Potential Market Turbulence Leading into 2025 - Followed by Euphoria!

News

|

Posted 21/11/2024

|

1531

While the current global macroeconomic cycle is entering the final stages of euphoria, complacency and greed - in the immediate term, we are walking on a knife's edge, with data cautioning investors to first be on the lookout for potential turbulence, leading into 2025.

Short-term turbulence indicators

U.S. Bonds

20-year and 30-year U.S. bonds have crossed the U.S. Fed's Funds rate.

In a healthy macroeconomic environment, all 5 duration bond yields should be above the Fed's Funds Rate - this allows for greater yield, in return for duration risk, taken on by bond investors.

All 5 bond yields have been below the Fed’s Fund Rate since late 2022 – but with the midterm rising trend in bond yields, and the U.S. Fed cutting interest rates, we have recently recorded the first signs of a return to normality for this dynamic.

However, the recent rise in bond yields has also temporarily created an environment of bond market volatility while simultaneously causing bond collateral values to drop - resulting in global liquidity falling.

It appears that once again the U.S. central bank is characteristically late to act, being reactive rather than proactive, leaving the current landscape in a precarious position.

An increase in bond yields from here could cause a tantrum in the bond market and a major systemic financial issue in the private banking sector - with banks primarily holding U.S. government bonds as their blue-chip collateral.

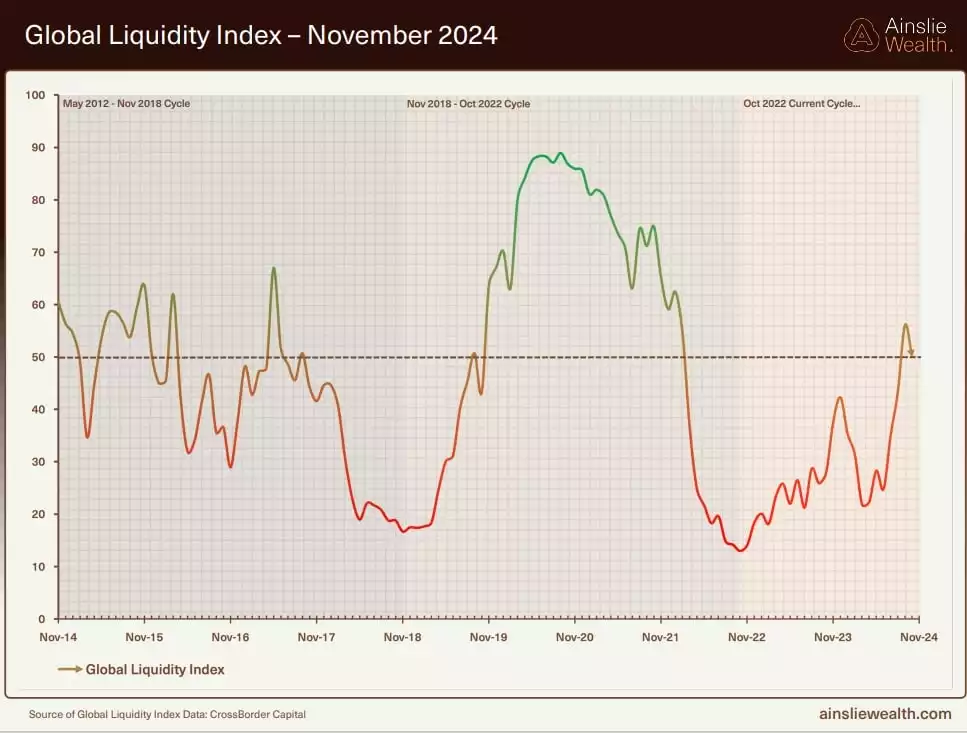

Global Liquidity

Global liquidity shrank this week, following a sideways and downtrend for a few months due to central bank liquidity injections slowing, bond values dropping and bond market volatility increasing. Without increased liquidity injections from central banks around the world, given the current conditions on the table, there is potential for systemic financial instability.

As central banks are tasked to maintain financial stability, the expectation of imminent liquidity injections from them is reasonable. This view is further supported by the ongoing macro liquidity and land cycles. Currently, we are still in the early stages of a macro-4–6-year liquidity cycle, which started in October 2022 - so it would be reasonable to expect this cycle to continue upwards into 2025.

We are also on the lookout for the final phase of the 18.6-year land cycle, called the “winner’s curse” phase (projected to complete between 2024 and 2028, with an average conclusion expected in early 2026) - where most markets rise, in an environment of complacency, liquidity injections, leverage and greed. While we are currently in the timing window for the winner’s curse phase, sentiment and liquidity indicators are far from being at concerning levels – indicating that while this phase has likely started, it is unlikely to have peaked. This further reinforces the expectation that the liquidity cycle will continue into 2025.

Once the potential short-term turbulence has passed, the macro conditions should lead us to a phase where most markets rise together, amid complacency, leverage and greed (the winner’s curse) - before a genuine, broad-based systemic collapse (which wipes out the excess leverage in the system, along with most market participants).

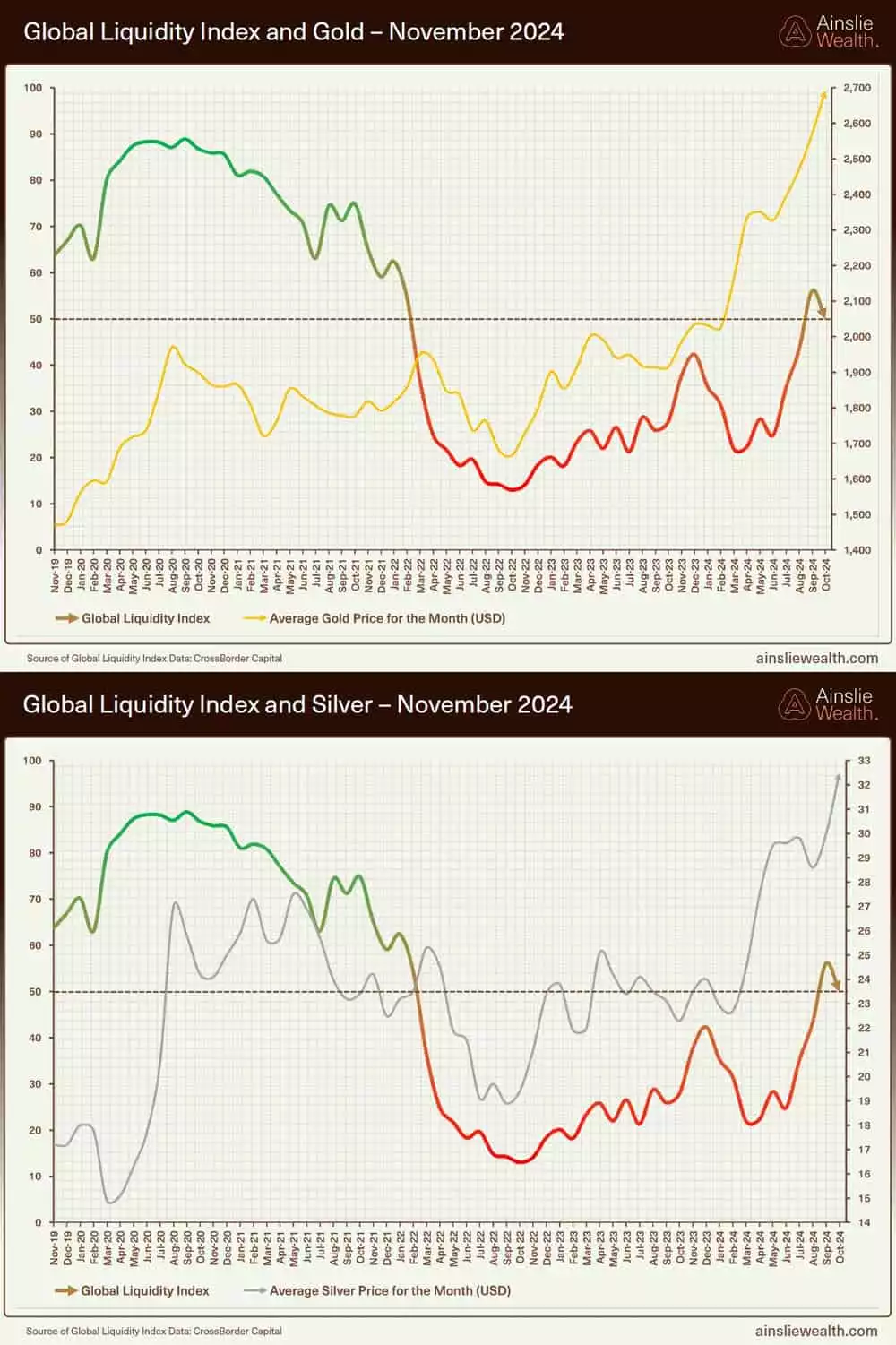

While gold and silver benefit from increasing liquidity - and rise with most markets during the winner’s curse euphoric phase - they continue to increase in value well after the systemic collapse phase that follows - while most other markets struggle. This helps form a clear expectation of a very long-term bull trend in precious metals currently being in motion.

Looking towards the end of the liquidity cycle, when most are complacent.

U.S. Inflation

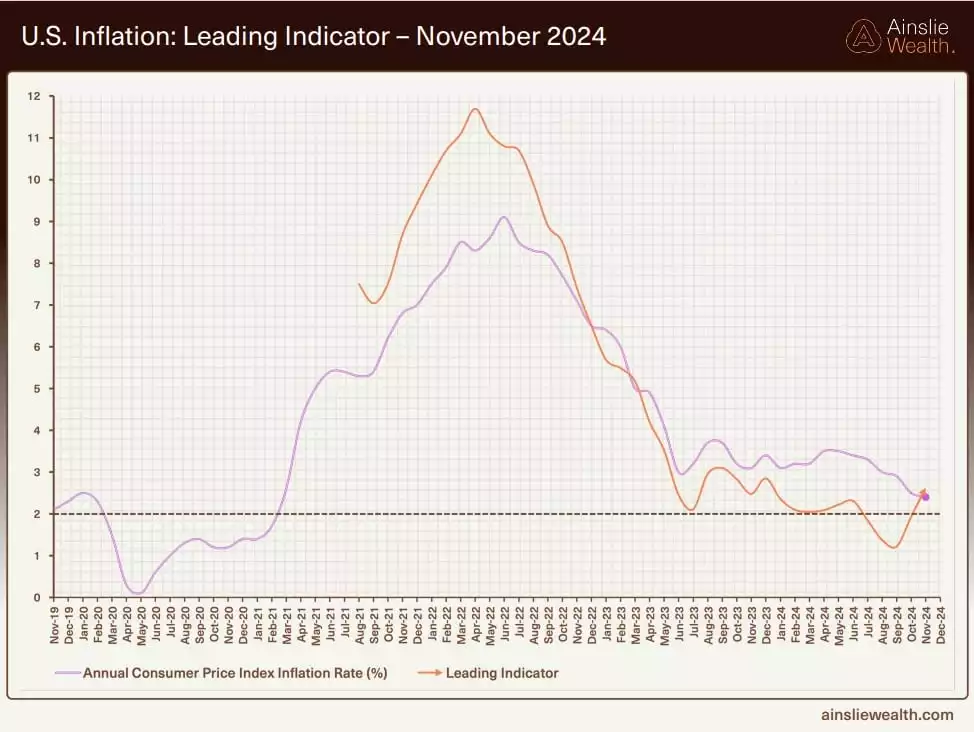

The chart below shows changes in the U.S. money supply (pink), directly affecting changes to inflation (blue).

The recent divergence in this trend is expected to resolve.

With changes in money supply being the cause (and hence leading inflation), we can expect the blue line to tick up rejoining with the pink – pointing to a potential imminent increase in inflation figures.

Our leading indicator for inflation paints a similar picture, showing that the leading indicator has crossed over the CPI figures.

A sustained rise in inflation would once again lead to the U.S. Fed having to tackle the issue with monetary policy, likely leading to the next rate-cutting cycle.

This leads us to ask the concerning question - has inflation bottomed? With the expectation of global liquidity to increase, is another sustained run of consumer inflation programmed in? And if so, what would another round of rate hikes mean for the global financial system?

Keeping in mind that U.S. inflation data is heavily manipulated, the CPI numbers could stay suppressed while the central banks ease monetary policy - in an attempt to ensure financial market and systemic stability - at the literal expense of the consumer. However, eventually, this manipulative practice begins to break, and the true inflation numbers become impossible to hide.

So, how resilient is our current financial system in withstanding the “two” of a “one-two punch” inflation cycle? Can private banks handle another round of interest rate hikes, can homeowners, or investors in commercial real estate?

We are approaching the final stages of an 18.6-year land cycle, which concludes with a land recession (the last one was the global financial crisis), while simultaneously being in the final stages of an 80-year socio-economic cycle (the last one was the great depression) - we suspect the upcoming rise in global liquidity - leading to a rise in inflation – could be the trigger that ushers us into the upcoming, cyclical, broad-based systemic financial collapse.

While land, stocks and most other assets are tricky to navigate during this phase - gold and silver, benefiting from the liquidity increase, and being the assets of choice in the collapse phase that follows - are well positioned to help navigate the upcoming decade.

Gold and Silver

We have seen both gold and silver front-running the global liquidity injections, with their current price action providing yet another hint about what to expect from central banks around the world.

As the safe haven asset of choice, due to their decentralisation, limited supply and millennia-long track record as a store of value - precious metals are also positioned to outperform during the collapse phase, once liquidity injections have peaked.

Looking forward we can expect short-term turbulence, midterm euphoria and long-term collapse.

While these can be tricky to navigate through using most asset classes, gold and silver provide an opportunity to gain shelter from the storm while simultaneously capturing significant capital growth, in the decade to come.

Watch the Ainslie Insights video discussion of this article here: https://www.youtube.com/watch?v=xqHoLmfzqgI