Real Yields Are Real Important for Gold

News

|

Posted 20/04/2023

|

11838

It is a common rule that negative real interest rates are the perfect conditions for a rising gold price. As a reminder REAL interest rates are nominally the headline interest rate we commonly talk about LESS inflation. Gold pays no yield or interest and so traditional (short sighted?) thinking investors think about the carry cost of owning gold and hence pay particular attention to real interest rates. Why? Because if real rates are negative your ‘zero risk’ yielding asset of bonds are in essence a losing bet. You are buying a bond priced on the promise of returning you, say, 3% when you know that 6% inflation promises you will lose 3% on that investment. Moreover, and as SVB and a few other banks painfully discovered, your bank deposit is paying you next to no interest which, less inflation, is seeing your money going backwards at a great rate combined with systemic banking risk. What SVB et al demonstrated is that this house of cards very quickly falls apart when there is a bank run of people taking their money out.

At Ainslie we are seeing 2 mega trends of late being a proliferation of SMSF’s piling into gold and silver to diversify their retirement savings out of this highly intertwined ‘system’ and into hard assets with none of that counterparty risk; and high net worth individuals sitting on cash in a bank waiting for the recession but becoming increasingly nervous in a bank for the aforementioned reasons and converting that to gold and silver.

But whilst negative real interest rates are very easily understood and clearly constructive for gold, a recent Bloomberg Markets report discusses “Gibson’s Paradox” that instead proves that this dynamic actually starts at a positive 2% real interest rate, not below zero. From that article:

“Real yields should provide an even greater tailwind for gold through the rest of 2023, supported by a weaker dollar and by buying from reserve managers.

Gold is flirting with all-time highs versus the dollar and several other currencies, while it is at its highs versus several more currencies, such as the Japanese yen, the Australian Dollar and the Indian rupee.

Gold is often simplistically taken as an inflation hedge. However, the correlation between gold returns and CPI is very close to zero over the long term. Instead, the interplay between inflation and interest rates — i.e. real rates — is more meaningful for gold.

Gibson’s Paradox stemmed from the observation that real interest rates and gold move inversely to one another (named a paradox by Keynes as it contravened standard economic theory). Gibson’s Rule said that for every percentage point the real fed funds rate was below 2%, gold should rally 8% over the next year.

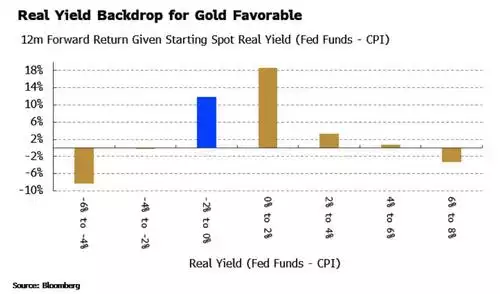

The data gives a more nuanced answer. The chart below shows the subsequent one-year return of gold (in dollars) for different real-rates buckets. There is more of a parabolic relationship with real rates and gold rather than a straight line.

Real rates (-1% now) are currently very favorable for gold on historical basis.

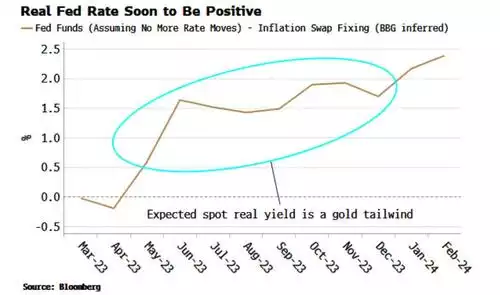

Furthermore, real rates are set to get even more gold-friendly. CPI fixing swaps and the current level of Fed rates show that the spot real rate is expected to be between 1% and 2% for most of the rest of this year, i.e. in the most favorable bucket for forward gold returns.

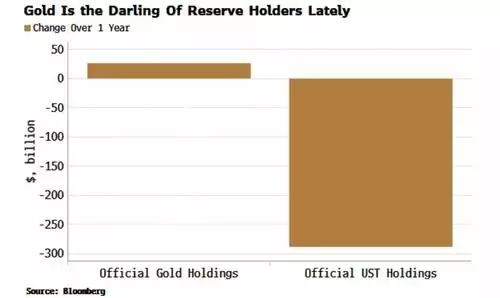

If we add to this real buying from reserve managers, the backdrop has fundamental support. It is way too premature to call the end of the dollar as the world’s reserve currency, but it is clear countries are diversifying away from USTs, and some of the gap is being filled by gold.

Add in a dollar downtrend that looks intact for now, and gold should continue to perform well, and quite conceivably start making all-time highs in several more currencies, not least the dollar.”

If we refer back to our article “YOU NEED TO UNDERSTAND THIS – IT'S ALL ABOUT LIQUIDITY”. To explain simply that these are in essence the same fundamentals consider that low nominal interest rates are caused by investors buying bonds (which raises the bond price and inversely lowers the yield) and/or central bank policy suppressing them. Here’s our first paradox. CB’s are clearly hiking or holding hiked rates well above where the bond market has them, so who prevails? The bond market is often referred to as the ‘market of truth’. That same bond market is also currently inverted, something that happens before every recession. That means long term yields are lower than short term, hence the pain for the banks. Hence also a market saying there is serious pain ahead and that CB’s will lower rates and open the liquidity spigots again in the future (to get out of the recession). Inflation is high and if we go back to fundamentals arguably one of the most famous economists, Milton Friedman, famously said: “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” Whilst there are ample signs that ‘inflation’ is dropping we need to introduce a new concept of two inflations – headline and asset, or lets say Main Street and Wall Street. We may well see Main Street inflation fall but the bond market (and a host of other indicators) is telling us a recession is imminent and CB’s will (and as we know, already are) turn on liquidity to stop the whole financial Ponzi scheme freezing up. That money will find its way to into assets that benefit from such debasement and low cost despite a ‘recession’ – gold and silver. We spoke most recently to the recession yesterday and where you can make money.

More money, less output, just like Friedman defined. So real interest rates will see lower rates AND sticky inflation, just not where mainstream headline looks.

Those who understand this can profit from the asset inflation whilst all others go backwards waiting.