RBA’s Housing Wrecking Ball

News

|

Posted 20/07/2022

|

15212

At a time when the Government is announcing an enquiry into the RBA we are seeing a stark contrast between their view of the world and that of the country’s largest mortgage provider and questions around the impact now before us of statements like “we will not be raising rates before 2024”. So lets see how that is playing out…

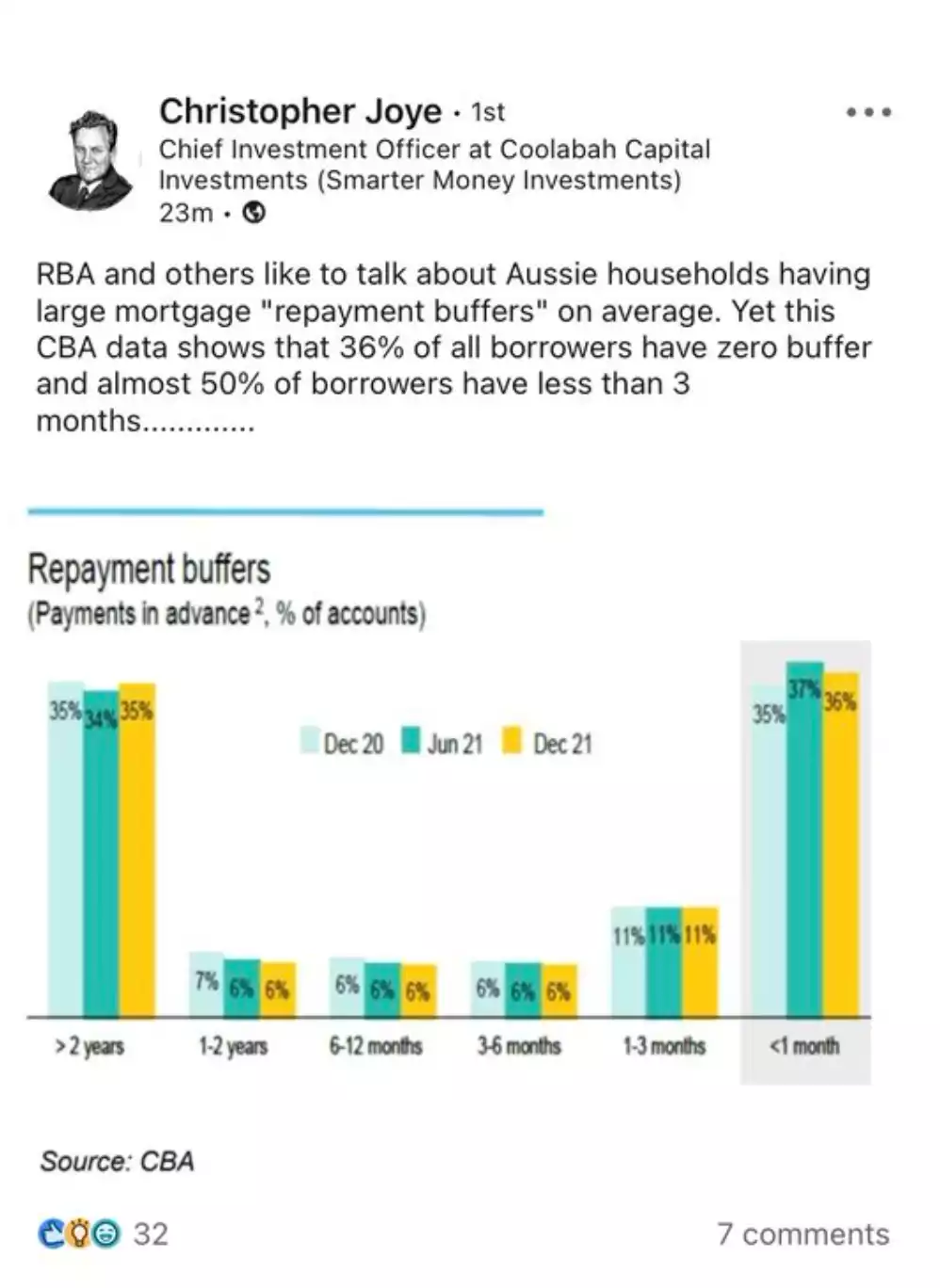

The following post from columnist Chris Joye has certainly got people’s attention:

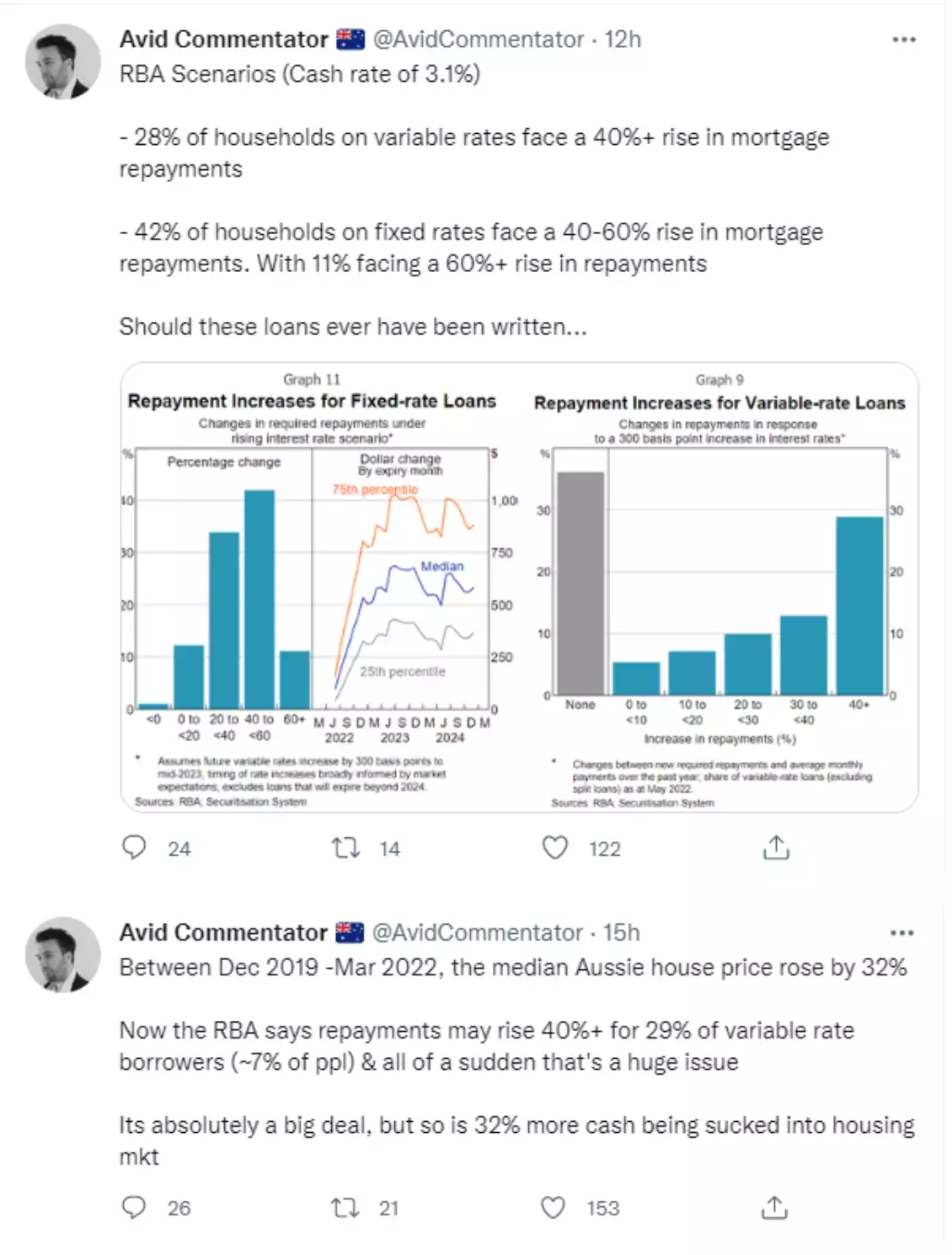

Consider this against the backdrop of the following 2 tweets from Avid Commentator:

The RBA would like us to believe there is no ‘policy mistake’ and that they can engineer a soft landing to a woefully poor call of 2024 rate rises and late response to rising inflation and lagging wage growth. The following excerpt of an article that should be read in full (full version here) paints an incredibly concerning picture for Australian’s ‘all in’ on property:

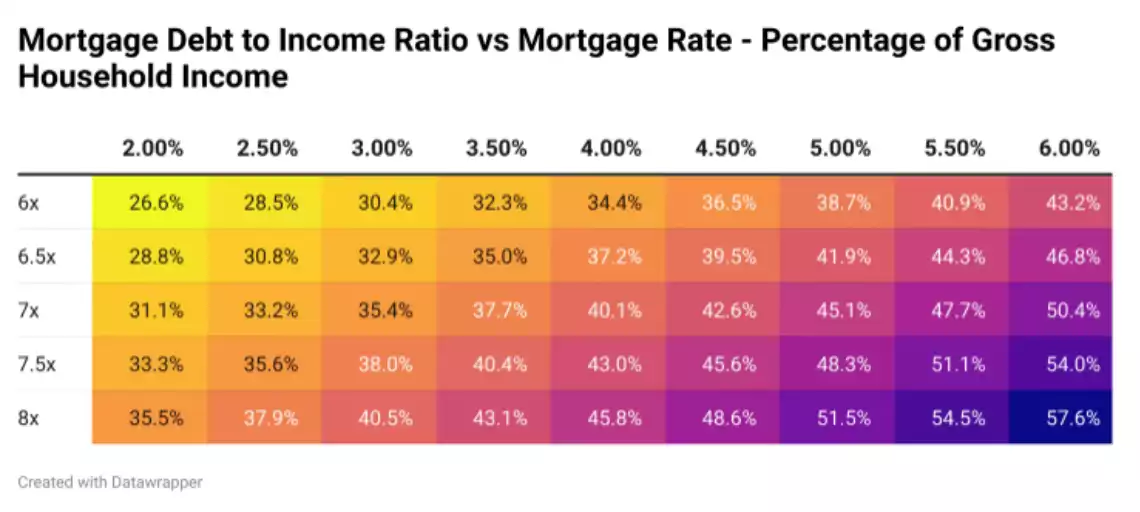

“With a recent survey performed on behalf of Finder.com.au showing that more than 1/3 of recent first home buyers were pushed beyond their budget in order to afford their home, we’ll be exploring the scenario of a household borrowing 6.8x of their income as one of our central themes.

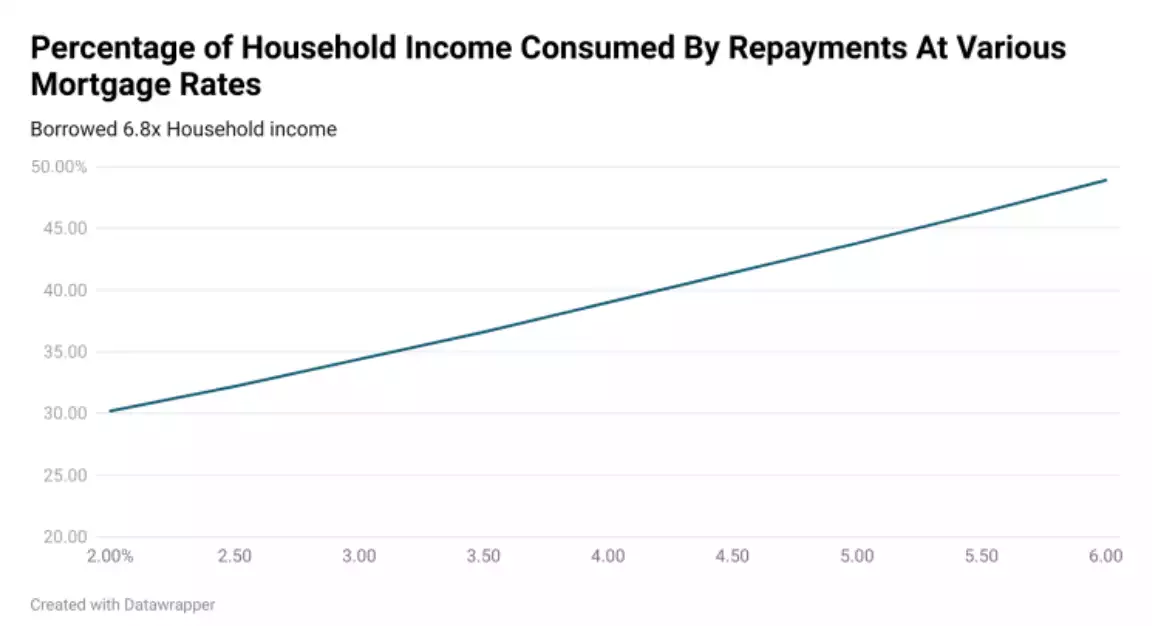

If this household borrowed 6.8x their household income on a 3 year fixed rate loan at 1.8%, this would consume 29.3% of their household income.

According to the RBA, prior to rates starting to rise the average mortgage rate on outstanding owner occupier loans was 2.5%. With the cash rate now having risen 1.25% and it widely tipped to rise another 0.5% in August, a mortgage rate of around 4.25% is likely to be roughly ballpark in the coming months.

At this level this would be consuming 40.2% of the gross income of our hypothetical household.

However, with the market pricing in a 3.5% cash rate peak for next year, this would put us at roughly the half way point of the interest rate rise cycle.

This view was recently shared by former Treasury Secretary Ken Henry during an interview with ABC’s 7:30 Report. During which he stated that the RBA will be looking to get the cash rate to a “more normal level of probably 3-3.5%”.

At a cash rate of 3.5% and a mortgage rate at roughly 6%, our hypothetical household would now be spending 48.9% of their gross household income on their mortgage.

Even in terms of the absolute best case scenario of a household borrowing exactly 6x their household income, at a 6% mortgage rate repayments would consume more than 43% of gross household income.”

And this is not a quick fix. He goes on:

“A scenario in which mortgage repayments rise to 43% of gross household income or more, was always going to be a challenging one, but once its put into the context of current circumstances, it becomes clear exactly how much pressure these households may find themselves under.

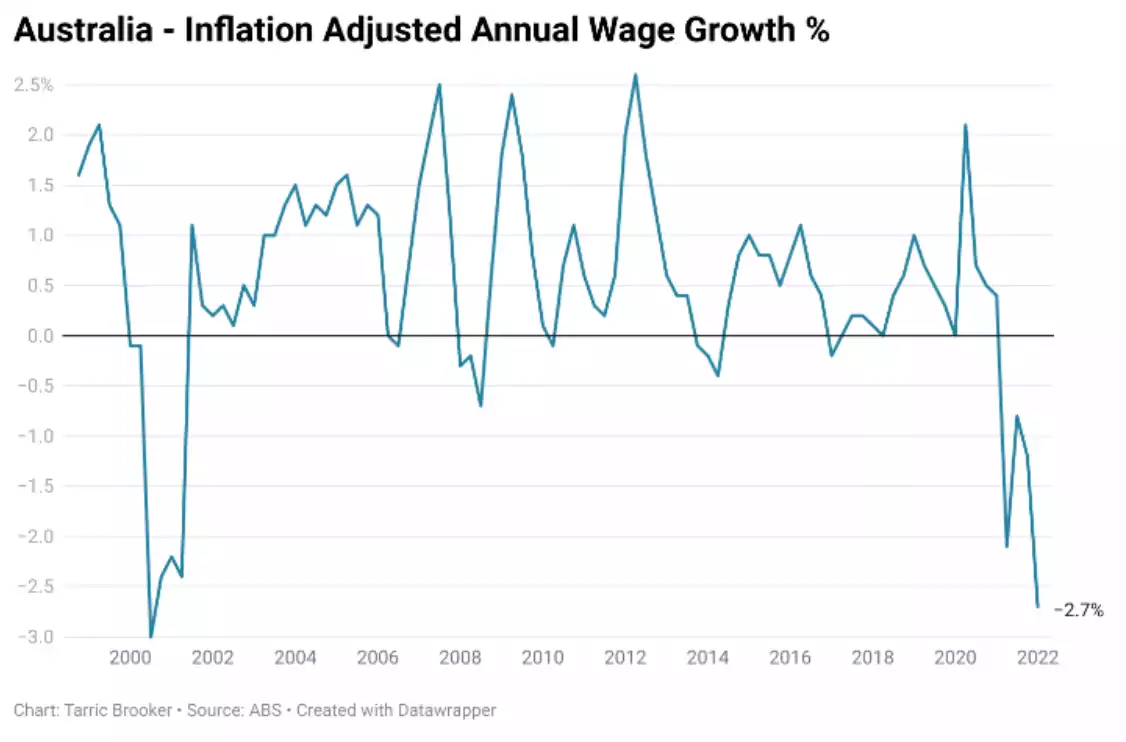

Currently Australia is in the midst of its longest period of negative real (inflation adjusted) wages growth since the introduction of the GST (goods and services tax) in the year 2000.

With the spending power of Australian households in aggregate falling behind the current rate of inflation by 2.7% per year and Treasury estimates that it will be 2024-2025 before wages growth begins to once again outstrip inflation, the challenge faced by mortgage holders who borrowed more than 6x household income will continue to grow in severity.”

And discounting the commentators who say we won’t get price declines until people lose their jobs and are forced to sell he points to: “As we’ve seen in New Zealand prices can plummet all on their own without any assistance from stressed households pulling the ripcord and getting out of the market.”

Whilst Australia is at record low unemployment, nearly every recession is preceded by very low unemployment and the bets of a recession coming are sounding louder and louder. Whether Australia escapes it as in 2008 largely depends on the demand for our commodities and this time it looks a little like China may not be there. Regardless we will most definitely feel the pain at a time when the figures above paint a very painful picture for many already. Choose your investments wisely.