“Rich Guys” Warn of Market Top & Insolvency

News

|

Posted 14/05/2020

|

23012

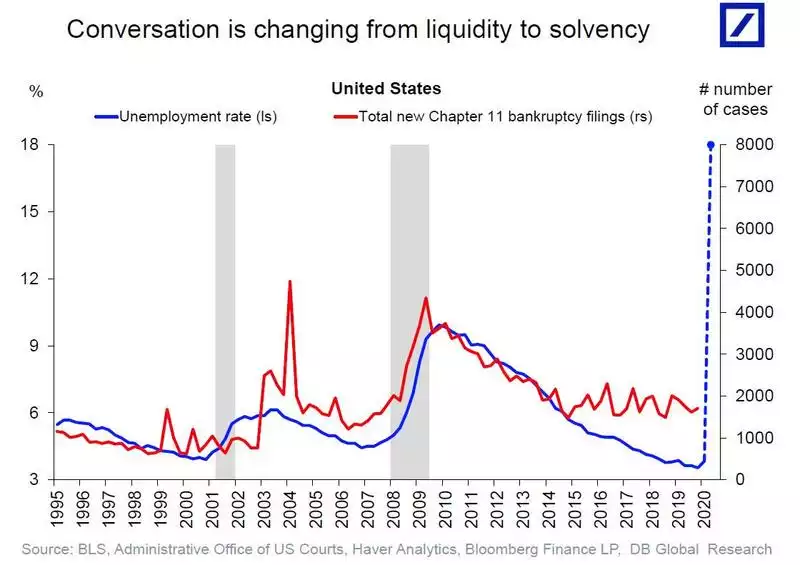

Yesterday we talked about the deflationary spiral before us as we move from a liquidity crisis to a solvency crisis. Topically yesterday billionaire Wall St hedge fund heavyweight Stanley Druckenmiller publicly warned of exactly this and the ramifications. He was joined by another billionaire hedge fund founder David Tepper sounding warnings and Fed Chairman Powell as well who warned of tough times ahead and hosing down expectations of the Fed going negative. It was too much reality for the market and shares sold off and gold and bonds bid higher again.

On the current sharemarket Druckenmiller said "The risk-reward for equity is maybe as bad as I've seen it in my career," and Tepper calling parts of the market “the most overvalued I’ve seen since 1999."

Trump didn’t like this anti ‘everything’s awesome’ sentiment one little bit Tweeting his frustrations at “the so-called “rich guys” speak negatively about the market”….

Speaking directly to the ‘don’t fight the Fed narrative’ for why it’s completely safe to pile into sky high valued companies during possibly the worst recession in a generation, Druckenmiller said:

"The consensus out there seems to be: 'Don’t worry, the Fed has your back'….. there’s only one problem with that: our analysis says it’s not true."

He goes on to spell out that despite the unprecedented amount of liquidity the Fed is injecting and stimulus the Government is injecting, that the effects of the virus are larger than they are being given credit for, longer lasting and we will soon see what he described as a “slew” of bankruptcies. In terms of the so called V shaped recovery he said "I pray I’m wrong on this, but I just think that the V-out is a fantasy".

Another “rich guy”, head of the worlds largest asset manager, Blackrock’s Larry Fink just last week reported that bankers were telling him to "expect a cascade of bankruptcies to hit the American economy."

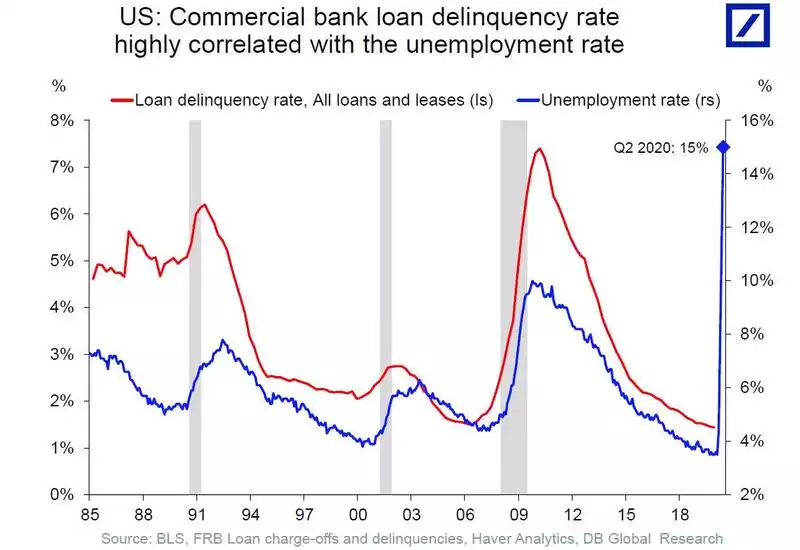

The following 2 charts (courtesy of Deutsche Bank Global Research) sound a very clear warning of the magnitude of what may be before us.

As Raoul Pal points out too the injection of liquidity may well spur on the emotion and liquidity driven sharemarket but it does nothing for the solvency of most companies or fundamentally improve economic growth. Druckenmiller on that $3 trillion stimulus injection - "It was basically a combination of transfer payments to individuals, basically paying them more not to work than to work. And in addition to that, it was a bunch of payments to zombie companies to keep them alive."

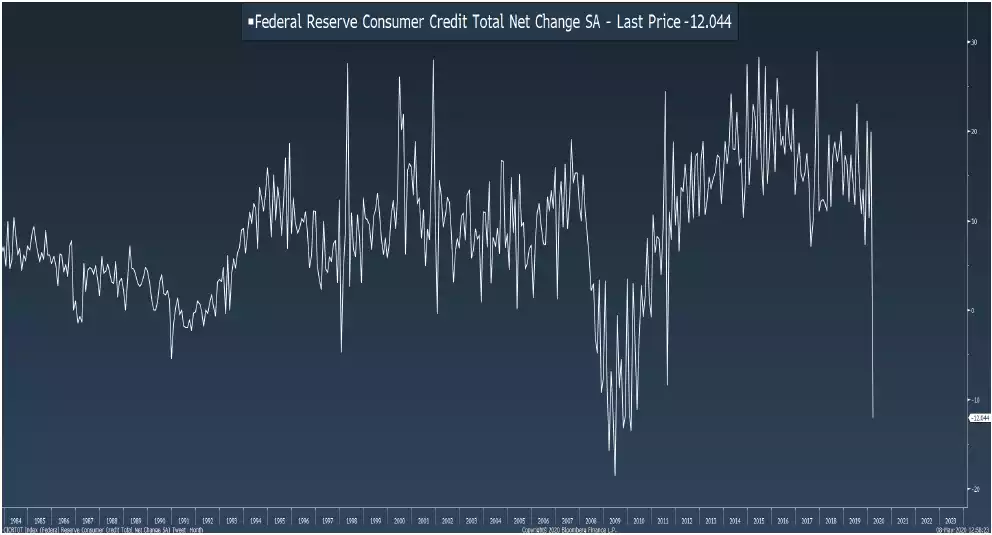

As Pal points out “You can't solve solvency with cash. Cash is a liquidity injection. It's to solve a liquidity crisis. A solvency crisis is all about revenues.”

The US has had 33m new people become unemployed in just 7 weeks, a new record 15% unemployment rate which predicted to go to 25% or even 30%. On no logical basis will that simply revert to what it was. Fewer employed combined with closures means less consumption and already US Consumer Credit has contracted by the worst amount since the depths of the GFC.

The insolvency crisis puts us into a situation not seen since the Great Depression. The GFC was ‘just’ a liquidity crisis recession. A solvency crisis, particularly one at this juncture of 75 years into arguably the biggest Long Term Debt cycle in history, could lead to a depression of similarly historic proportions. As Druckenmiller noted yesterday “there's a good chance that we just cracked the credit bubble that's the result of free money."

Noting in the interview that gold is up 28% this year, it should be no surprise that Druckenmiller’s fund is long gold…