September Rate Cuts - Cause for Caution Not Complacency

News

|

Posted 20/08/2025

|

1475

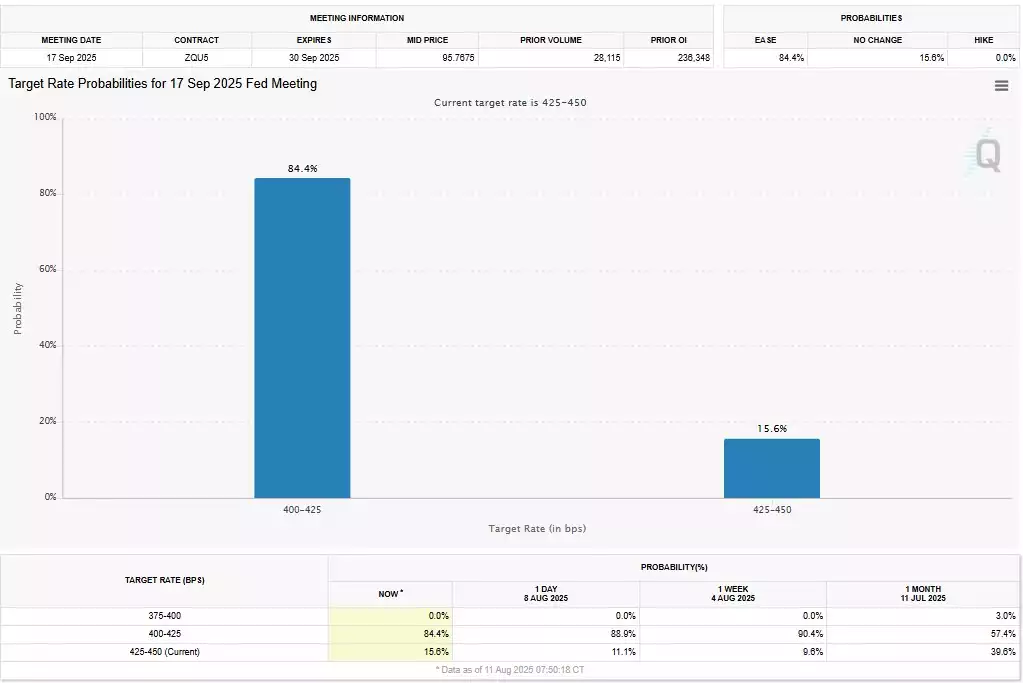

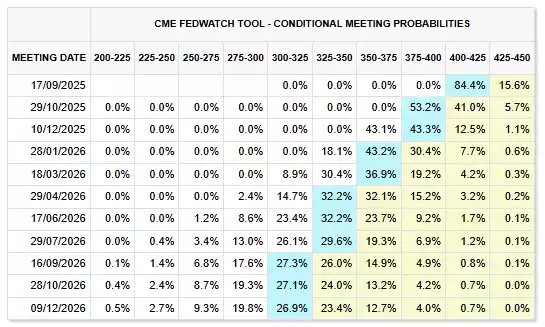

With markets now pricing a 90% chance of a US Fed rate cut in September, the reaction from many is one of optimism. However, viewed through the lens of the 18.6-year land cycle, this should be cause for caution—not complacency.

We're currently within the expected window for a cycle peak (2024–2028), with early 2026 being the average. Looking back to the previous peak during the Global Financial Crisis (GFC), we saw that interest rates were held high right into the top of the cycle. When the Fed eventually began cutting, the market had already peaked—or was only months away from doing so, with the S&P 500 topping out three months later in October.

Whether rate cuts are bullish or bearish depends heavily on the surrounding economic conditions.

Rate cuts following a period of high rates—while employment remains strong, inflation contained, and land markets stable—tend to be bullish. But when cuts come in response to

weakening conditions, as they did during the GFC, it’s typically a sign that the Fed is behind the curve, forced to react rather than lead.

Cutting into weakness usually signals that cracks in the financial system are already significant, and that a repricing is imminent—often catching complacent investors off guard. This is the kind of dynamic that has historically marked the top of the 18.6-year land cycle.

With September rate cuts now expected—and considering the historical three-month lag between the start of cuts and the cycle peak—a major macro top in the next 3–6 months is a scenario worth watching closely.

Historically, land and equities don’t peak simultaneously. During the GFC, land peaked first, followed by a divergence: the homebuilders ETF posted a lower high while the S&P 500 pushed to new records. Today, we see something similar—the S&P has climbed to new highs post the Trump tariff sell-off, while the homebuilders ETF has managed only a modest rebound. This may signal the early stages of a divergence, and we’re closely watching for a lower high to form in housing-related equities.

There is still a possibility that this cycle extends beyond the average—particularly if employment data improves over the coming months. However, late-cycle complacency rarely pays off. Now is a time for vigilance.

It's also worth noting that this marks the fourth 18.6-year cycle within the broader 80-year macro cycle. This opens the door for a possible final blow-off rally—much like the Roaring Twenties before the Great Depression. A rate cut this September could mark the beginning of the final ascent before a significant correction. But that doesn’t necessarily end the land cycle—it could stretch toward 2028, especially if we see the next four-year business cycle “left translate” into a sharp rise, marking a macro top.

Should this unfold, it would likely be supported by aggressive monetary easing in response to a 2026 downturn—potentially under a second Trump administration.

We’ll continue tracking the land market closely for signs of a turning point. Historically, land and stocks rise into the peak, then take years to recover. Precious metals, on the other hand—

particularly gold and silver—have tended to rise into the peak and continue gaining strength afterward.

Silver has historically outpaced gold in the recovery phase, with the gold-to-silver ratio dropping significantly post-crash as speculative capital flows into one of the few asset classes showing resilience. This positions precious metals investors well—offering sustained rallies into the peak, followed by potential blow-off moves during the downturn and beyond.

Watch the Insights Video inspired by this article here - https://www.youtube.com/watch?v=LMwTs66xjBs