QE3 post-mortem

News

|

Posted 30/10/2014

|

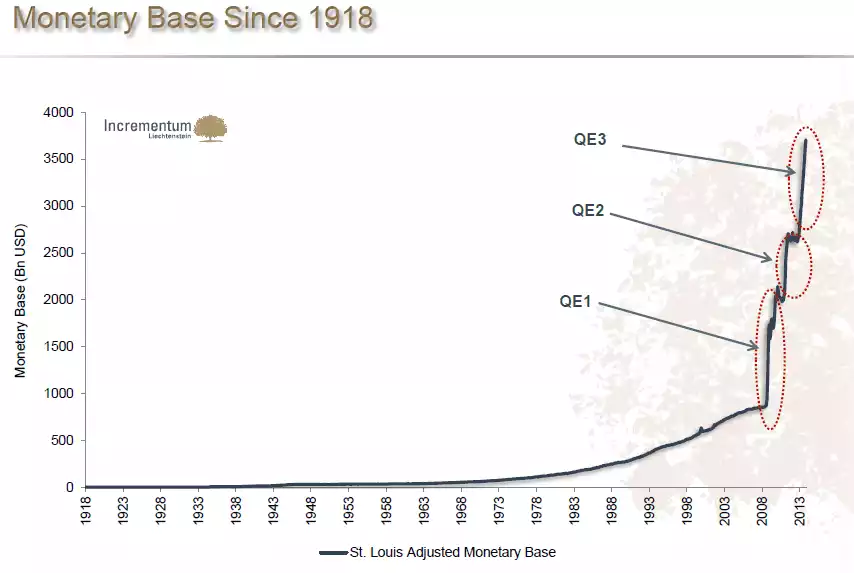

5332

After months of tapering the patient off printed money, QE3 finally ended in the early hours of this morning. You will note we say QE3 not QE per se. Many still expect, as with QE1 and QE2 that we will see QE4 shortly as the patient is hooked on the drug and still not well enough to survive without it (and the hospital needs the income). Time will tell but as gold dropped over 1% on the news because everything is awesome now, let’s just briefly reflect on the QE program to date:

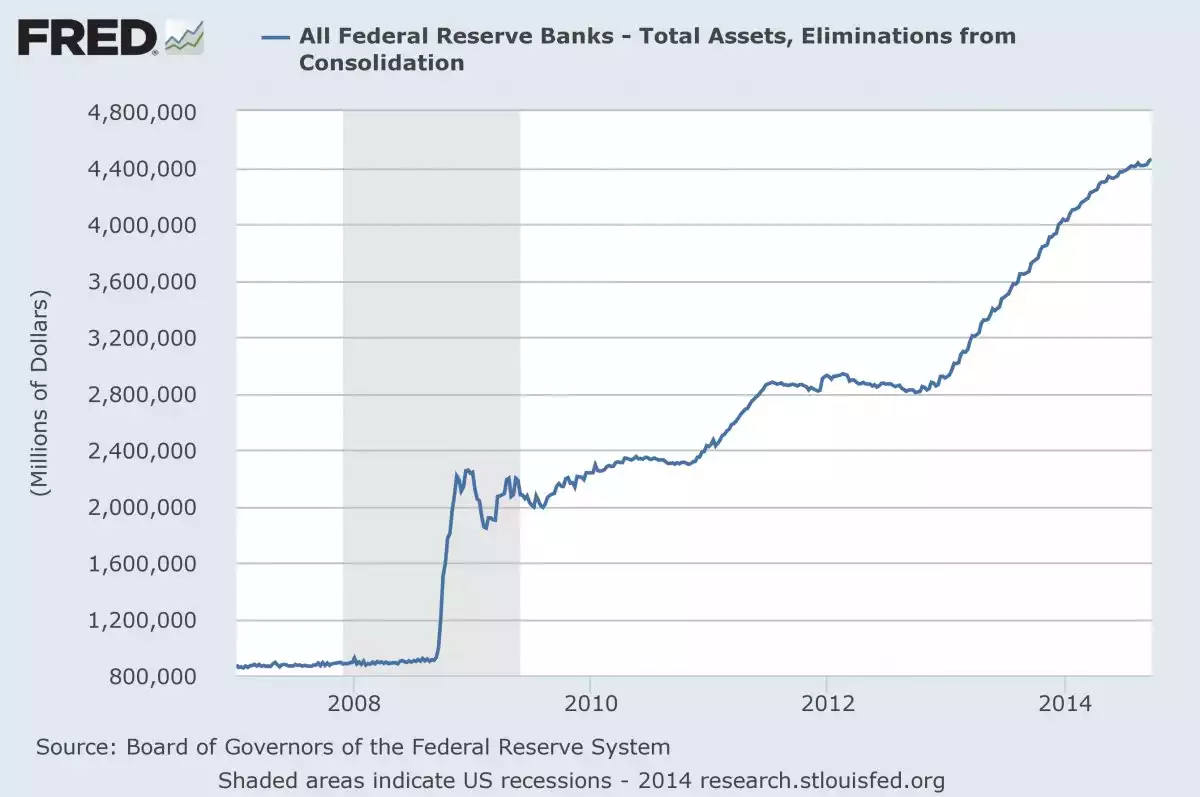

- Since the GFC the US Fed balance sheet has gone from a little over $800b to over $4.5trillion. i.e. they have bought over $3.5 trillion of debt paid for with printed money. For perspective, it took almost a century to get to that $800b, and then they’ve printed almost that each year since the GFC!

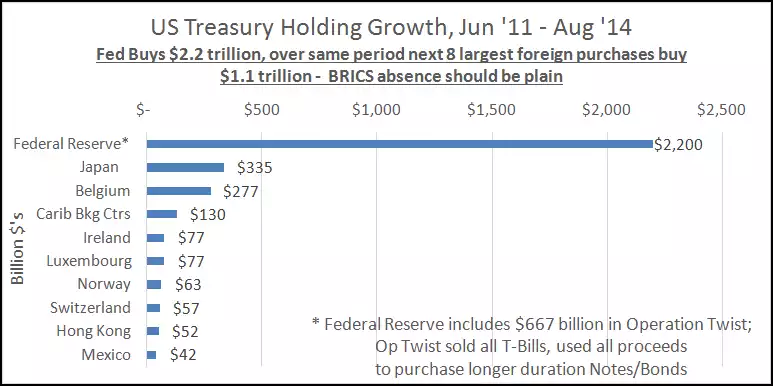

- As the US was buying its own Treasuries with printed money it was devaluing its dollar against it’s creditor countries. The biggest buyer and owner of US treasuries, China, started to see this was not good for them and has actually reduced its holdings. So it begs the question, if the US stops buying its own debt (debt which is necessary to fund its continual deficits), who will? This graph tells it all (see someone missing? Someone who’s been buying mountains of gold instead of UST’s since 2011??):

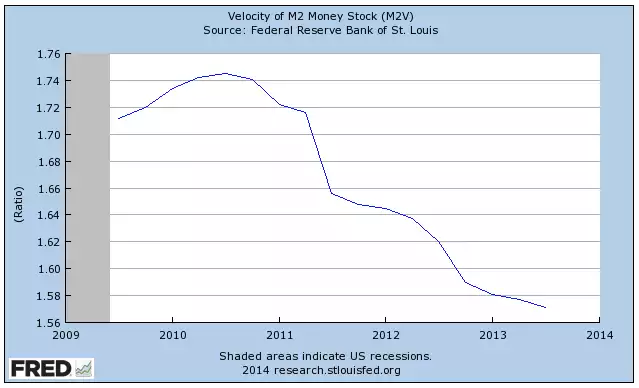

- Whilst everyone talks about the $trillions printed, fewer talk of the Velocity of that money. Since the GFC the velocity of money has been in sharp decline. i.e. apart from shares (enriching the 1%), the money has not been ‘used’.

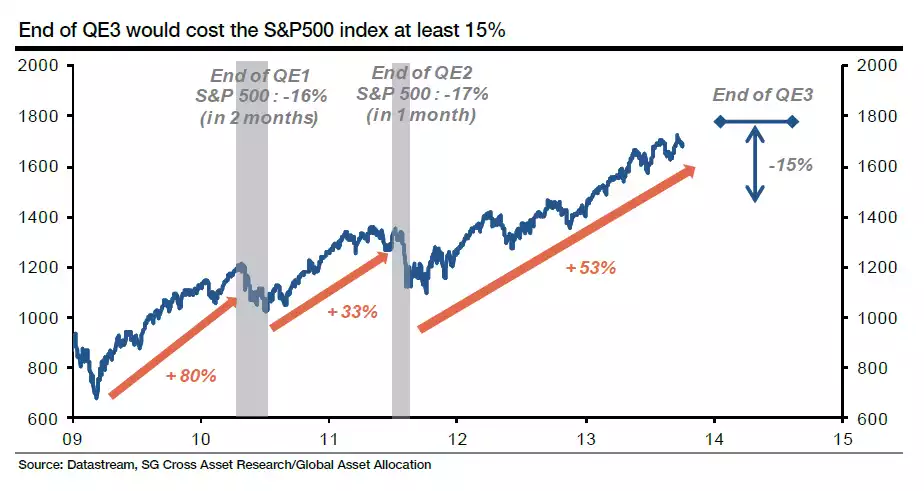

- This is part of the reason why some think the sharemarket corrections that happened after QE1 and QE2 will not be as quick after QE3 due to the sheer amount of that printed money sitting ‘unused’. Per below, others don’t.

- The only weapon left in the Fed’s arsenal now is its ZIRP – zero interest rate policy to try and stimulate what is still an anaemic economy. Again this morning they continued their ‘considerable time’ rhetoric on how long before they start raising them. Given the poor state of their housing market, low reported inflation and underutilised job market it is hard to see this happening any time soon.

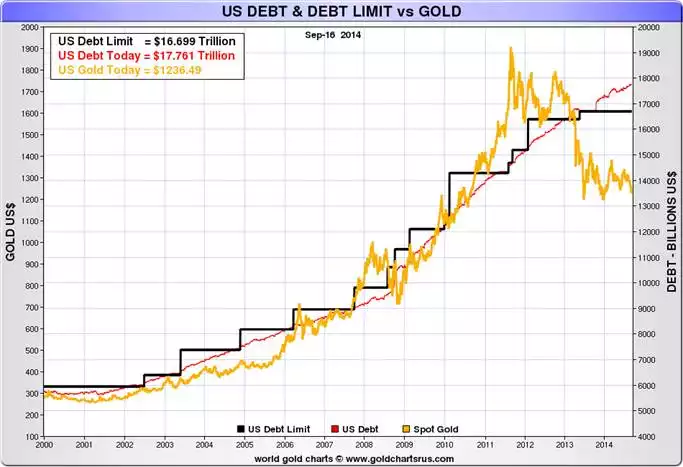

- Finally it is worth remembering the time between QE1 ending and QE2 starting was 17 months and QE2 to QE3 15 months. Time will tell on QE4. And let’s not forget that the European Central Bank have just stepped up to the QE plate just as this is ending. At some stage the world must realise that addressing a debt fuelled financial crisis with more debt must end in tears. You’d also have to think that the complacency triggered anomaly (that started in April last year) captured in the graph below must end too. No common sense look at the above can say all is well and there is not still enormous risk in the market. Maybe it just presents a great opportunity to buy gold and silver at disconnected low prices…