Pound Plummets: Bank of England Fails to Calm the Masses

News

|

Posted 28/09/2022

|

10876

The Bank of England yesterday attempted to ease concerns over the nation’s currency crisis by releasing a statement saying “It would not hesitate to change interest rates” to keep inflation under control. Spoiler alert: It didn’t work.

“The MPC (monetary policy committee) will not hesitate to change interest rates as necessary to return inflation to the 2% target sustainability in the medium term, in line with its remit.”

Traders reacted to the announcement with extreme bearish sentiment, as the Pound dropped to a record low of 1.035 GBP/USD, though later rebounding to 1.07. Even when put in historical context, this drop looks every bit of the currency crisis it is purported to be.

The BoE went on to say that it did not intend to conduct a “full assessment” of the UK government’s controversial tax plan, which aims to stimulate growth at the expense of increasing inflation via providing £45 billion in tax cuts and an increase in new borrowing. The likely consequence of such a bold direction in taxation policy will be a strong increase in inflation, which will continue to cause the Pound to depreciate against other major currencies, specifically the US dollar, which has been rallying for months.

Investors are becoming increasingly spooked by the distinct lack of coordination between the Central Bank of England and the UK government, headed by recently elected prime minister Liz Truss.

In what can only be described as some kind of economic tug of war, the UK government’s economic stimulus plan was released only days after the BoE raised interest rates by 50 basis points, an obvious response to their current inflation figure of 9.9%.

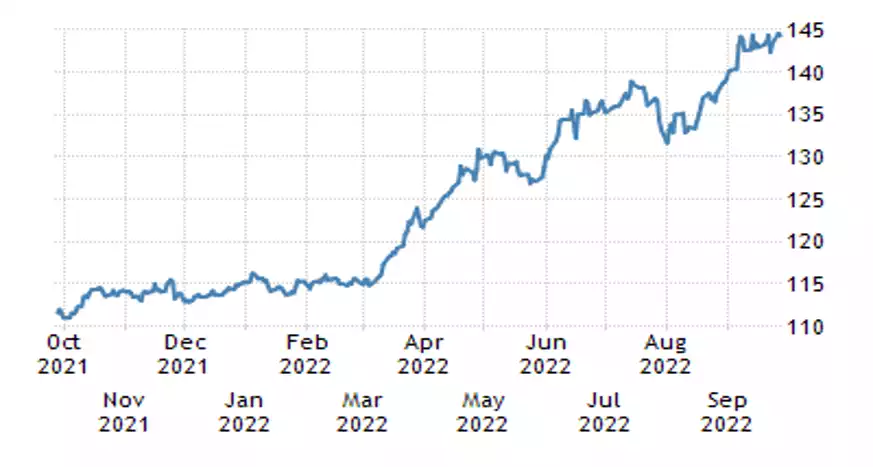

An interesting comparison is Japan, whose reluctance to raise interest rates (due to Japan having a manageable inflation level) has seen its own currency (Yen) depreciate from 110 per USD to now 145. This has forced the Japanese Central Bank to prop up its own currency through an intervention, something that has not happened in Japan for a quarter century.

Could the Bank of England be forced to do the same?

Needless to say, that in the event of a further currency collapse and subsequent Bank of England intervention, there will be a distinct lack of assets that will provide appropriate yield for investors, with precious metals being one of the few that could actually protect your wealth, something that is likely a very high priority to anyone living in the UK.