Shocking Eco Data v Sticky Inflation – Market Gyrates ahead of Jackson Hole

News

|

Posted 24/08/2022

|

11197

Markets were volatile last night as ‘bad news is good news’ hopes of a dovish pivot from the Fed were then met with growing fears of a hawkish Fed speech at Friday’s Jackson Hole international central bankers annual love-in. Shares were down and gold was up, but let’s explore what happened.

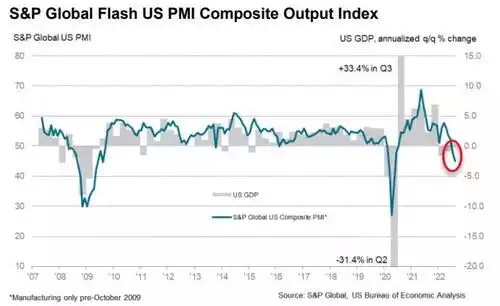

A month ago we wrote about the recessionary signals being sent by the PMI’s then. Last night it got worse again. The manufacturing survey fell to 51.3 from 52.2, beneath the expected 51.9 while Services stumbled to 44.1 from 47.3, despite an expected acceleration to 49.1. The composite fell to 45 from 47.7. As a reminder, anything below 50 is contraction.

We also saw poor home sales data. US new home sales fell 12.6% in July to 511k, beneath the expected 575k and the prior 585k, and as such printed the slowest pace of sales since January 2016 including pandemic lows. Additionally, new home supply rose to 10.9 months (prev. 9.2 months), increasing for eight consecutive months, hitting its highest level since 2008. In other words, sales are plummeting and inventory rising. Whilst prices are holding the pressures going forward are clear as mortgage rates rise and real wages continue to fall painting a very concerning supply demand imbalance.

The final print was the Richmond Fed survey for August which disappointed, as the composite manufacturing index declined to -8 from 0 with shipments falling to -8 (prev. 7.0) and volume of new orders sliding to -20 (prev. -10.0).

You can’t get a clearer picture of recessionary pressures. From the PMI author S&P Global Market Intelligence’s Senior Economist:

“August flash PMI data signalled further disconcerting signs for the health of the US private sector. Demand conditions were dampened again, sparked by the impact of interest rate hikes and strong inflationary pressures on customer spending, which weighed on activity. Gathering clouds spread across the private sector as services new orders returned to contractionary territory, mirroring the subdued demand conditions seen at their manufacturing counterparts. Excluding the period between March and May 2020, the fall in total output was the steepest seen since the series began nearly 13 years ago.”

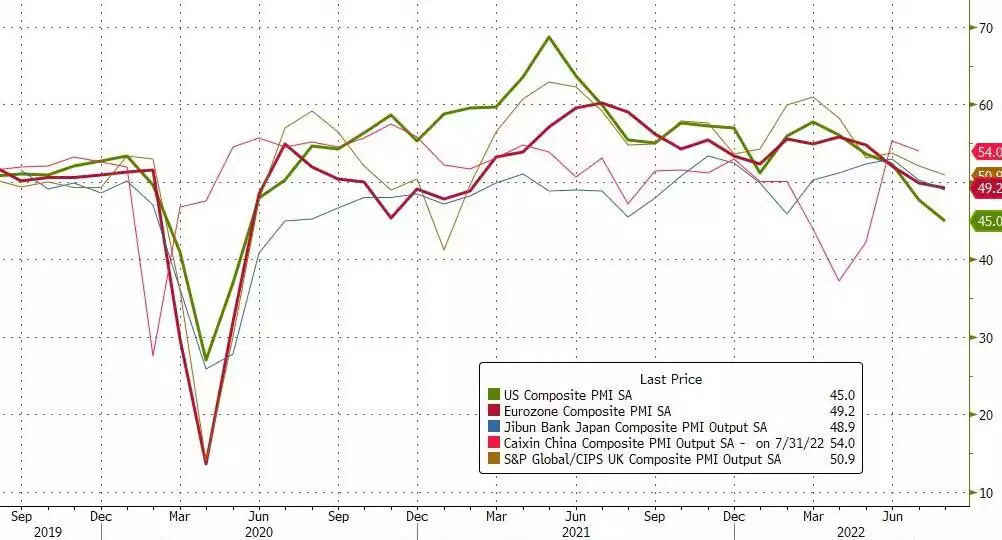

This now puts the world’s biggest economy at the head of the majors pack in terms of lowest PMI’s but overnight we saw the Eurozone join them in the sub 50 club along with Japan. You can see below that China and the UK are falling as well.

All this bad news of course saw shares rally as the easy money addicted market saw an easing Fed more important than a recession…

But then we saw a reversal… From Bloomberg:

“Hawkish recent comments from Federal Reserve officials appear to have convinced market participants to get out of the way as the central bank raises interest rates, leading to a consensus that Chair Powell will deliver a hawkish message on Friday, according to Standard Chartered Plc.”

Investment giant Nomura expects Powell to be hawkish as a number inflation overshoot prints around the world remain “structurally sticky” meaning Central Banks will be forced to run “restrictive / higher for longer,”.

We even saw 2 of the Fed members calling a 100bps rise in September!

The other challenge dead ahead is the fact that there has been no net QT to date and it is expected now to kick in next month. This clearly presents another critical piece to the Fed’s removal of liquidity from the market. The unspoken liquidity handbrake is the impact of rising energy costs and that too last night took a bad turn with OPEC+ essentially saying they will reduce supply to keep prices high and the critical Freeport LNG facility announcing delays in initial production by one month adding to the natural gas crisis.

Shares reversed to the red and bond yields rallied with an awful 2 year auction and the 10 yr back over 3% again. Gold is reading trouble ahead and jumped nearly $20 and back about $1750. The falling USD took the shine off in AUD terms as the AUD jumped back up to mid 69’s.

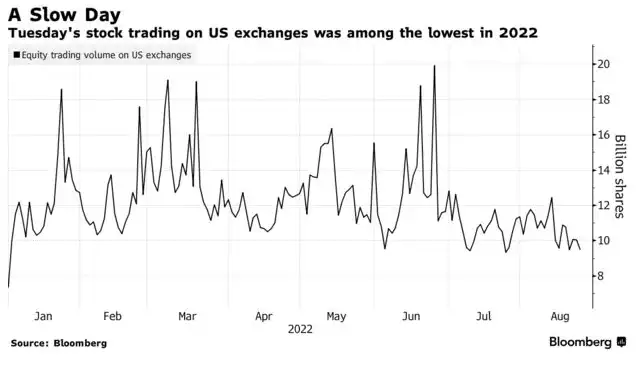

This is clearly a skittish market. It is also a relatively illiquid market with last night’s trade one of the lowest this year (see below). Participants are rightly worried and seemingly holding back to see what happens. Many are in cash ready to deploy. The problem is, that cash is going backwards at high single figure rates as inflation tears through the few dollars in interest you may be lucky enough to get.

It’s a busy data week ahead of Jackson Hole with US durable goods, MBA mortgage applications, pending home sales, US GDP and initial jobless claims all before Mr Powell speaks at 10am US time Friday. What….will…he…say. As we reported last week, as crazy as it seems, it’s all about the Fed at the moment, but no one knows what they will say next!

Stay balanced and join us this afternoon for more GSS Insights discussion on this topic.

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************