Platinum on the Rise

News

|

Posted 29/05/2025

|

4471

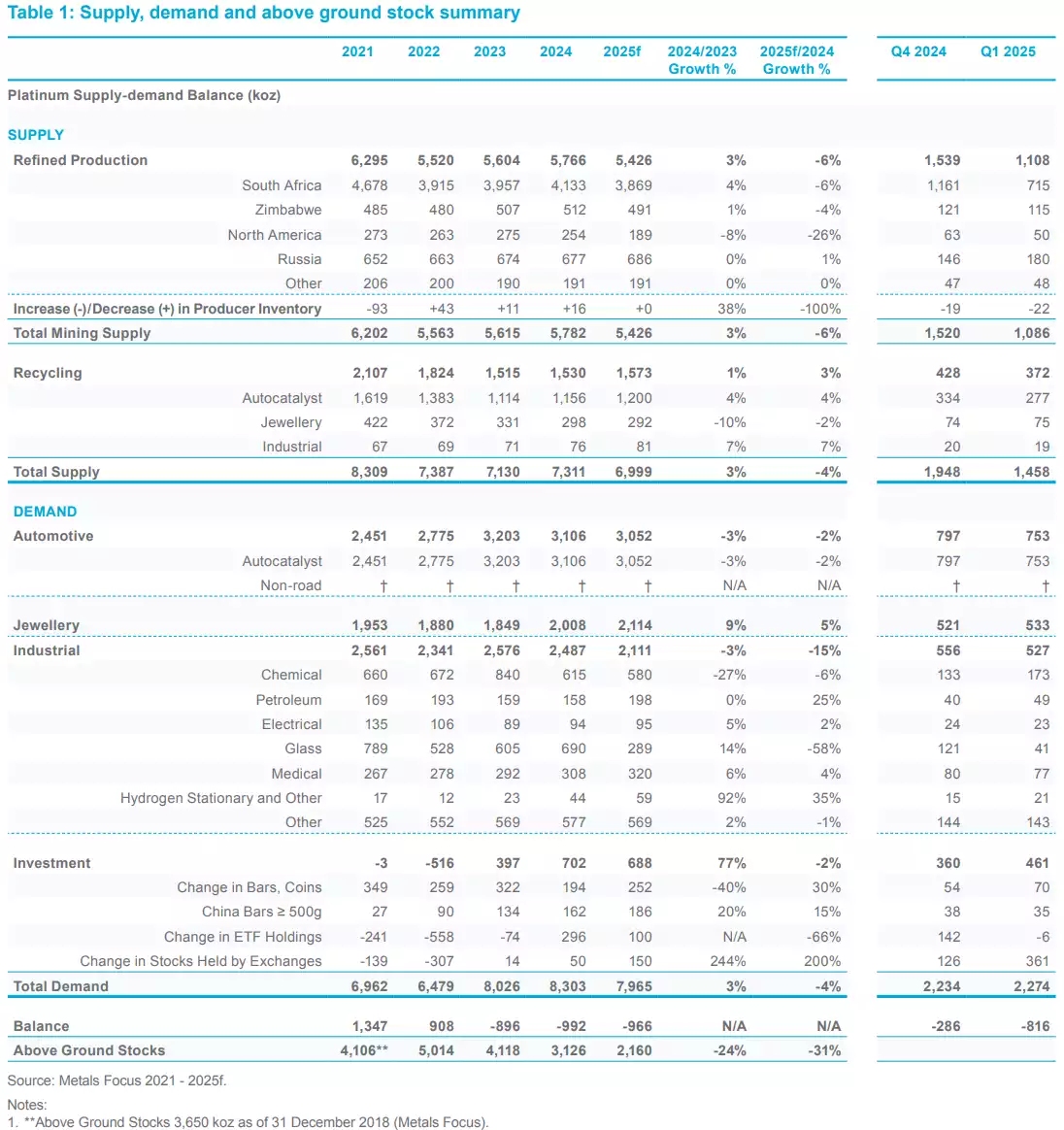

Platinum prices have seen an AU$5,000 per kilo spike in the last week, far outperforming gold and silver whose prices have declined from their February highs. So, are platinum prices finally starting to move with silver and gold? Having stayed steadily around AU$50,000 per kilo over the last three years, it has a lot of catching up to do. In that same period, silver climbed around 50% from US$20/oz to US$33/oz, while gold has catapulted higher from roughly US$1,900/oz to US$3,300/oz, a 65% increase. Platinum in the meantime is still down from its 2022/2023 peaks of US$1,198, currently sitting at US$1,066/oz. But with platinum yearly deficit again growing with total mining supply falling 13% year on year, the lowest output since 2020 and Chinese platinum demand spiking by 47% last year – is it time for platinum to play catch up?

Platinum WPIC Forecast

The World Platinum Investment Council released a new report indicating global demand in the first quarter of 2025 recorded a year-on-year increase of 10% whilst mining output saw a 13% decrease. This would be the third year of platinum in deficit, with 2025 being estimated at a 26mt deficit. Despite the increase in demand during the first quarter, the WPIC projects that overall demand for the year will decline to 244 metric tonnes, down from last year. Meanwhile, output is expected to reach 218 metric tonnes.

Total mining supply fell 13% year on year in quarter 1 of 2025. The rest of the year is forecast to decline by 4% on 2024 output. Similarly, weaker recycling supply driven by auto catalyst recycling has also dampened output.

Above-ground platinum stocks due to the deficit fell by 23% in 2025 to 105mt with this year's deficit forecast to drive it lower to around 3-4 months of world supply.

This forecast may be underestimating demand. Last year, the WPIC projected a deficit of around 20 metric tonnes, but the actual shortfall reached 31 metric tonnes, largely due to strong investment demand driven by ETFs. If a similar pattern emerges this year, the deficit could end up being even larger than currently expected. Similarly with platinum now well below gold's price, jewellery demand for the white metal grew last year, and is expected to grow further this year as jewellery buyers substitute for gold.

Platinum Price Predictions

Many commentators on Twitter have started predicting a start to the platinum bull market – including Graddhy, a commodities expert. Last week's 10% gain saw platinum breaking out of a triangle formation that had been forming since 2021.

Similarly, Fernando Pertni recognises all the price pressures currently on platinum – including the fact that it is 30 times rarer than gold, it's in a structural deficit, and demand is increasing. With it being such a small market of around US$7 billion for all platinum it won’t take much to see platinum prices soar from here.

Will platinum finally join the precious metals bull market? Only time will tell – but the fundamentals suggest that once it does, the move could be significant.