Precious Metals Price Pinch

News

|

Posted 09/07/2014

|

4898

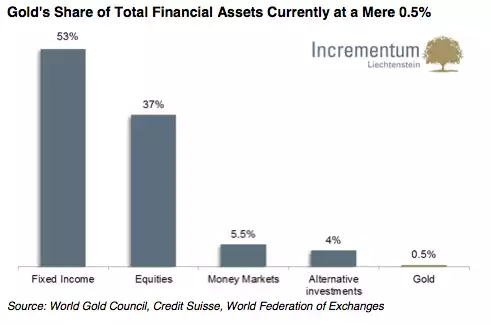

Yesterday we posted just one of a growing number of investment experts talking about reallocating assets away from equities ahead of a financial crash. Legendary Warren Buffet too is divesting shares heavily into defensive assets. Precious metals are one such asset. But consider this absolutely crucial fact. The very essence of gold/silver’s appeal is its scarcity and the inability to simply reverse that. How scarce? The graph below illustrates it’s just 0.5% of all financial assets! So if there was any sort of material shift into gold you can well imagine what the price must do when there is so little to go around. Consider too this quote from silver analyst Ted Butler just last week:

“While the same 100 million ounces of metal is, effectively, available for investment in both gold and silver annually, because of the great price difference, that translates into a markedly different comparison on a dollar basis. 100 million oz of gold equals $130 billion, while 100 million oz of silver equals $2 billion. These are the dollar amounts required to be expended by the world’s investors in order to absorb the new gold and silver produced annually. Not only is it, obviously, easier for the world to come up with $2 billion than $130 billion, it is also easier for the world to come up with more than the $2 billion required in silver to strongly propel silver prices higher. That’s the key to precious metals prices – investment demand. That silver requires such a small amount of investment dollars to ignite prices to the upside compared to gold is the key difference between the two metals.”