RBA Day & the Aussie Housing / Immigration Ponzi Scheme

News

|

Posted 05/09/2023

|

2410

GDP per Capita Recession

In July, despite a 4.9% CPI in July, retail volumes plummeted 1.4% for the year. On top of this the Household Spending Indicator for July is now down 0.7% year on year. Discretionary goods and services were down 3.3% year on year and non-discretionary spending rose 1.7%. Now non-discretionary are things you have to have, and to simplify just for illustration, if CPI is up 4.9% (1.7%-4.9% = -3.2%) so people are forgoing necessities at a rate of -3.2% and discretionary items are cratering (-3.3%-4.9%= -8.2%) down 8.2%. Speak to anyone and they will tell you times are tough and they are foregoing items – But our CPI at 4.9% shows we are not in recession – how?

Housing Market Inflation

Last months inflation figures once again showed the endemic problem the Australian housing market is facing, with the most significant contributor to CPI being inflation at 7.3%. With our net immigration hiding the current GDP per capita recession can the great Albanese Ponzi scheme continue without putting even greater strain on our cost of living? Well let’s have a look at the numbers….

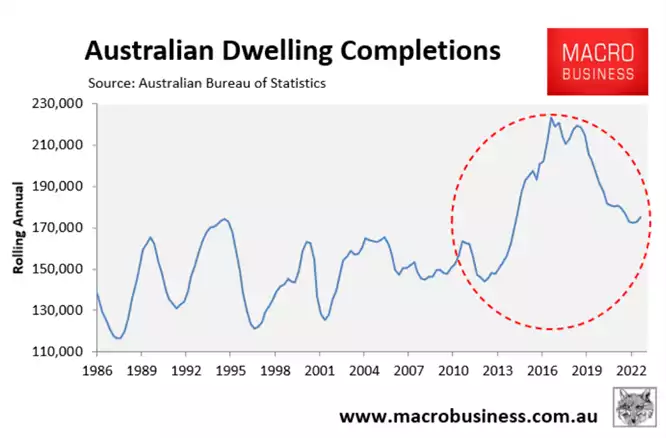

Since 2010 Australia experienced the biggest dwelling construction boom, and as we all know finding a house together with exorbitant stamp duty rates, sometimes its just easier to renovate and stay. We also remember all the free passes the construction industry got to keep building during covid – meaning that part of the Australian economy did not slow significantly during the lockdowns.

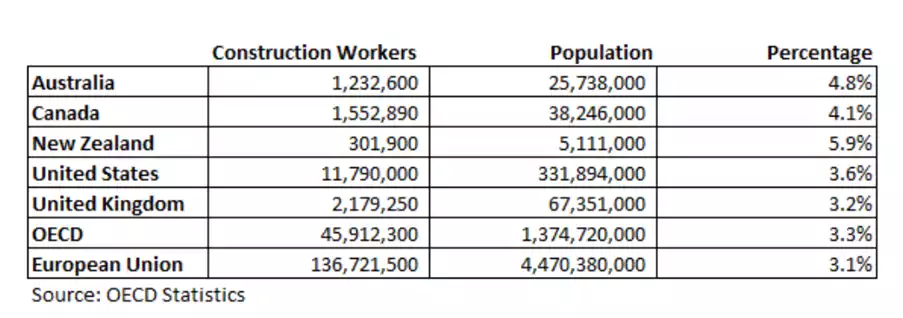

Now in order to build all those houses, Australia compared to other countries in the world had 1,232,600 or 4.8% of our population employed in construction, one of the highest in the OECD.

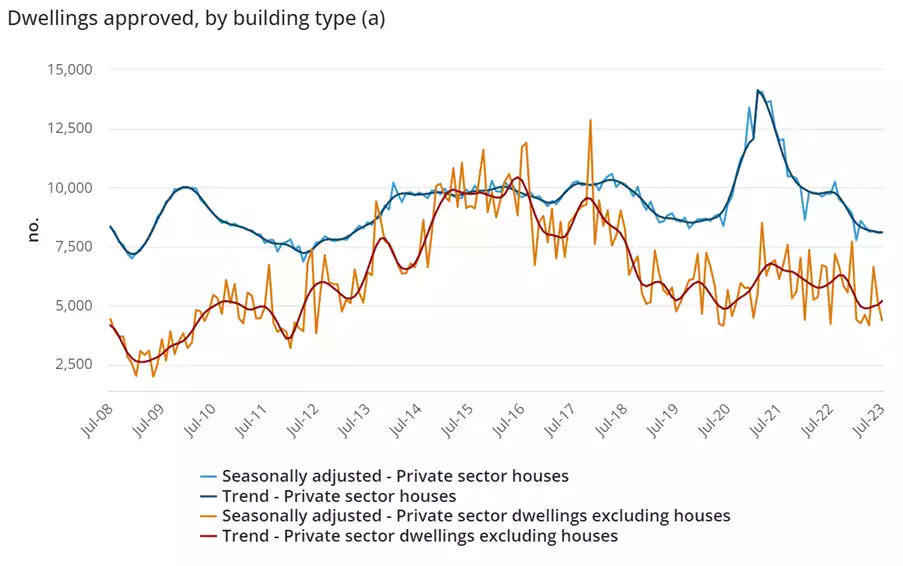

Now peak construction saw 223,000 homes built in 2017. But looking at current data and housing starts in 2016 (assuming a 12 month construction lag) approvals were sitting around 20,000 per month. Now looking at July 2022 – approvals were around 16,000 per month. But look at the rapid deterioration through 2023 – approvals (and therefore pipeline) are sitting well below trend at around 12,000 units per month, this equates to next year housing coming on line of around 140,000, well below previous trends and well below what we need to: 1. House immigrants 2. Keep a lid on housing inflation and 3. Keep construction workers employed.

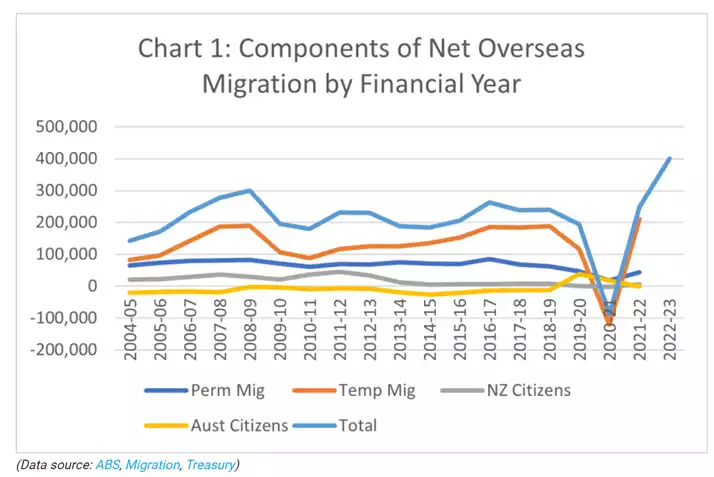

Net Immigration vs Impossible Policy

Currently in Australia we are seeing net immigration of around 1350 people per day – around 500,000 per annum. In response the national cabinet has committed to build 1.2million homes from July 1st 2024, or 240,000 homes per year, by relaxing planning and zoning rules, hoping private companies will respond with these required developments. Currently stuck in cabinet is the Housing Australia Future Fund target to supply 30,000 homes (just 2.5% of the required stock), the government can’t even get that through senate.

Now let’s refer back to the previously disclosed numbers. Currently we have only ever built a peak number of dwellings of 225,000 in 2017, currently in the pipeline we only have 140,000 approved and we have 500,000 immigrants arriving per annum. And this immigration is hiding a recession and continuing to add to housing inflation at 7.3%. Forget the strain on the economy with hospitals complaining of not enough beds, infrastructure shortages and a growing unemployment rate with a surprise jump in July to 3.7%.

Something’s going to give

Based on the numbers above you can see that the supply side of the housing equation will not be adequate to house all these new immigrants. Something will have to give and like in Canada (who with Australia has had huge immigration numbers and even greater housing gains) they have recently started looking at caps on the number of international student visas to temper net immigration, helping with their housing crisis. Australia is likely needed to do the same. So Australia is now faced with a choice, continuing adding to housing inflation and possibly force the RBA’s hands on further rate rises, or slow immigration and therefore GDP and let the economy finally show the recession we are in….