Reaganomics vs Bidenomics

News

|

Posted 11/07/2023

|

6729

What is Bidenomics?

Bidenomics is a new term that the Biden government has recently termed and appears to be the start of their 2024 Presidential Campaign. Though nothing new it is using government spending to help jumpstart an economy. Keynesian Fiscal polices act in a direct way and generally impact the economy immediately through taxes and spending within 3-12 month timeframe.

Bidenomics (although just Fiscal with a new name), is a policy according to Wiki

‘is characterized by relief measures and vaccination efforts to address the COVID-19 pandemic, investments in infrastructure, and strengthening the safety net, funded by tax increases on higher-income individuals and corporations. Other goals include: increasing the national minimum wage and expanding worker training; narrowing income inequality; expanding access to affordable healthcare; and forgiveness of student loan debt.[1] The March 2021 enactment of the American Rescue Plan to provide relief from the economic impact of the COVID-19 pandemic was the first major element of the policy. Biden's Infrastructure Investment and Jobs Act was signed into law in November 2021 and contains about $550 billion in additional investment. His Inflation Reduction Act was enacted in August 2022.’

Joe Biden has claimed Bidenomics is very much middle out, bottom up, growing the middle class’. He has claimed his spending policies have helped temper inflation and reduce unemployment – though we would argue that for the latter this may be true, but inflation has only tempered more recently coinciding with the Republican control of the House of Representatives.

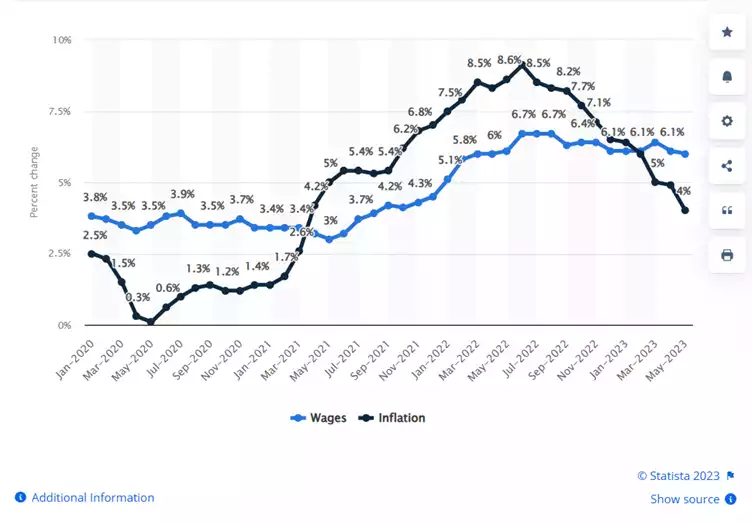

All well and good to have low unemployment and dropping inflation, a real wage recession is what most bottom to middle class Americans have seen and the differential does not paint a rosy picture. In the 29 months since Biden has taken office, real wages have fallen 3.16%.

Reaganomics

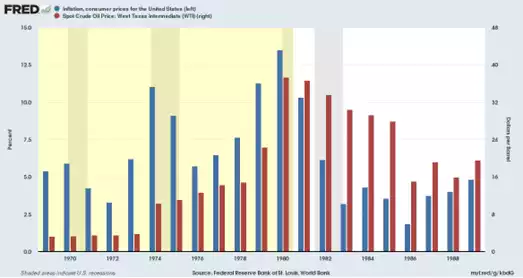

Before the Reagan administration, the US economy was experiencing stagflation. In 1981 Reagan new to the POTUS office announced his 4 pillar Reaganomic Policy - reduce taxes, reduce federal spending, reduce regulation ad tighten money supply to battle inflation.

This type of policy is known as a supply-side policy and a true ‘monetary’ policy, saw inflation decrease throughout the 1980s bringing inflation back in control and a 15 year US economic golden era followed.

*Yellow side predates Reaganomics

Reaganomics is also known as ‘trickle-down’ economics where the benefits of such as tax cuts (70% marginal rate to 28% marginal rate under Reagan) eventually trickle down to the lower and middle class but can take several years to take effect. Trickle-down economics was a key component of Trump’s economic policy preceeding the Biden fiscal policy.

Trump and Biden supercharged economy

As discussed, Reaganomics or trickle-down economics can have a lead time of several years before it takes effect and Bidenomics, another name for Keynesian fiscal policy can have near to immediate impact, so what we are seeing in the US right now may actually be the intersection of Trump and Bidens opposing but complimentary economic policies. As companies kick into their new investment during a time of increasing interest rates they need to look for higher returns – creating inflation and labour market strength, meanwhile fiscal government spending increases also creating higher inflation and labour market strength. More recently with a tempering of inflation the hangover from supercharging the economy with both supply-side and fiscal policies may lead to an even greater hangover.

In fact, supporting Trumps policy impacting the US economy which Bidenomics is attempting to take credit for, the economy grew more than three times as fast in the first quarter of 2021 than in the first quarter on 2023

In a recent visit to Chicago on the 21st of June, Biden touted all the new construction going on from the Democrats passed in congress – but based on the building cycle – this is unlikely as a result of Bidenomics but a result of Trump policy. And its all well and good building new skyscrapers, but with the recent working from home trends the supercharged building going on may actually lead to an even greater fall with no demand for these new investments, a trend that Ainslie has recently identified in the article Is Blackstone the NEXT domino to fall? (ainsliebullion.com.au)

Reaganomics vs Bidenomics.

In the past 60 years the US budget has been in surplus 5 years, 1969 and 1998-2001. And the likelihood of this happening anytime in the future seems more and more unlikely with a huge increase in government interest payments.

The real difference between these Reaganomics and Bidenomics is Reagan attempted to balance the budget and ensure government spending did not exacerbate inflation and ensured future generations didn’t need to pay these deficits.

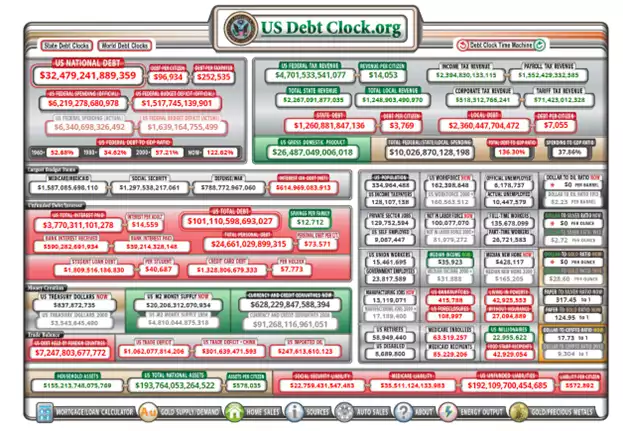

Whereas Joe Biden continues the increase government spending with a rapidly increasing deficit - $32.5 trillion and counting.

The Hangover

Supply side economics, like Trump’s ‘trickle-down economics’ – tax breaks for companies and the wealthy, an attempt to strengthen the economy though the trickle down of benefit to the rest of the economy, can have impact periods of years and US economic strength would currently still be seeing the tailwinds of these polices. Bidenomics – ‘very much middle out, bottom up, growing the middle class’, fiscal spending has a much shorter 3-12 month economic impact, again which we saw through 2022 and only appears now to be slowing down marginally. With the House of Representatives now tempering this spending and both expansionary polices coming to an end are we about to see the hangover of this intersection and will this one be bigger with fewer levers left to pull?