Rick Rule – Why Silver will outperform

News

|

Posted 15/07/2021

|

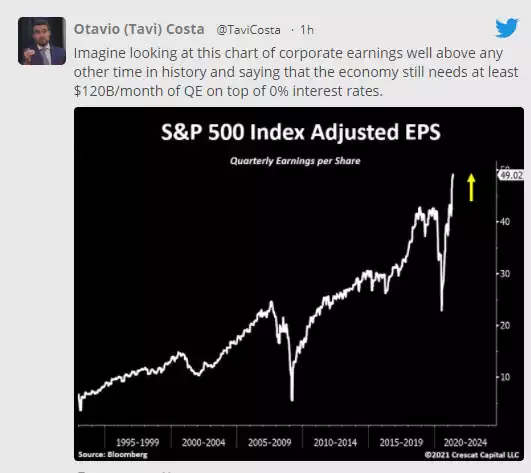

9048

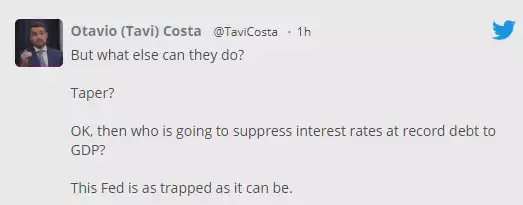

Yesterday we got commodities legend Rick Rule’s thoughts on gold and today we see what he thinks about silver. But first we had more newsworthy market action overnight in Fed chair Powell testifying before Congress and getting grilled on their easy money policy amid surging inflation. Powell steadfastly held his ground saying the economy still had a long way to go before it would be considered ‘recovered’, though acknowledged inflation had "increased notably” and that it would likely "remain elevated in the coming months before moderating." Gold had a strong night and bond yields fell as the market was reminded of the absurdity of all this so insightfully captured by this tweet afterwards:

They may be trapped but as an investor you can protect and indeed profit from this unprecedented economic debacle. And that is the perfect segue to throw back to Rick Rule’s recent interview with Real Vision. Yesterday was about gold (and if you missed it there is no better succinct explanation for why you need to own it – here) and today here’s what he said when asked about silver:

“Traditionally, in the second half of a precious metals bull market, silver outperforms gold, because silver attracts both the greed buyer and the fear buyer.”

“Why does silver always follow gold?

Why it always follows, I don't know, to be honest with you. I'll just be completely candid and say, I don't know. I do know that for thousands of years, gold has been viewed as insurance against social calamity through lots of cultures. Gold is money. It's an asset that is not simultaneously somebody else's liability, and it's a store of value.

Silver is all of those things, too. It's tended, over time, to be more volatile. My own belief is that in the next 10 years, silver will maintain its volatility, but it will outperform gold. It has traditionally outperformed gold in later stages of a bull market, as we've said, but the fabrication technologies that utilize silver are such that I think that what people who look at both metals forget to understand is that gold doesn't go away. It gets taken from a hole in the ground called a mine, and it gets thrown into a hole in the ground called a vault.

When people talk about gold supply, they need to take into account that most of the gold that's ever been mined is still supply. Silver is different. We use a lot of silver for a lot of applications. Solar panels, as an example. The solar industry wouldn't exist without the reflective properties of silver. Silver is also an extremely effective germicide, so when you see a water treatment plant being built as an example, you're seeing silver being consumed. Similarly, we should add note by a sidebar that PGMs, platinum group metals, have also traditionally been precious metals and in many, many markets, mediums of exchange, money and stores of value.

Similarly, like silver, they get used up. In their case, they get used for catalytic converters, and they go out a tailpipe. I believe over 10 years that you're going to begin to see a disconnect between gold and silver in silver's favour. Much is made of the fact that the ratio of the metals in the Earth's crust is 16:1 silver over gold, but the difference in terms of pricing is 55:1 or 60:1 [69:1 now]. That in of itself is a factoid. The silver bugs always say that silver has to go up because it's underpriced relative to gold on the supply side.

That doesn't matter. What matters is utility. I think the utility of silver in industrial applications, and the utilization of silver in industrial applications is growing so fast in so many places, that you will begin to see the pricing dichotomy between gold and silver correct in silver's favour, although I think both will do well.”

We’ll share Rule’s thoughts on platinum tomorrow…