Prepare for the “Un-Inversion”: Short term recession signal just flashed red

News

|

Posted 03/04/2023

|

11042

Un-inversion of an inverted yield curve

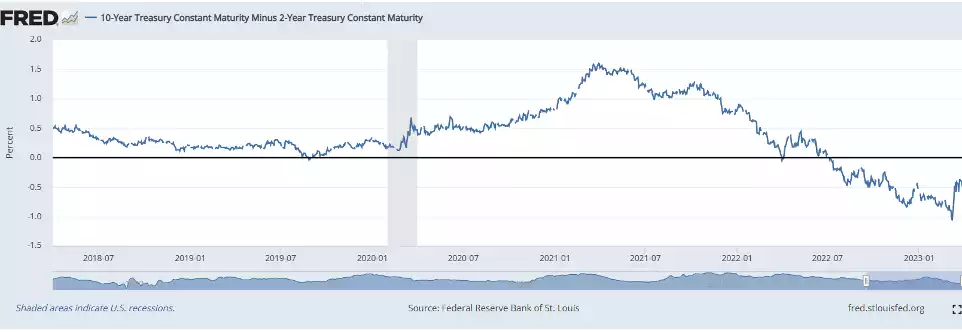

Investors use the inversion of the yield curve as a signal of the economy slowing and an incoming recession. Since 1960 every time the 10 year and 2 year yield curve inverts a recession has followed, but when it has not been clear, sometimes the bond markets have rallied and the recession hits 2 years later. So the more reliable signal investors now look at is the un-inversion of the yield curve signaling a recession is imminent. So as the Fed begins to talk of slowing or pausing interest rate rises, as inflation begins to tame, and as banks collapse under the weight of tightening pressures, is this the un-inversion event that we should all be looking out for?

As Commonwealth Bank CIO Brad McMillan said ‘When the yield curve un-inverts, it is signaling that the recession is closer (within one year based on the past three recessions). While the inversion says trouble is coming in the medium term, the un-inversion says trouble is coming within a year.’ The yield curve inverted in December 2022 however this was not the signal to attempt to time the market upon, with most recessions following within 2 years, but that is a large timing window.

The yield curve inverted in July 2022 amid peak inflation in the US. To illustrate the volatility in the bond market since then, the first week of march saw a rollercoaster, with the collapse of SVB on March 7th, the steepest inversion since the 1980s, followed by the fastest 3 day re-steepening of the yield curve since 1982 as the SVB fallout became apparent.

*source: 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity (T10Y2Y) | FRED | St. Louis Fed (stlouisfed.org)

The 10 year treasury constant maturity minus the 2 year treasury constant maturity shows the 7th of July inversion as it crosses the 0 axis and the March 7th steep reversal, reapproaching the 0 axis as it gets closer to un-inversion.

US Inflation is slowing

On Friday the core PCE, the preferred US Federal Reserve gauge of inflation, was published in the US with a 4.6% YoY, this was lower than the forecasts of 5.0% and lower than the January PCE of 5.0% showing a clear deceleration of inflation. In support of the pivot, several Federal Reserve members have started to state their expectations of a slowdown in inflation. On Friday John Williams, New York Federal Reserve President, stated that he ‘expects US inflation to fall to about 3.25% this year before moving closer to the central bank’s 2% target in the next 2 years’.

Slowing of Asian trade showing headwinds

Looking abroad cracks are beginning to show in other central banks. Vietnam’s central bank announced it will cut a key interest rate for the second time this year, reducing its refinancing rate from 6% to 5.5%. In Vietnam key manufacturing segments of footwear and textiles have seen orders falling a massive 70-80%. Similarly in South Korea, March exports continue to slump with shipments decreasing by 17.2% a year earlier and more worryingly the chip sector falling 34.5%.

So how do we prepare for the un-inversion?

Tomorrow, in Australia, we will hear from the RBA, but the dovishness of Lowe has been priced into the Aussie dollar already, with markets only pricing 4 basis points into the move, indicating the unlikely event of our 11th straight interest rate rise.

If the Fed starts following the Asian lead and indicates an impending pause in interest rates it will inevitably complete the un-inversion. This will be the signal for traders to move from risk equity assets to safe haven precious metal assets as the short term recession signals will well and truly be flashing red.