QEternity – No end in sight

News

|

Posted 13/09/2019

|

15812

As we reported yesterday, and according to prophecy, the ECB last night drove their rates further negative to -0.5%, restarted their QE program to the tune of $22billion per month, TLTRO (sweet lending deal to banks), and very dovish forward guidance.

Welcome to QEternity; open ended QE "for as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before it starts raising the key ECB interest rates."

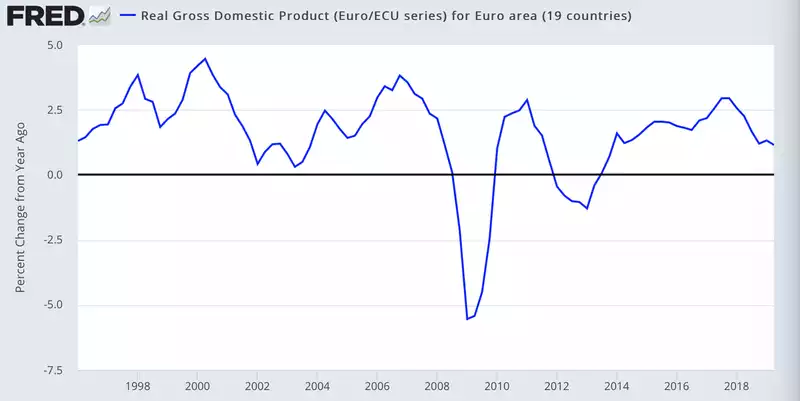

That this is not widely being talked about as propagating a failed campaign is incredible. Negative interest rates and QE (money printing for newcomers) has failed to produce the rebound intended from the GFC. The ECB further downgraded growth projections to 1.1%, inflation remains stubbornly low, and the shining light of Germany is dancing with recession. Yes it pulled them out of recession in 2013 but its trending down again. They are addicted/reliant on stimulus:

And same for inflation:

Einstein famously said that insanity is doing the same thing over and over and expecting a different result. The problem is no one wants the inevitable crash on their watch. Last night was Draghi’s last meeting before ex IMF chief Christine Lagarde takes over. Many believe she has been handed the job as she is a superior political tactician and the results of all this “unconventional monetary policy” are going to become very political not economic. A financial crash and crisis will handle the economy side of the equation, it will be dealing with its effects that will test the ECB. The growth of far left and far right political movements are just one symptom of the social inequality such measures exacerbate. The following table highlights this point:

Whilst the coming crash will bring those percentiles ‘together’ as the equities bubble bursts, it is a recipe for the sort of social unrest that Dalio and others predict.

We remind you to that this is not just an ECB, BoJ or Fed issue, there are growing predictions that our own RBA will be forced to implement QE as well. The RBA even outlined the scenarios it is considering for “unconventional monetary policy” including QE and negative interest rates to a parliamentary committee this week. With economists predicting our current record low 1% to drop to 0.25 or 0.5% by mid next year that leaves such measures as the only alternative when the recession hits. Philip Lowe told the committee “Globally, if all central banks go to zero, then we'd have to consider that as well…..We are prepared to do unconventional things if the circumstances warranted it."

Since the GFC central banks have added around $15 trillion of assets to their balance sheets. In other words they have injected $15 trillion of new “money” into the economy. This unprecedented and disarmingly termed “unconventional monetary policy” may have staved off the GFC getting worse but it has hardly created strong growth across the economy or society, just higher sharemarkets and property prices for those lucky enough to own both. That luck is looking decidedly shaky right now and they are about to double down with the same strategy. The smart money is piling into gold and silver right now.

Einstein also famously said:

“Two things are infinite: the universe and human stupidity; and I'm not sure about the universe.”