Saudi Arabia deals ANOTHER blow to US Dollar

News

|

Posted 14/04/2023

|

11079

This week Saudi Arabia has dealt another blow to the U.S Dollar, with the clearest sign yet that America is facing an increasingly inevitable downward spiral in geopolitical influence. China and Saudi Arabia have completed new agreements on oil and trade,

From Nov 2021 until Jan 2023, the US drew on the U.S. Strategic Petroleum Reserve to push oil prices down globally. In late March the Biden Administration announced that it was seeking to build the reserves back up again. Right on cue, OPEC+ announced a cut of more than one million barrels per day (BPD), sending the spot price right back up. This was met with a direct threat from the Biden Administration of “severe consequences” if Saudi didn’t raise production. Many commentators have suggested that Biden may have more success controlling the price of oil if they loosen the permitting restrictions on oil developments. The “severe consequences” were announced by Biden as the potential to remove their military support of the Arabian nation underpinning the PetroDollar. In an interview, the Crown Prince responded to questions about these threats by stating simply, “we are done trying to please the United States”.

One wonders why the Saudis would say something like this publicly. They must already have their next major powerbroker ally in the bag to show such public indifference to the health of their US alliance. The Kingdom of Saud is potentially revealing itself as a global bellwether, in the shifting strategic sands. According to a UK based research firm, BRICS nations now contribute 31.5% of global GDP, narrowly overtaking the G7 nations with 30.7%.

As we have stressed numerous times on Ainslies’ Daily News, the significance of the power shift will see a destabilisation of the US Dollar as the world reserve currency, and the flight to gold as a universal standard of value among trading partners that don’t necessarily trust each other. This has been borne out by BRICS nations stockpiling gold and dumping treasuries as the power structures re-balance.

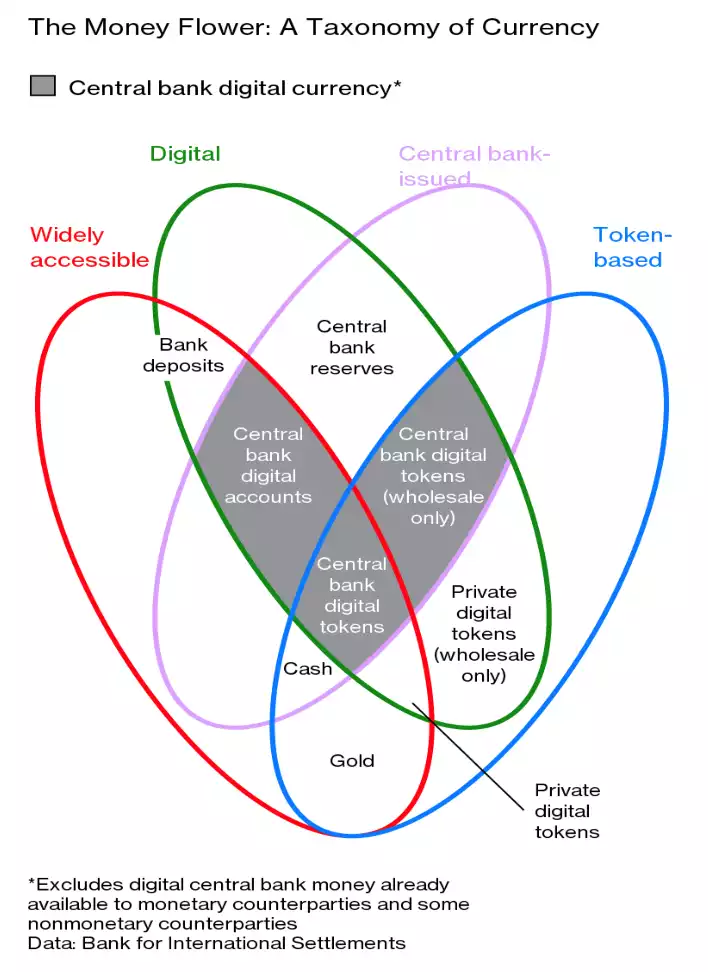

The Bank of International Settlements themselves showed it best, with their “Money Flower: A Taxonomy of Currency” published initially in October of 2018. It showed gold as the foundation on which forms of currency stand: whether they be regular deposits, central bank reserves or private digital tokens.

Conveniently, they have now taken “gold” out of the bottom circle, and left it empty. Given how those in the know are acting and the recent price action, it’s likely that the careful retraction was far from an accident.