Repo Rates Spike - US Fed Prepones Pivot

News

|

Posted 05/11/2025

|

2980

The US repo market—the backbone of short-term funding for American banks, with daily volumes exceeding US$4 trillion—has shown signs of acute liquidity stress over the past week. On 31 October, while many were focused on the cricket, the Federal Reserve quietly injected US$29.4 billion into the banking system via overnight repurchase agreements. This marked the largest single-day repo operation since the pandemic panic in March 2020. Since last Friday, total liquidity injections have surpassed US$125 billion.

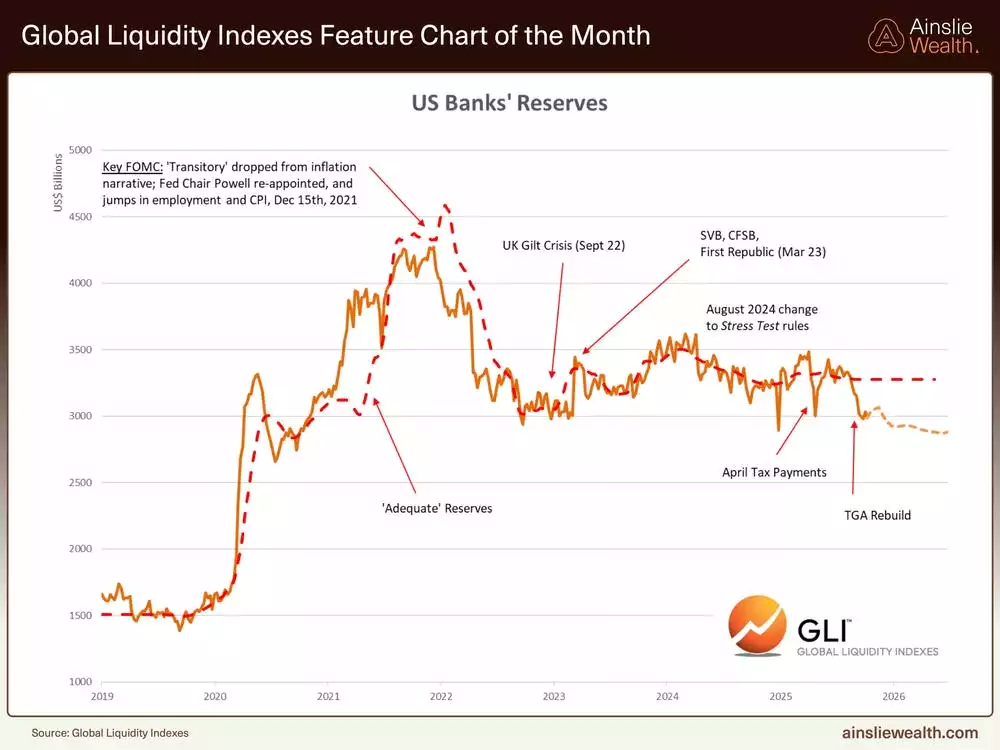

The SOFR (Secured Overnight Financing Rate), the key benchmark for repo rates, spiked to 5.33% on 1 November—35 basis points above the Fed Funds Rate—highlighting the scramble for liquidity. Concurrently, US bank reserves held at the Fed have dropped to US$2.8 trillion, reaching levels considered precariously low.

In response, the Federal Reserve brought forward the end of Quantitative Tightening by a month to 1 November. It also pivoted towards short-term Treasury bill purchases to relieve supply-side pressures, amid a heavy issuance schedule by the US Treasury—roughly US$600 billion in October alone.

With the Fed now actively buying newly issued government debt, the structural vulnerabilities of the global debt-based financial system continue to deepen. Gold, long regarded as a barometer for US fiscal credibility, often rises as the dollar is devalued to service ballooning debt. The Fed’s latest pivot underscores the inflationary environment we are likely to endure for the foreseeable future.

As human-designed financial systems—often distorted by short-term incentives—begin to buckle, tangible assets like gold and silver remain reliable stores of value, offering protection against inflation and systemic instability.