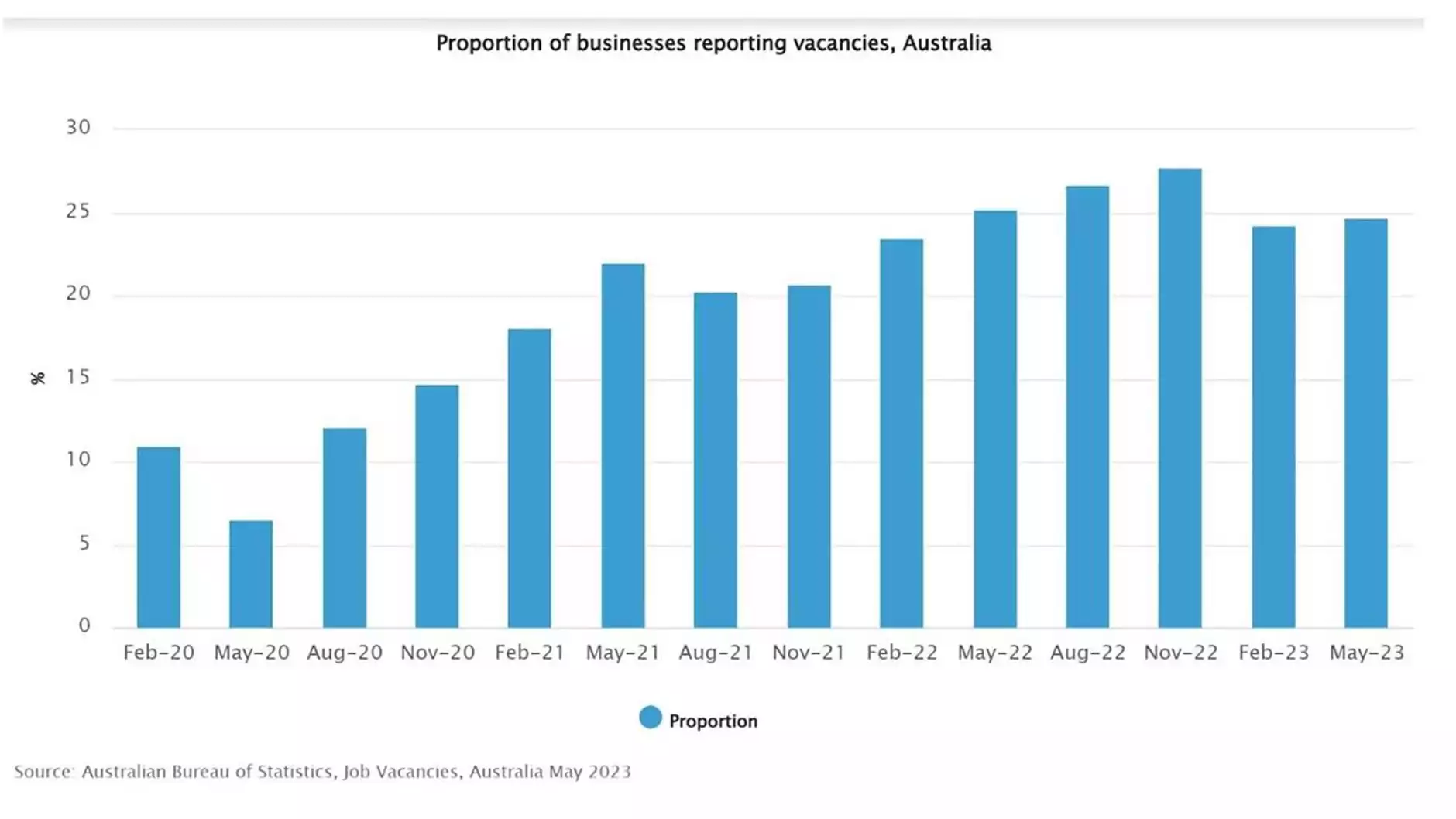

Before the pandemic reached our shores in February 2020, 11.0% of businesses reported job vacancies. Between then and the metric's peak in November of last year, this proportion more than doubled to 27.7%. Job vacancies followed a similar trajectory, with total vacancies increasing by 110.3% from February 2020 to May 2022.

Typically, a significant spike in unemployment follows a drop in job vacancies, marking a transition from hiring to layoffs. For instance, 13 months before the pre-COVID recession in 1989, the ABS job vacancy index noted an 18.2% decrease in available jobs, which, five months later, triggered a surge in unemployment.

However, our current economic cycle hasn't seen a rapid deterioration in job vacancies. Instead, we've been on a slow, steady downward grind since May last year. Nevertheless, job vacancies are still 89.3% higher than pre-pandemic levels, suggesting that if the decline continues at its current rate, we won't revert to pre-COVID levels until 2030.

Surprisingly, despite the daunting increase in interest rates, diminishing inflation-adjusted retail sales, and the recessionary levels of consumer confidence, employers are largely unwilling to let go of staff. Even with the reopening of our international borders in February last year, the proportion of employers reporting job vacancies remains high, with the figure standing at 24.7% as of May.

The past 30 years have seen Australia skirt what might be deemed a 'typical' recession, where a considerable contraction in economic output corresponds with a significant increase in unemployment. Instead, threats to economic growth prior to COVID-19 were often counteracted with government or RBA stimuli or sheer good fortune. This created a deep-seated confidence among businesses in the Australian economy's ability to manage crises swiftly and efficiently.

However, the recent increases in interest rates and the decline in inflation-adjusted retail sales over the past 18 months are far from 'normal.' While various job ad and employment vacancy indices currently suggest sustained labour market resilience, the long-term forecast is murkier. The confidence vested in the economy's ability to weather a storm may soon be severely tested as the domestic economy slows and the spectre of recession hangs over some of the world's largest economies.

Let's unpack this further and consider the potential ramifications over the next 18 months.

- Resilience of the Labour Market: If businesses, particularly small ones, feel the squeeze from increased loan costs due to rising interest rates, we could see a downturn in job availability and subsequently, increased unemployment rates. The resilience of the labour market is a critical factor in the coming months, both as an indicator of economic health and as a safety net for households.

- Eroding Consumer Confidence: Rising interest rates and stagnating wage growth coupled with escalating inflation could pose significant threats to consumer confidence. With the cost of living effectively on the rise, Australians may tighten their belts further, causing a decline in consumer spending, which could exacerbate the contraction in the retail sector. Low consumer confidence could dampen the demand for goods and services, thus slowing economic growth and impacting businesses and employment rates.

- Potential Recession Impact: As these factors intertwine, the spectre of a recession could become more real. Typically characterised by negative GDP growth, high unemployment rates, and diminished consumer spending, a recession could take these existing trends and magnify them, creating a domino effect across the economy.

Looking ahead to the next 18 months, it's clear that Australia is navigating uncertain economic waters. The robust job market may continue to act as a buffer against a severe economic downturn. However, with the looming threat of recession, increased interest rates, and dwindling retail sales, the strength of this buffer could be severely tested.

So, as the Australian economy faces an uncertain future, and as the international markets flounder in a turbulent sea of challenges, perhaps it's time to turn back to gold and silver – not just as a store of value, but as a beacon of certainty in uncertain times.

Despite the rollercoaster ride of economic surprises that 2020 and 2021 have presented, the sheen of gold and silver has remained undiminished...