Recap – What is BRICS & Why Gold is Pivotal to It

News

|

Posted 29/10/2024

|

2793

Established in 2006 and coming together for the 1st BRICS summit in 2009, BRICS is an economic and political alliance initially between Brazil, Russia India and China and later South Africa. The group was formed to cooperate on economic development, trade, finance and global governance.

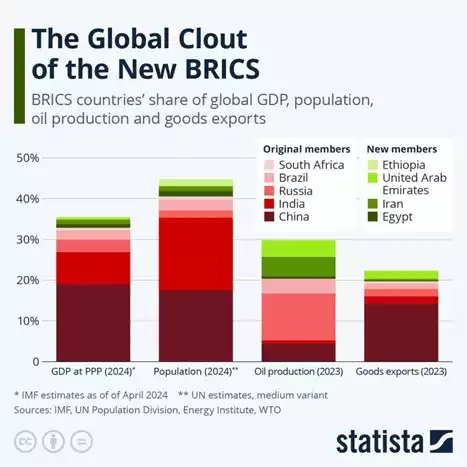

Today, BRICS has expanded to include Iran, Egypt, Ethiopia, and the United Arab Emirates, making a total of 9 member states. There are also 13 partner countries including Turkey, Vietnam, Nigeria, Malaysia, Indonesia and Belarus. You might consider this the waiting room to get in….

The goals of BRICS are:

- Economic Collaboration: BRICS countries account for a significant share of the world’s population, landmass, and GDP, making their combined influence considerable on the global economy. They cooperate on a range of issues, from trade to infrastructure development.

- New Development Bank (NDB): Established in 2014, the NDB provides financing for sustainable development projects across member countries, serving as an alternative to traditional Western-dominated financial institutions.

- Contesting Western Dominance: BRICS countries advocate for a more multipolar world order, challenging Western political and economic influence in global affairs. They often seek reforms in international institutions to better reflect the interests of emerging economies.

- Annual Summits: BRICS leaders meet annually to discuss strategic cooperation on issues like climate change, health, technology, and sustainable development.

- Expansion Plans: Recently, BRICS has considered expanding its membership to include other emerging nations, aiming to extend its influence further across the global south.

A Significant Team of Players

The magnitude of the combined economies, and the potential influence they can have on the world in future, can’t be understated. As shown below, the member nations account for a significant amount of the world’s trade, and with 35% of global GDP they outweigh the G7 at 30%

BRICS, the U.S. Dollar and Gold

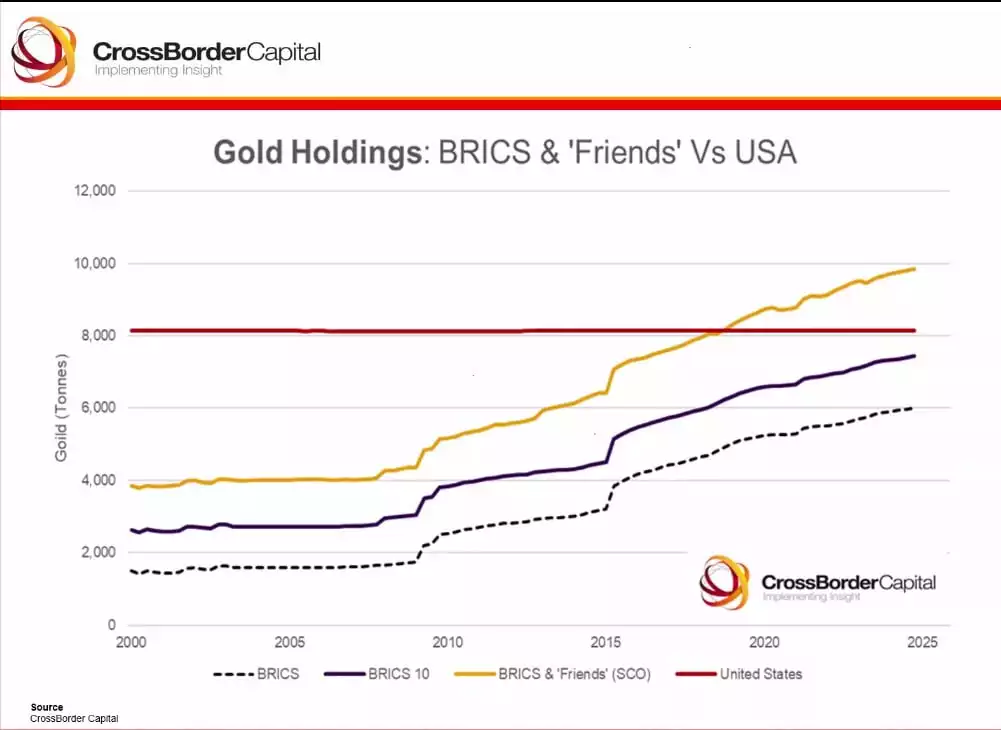

One of the stated goals of BRICS is to achieve de-dollarisation. This means they can conduct their affairs like trade and finance without using U.S. dollars. One way they hope to achieve this is through the creation of a new currency that will be used instead of U.S. dollars. So far, the member states have talked about using a basket of national currencies (e.g. Chinese Yuan, Russian rubles etc.). This will take some time and a lot of coordination between countries to achieve. BRICS has also spoken about the possibility of backing their new currency with gold, along with a basket of national currencies. While the currency will take some time before it’s ready to use, the uptick in gold buying from the central banks of the bloc may hint at a future gold-backed currency. One has to consider the quite different idealogues and so gold is a single unifying element of trust between them.

The ability to de-dollarise also serves as a means to achieve another stated objective of BRICS, which is to challenge the unipolar world that is dominated by the likes of the United States, the International Monetary Fund and the United Nations. By reducing the demand for U.S. dollars, the bloc challenges U.S. dollar hegemony and lessens the influence of America.

16th Annual Summit in Kanza, Russia

One significant piece of news from the event was the agreement between Prime Minister Narendra Modi of India and President Xi Jinping of China to resolve their border conflicts after their first formal meeting together in 5 years. Much of the doubt around BRICS is about the challenges between nation-states and this was seen to be very material as they agreed to improve relations and disengage troops at contested borders.

To discount BRICS would be foolish as would downplaying gold’s age-old role as a single trusted asset without counterparty risk. Just as central banks are buying up gold at a record pace, one should always ‘do as they do, not do as they say’ (as in trust our ‘paper’ currency…)