Rick Rule – Gold’s Compelling Case for Big Run from Here

News

|

Posted 01/03/2023

|

9179

Last night saw more pain on Wall Street as yet more data to the growth upside spurred on concern that a ‘soft landing’ is off the table and the ‘no landing’ scenario we outlined a couple of weeks ago is gaining more traction. That saw shares off again and gold, silver and platinum rallying strongly despite a stronger USD. The second-guessing by the market is a classic example of intense concentration on the trees and not seeing the forest. Rick Rule was recently interview by Real Vision and gave us a salient reminder of that forest scale view and why so many are joining his bullish gold view.

Primarily this is about debt and deficits, a “truly terrifying” set up in his view. Regular readers will know this, but it is a timely reminder as we get caught up in soft / hard/ no landing narratives as to ‘what is next’. What is next is exactly as it has been before through millennia as credit cycles and Fiat currencies boom and bust.

Lets start with the facts.

US Debt

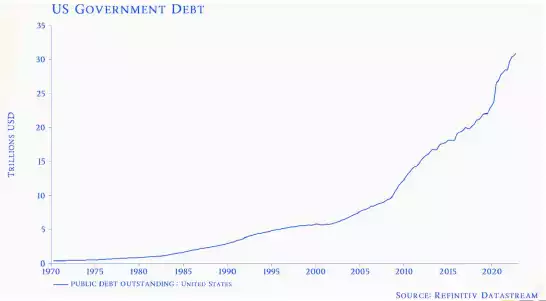

The holder of the world’s reserve currency is sitting on $32 trillion of public debt. If you deduct the Fed’s balance sheet (by virtue of all the USD it has printed through QE) that is still $26 trillion. A truly and unprecedented amount of debt.

Rule points out too, that whilst that is an extraordinary number it simply pales next to the unfunded liabilities not put on that account that the US’s very own Congressional Budget Office estimates to be $100 trillion. These are very real and growing commitments around the likes of Medicare and Social Security that WILL be needed and are not included in their debt figure. Critically too, that figure does not include debt at the State and Local Government Level.

US Deficits

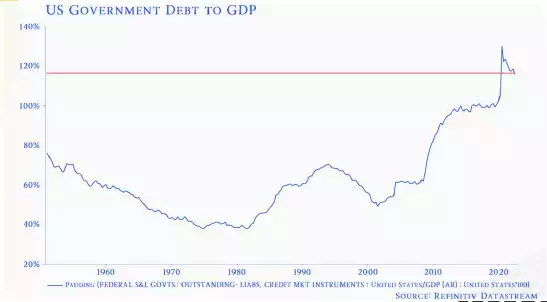

To make matters worse, they are nowhere near being able to pay that debt down as they are also seeing annual deficits of around $2 trillion which ADD to the debt not reduce it. No one would argue productive debt is a good thing as you pay it down with your profits. This simply is not happening. In 1980 the debt compared to US GDP (the measure of growth to possibly pay it down) was 20%. It is now over 100%!

Interest Rates – Nominal & Real

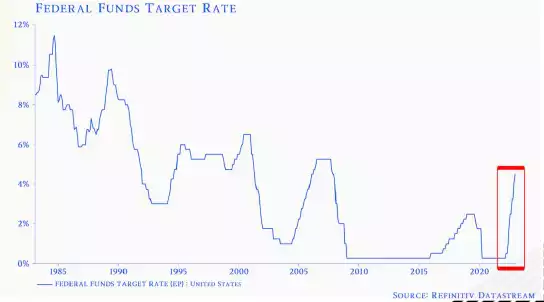

Since that turn in 1980 we have seen interest rates trending down. Rule argues that has come to an end and has dire consequences.

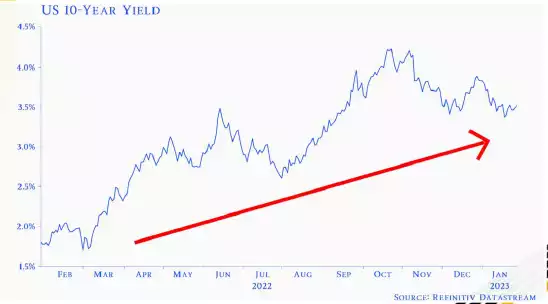

Firstly, all that aforementioned debt needs servicing. The government has been unable to achieve a surplus at record low interest rates, how on earth will it do so at 4 maybe 5%? The interest they are paying on their benchmark security, the 10yr Treasury has doubled in just 12 months.

However that is only half the story. US inflation is around 7% so that US 10yr Treasury yielding around 3.5% is guaranteeing you that you will LOSE around 3.5% over 10 years. The US Treasury is the global ‘risk free return’ benchmark. Jim Grant cleverly corrects that to be ‘return free risk’…

The USD

Underlying ALL of the above is of course the USD. It was on a tear given the Fed were earlier than anyone in raising rates and attracting money into its ‘risk free’ bonds. There was already a run to it as the US equities market outperformed the world. But the wheels are now clearly wobbling AND they have arguably overly weaponised it to the point, as we have written extensively in past weeks, there is a very real, tangible global move away from it. On top of the fact that, as a creditor you see the behaviour of the issuer and do the aforementioned math of REAL returns (after inflation) and start to think, can I do better in my own country than -3.5% return?

That Leaves Gold

And so if you have the safe havens of USD, bonds and gold, he argues you can see the massive appeal of gold coming to the fore.

Rule sees the 2023 and 2024 story as the long bonds disintermediation, the exiting of these positions in light of all the above and that some of that will go to gold. ‘Some’ seems an underwhelming word but here is the key point. The US Treasury market is the biggest in the world. Not everyone will get this move but even at the margin, it is a massive number. Precious metals currently sit at around 0.5% of the US investment market. The 40 year mean sits at around 2%, and at the market top last time this setup existed in 1980, it was more than 6%. That’s not to say it will go back to 6% but even just to 2% is a 400% increase in market share and hence demand.

Unlike USD or US Bonds, you can’t just print more to meet demand. Economics 101 has the established equation of supply , demand and price. 400% demand against 2% supply leaves a rather alluring price part of that equation. There is no other variable.

How the Fed orchestrates the so called ‘landing’ from these massive rate hikes in the short term is less relevant to the bigger picture of a structural setup that when you stop looking at the ‘landing’ trees and look at the forest of debt, deficits, the USD and US Treasury set up, you get a much clearer view of the way forward and the need for precious metals in any investment portfolio.