Platinum Soars on Deficit & Green “Catapult”

News

|

Posted 12/02/2021

|

9726

Despite a little pull back, along with all metals last night, platinum has had a stellar week this week surging $150 to a 6 year high.

News out this past week saw confirmation of another year of a supply deficit in 2020 and analysts expecting further upside driven by higher demand from the automobile sector after news of last month’s 30% year on year surge in auto sales in China and the broader reflation trade trend. From the latest Johnson Matthey PGM report giving the supply and demand summary for 2020:

“Platinum supply and demand fell steeply in 2020, as the Covid-19 pandemic triggered temporary closures of mines and automotive plants, disrupted the collection of pgm-containing scrap, and hit consumer purchasing of new cars and jewellery. World primary supplies contracted by 20%, with outages at Anglo American Platinum’s converter plant adding to Covid related disruption. Autocatalyst demand plunged by 22%, as diesel car production in Europe fell steeply, while sales of platinum to Chinese jewellery manufacturers slumped to a twenty-year low of less than 1 million oz. However, industrial demand was more resilient: new plant construction by Chinese petrochemical and glass companies proceeded on schedule, and low prices stimulated some advance purchasing for future projects. Price trends were also supportive of physical investment: Japanese bar demand surged after yen-denominated prices hit seventeen-year lows, while ETF investors in the US and Europe added to their platinum positions. Overall, changes in supply and demand were nearly identical, leaving the market in continued moderate deficit.”

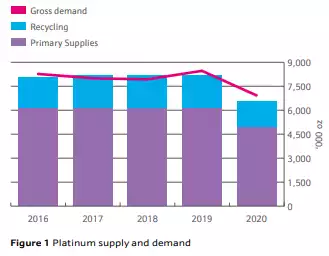

The chart below clearly shows that double dip of demand and supply but demand outstripping supply for the second year.

Set out in table form you can see the relative size of that auto catalyst sector compared to the current investment demand.

The elephant in the room from a demand perspective is the emergence of green hydrogen energy. We touched on this in our article last week (which if you’d bought platinum after reading you’d be up almost 13% already) noting platinum is a key component in this new energy generator. The issue to date has been the relatively high cost of output, however the recently announced ‘Green Hydrogen Catapult’ will see a coordinated and huge investment to get the scale needed to make it viable. From WPIC:

“The new ‘Green Hydrogen Catapult’ initiative will see green hydrogen industry leaders take on this challenge, targeting the deployment of 25 gigawatts of renewables-based hydrogen production by 2026, with a view to halving the current cost of green hydrogen to below US$2 per kilogram and increasing production fiftyfold. In establishing the initiative, the world-leading enterprises behind the Green Hydrogen Catapult are collaborating to accelerate the necessary technological and infrastructure advancements, as well as related market development. In addition, the Catapult target requires investment of roughly US$110 billion.”

The longer term impacts on platinum demand can’t be under estimated.

“It is now estimated that green hydrogen could supply up to 25 per cent of the world’s energy needs and become a US$10 trillion addressable market by 2050. These projections are underpinned by the recent emergence of strong green hydrogen-focused national hydrogen strategies, including those announced by Australia, Chile, Germany, the EU, Japan, New Zealand, Portugal, Spain and South Korea. The USA re-joining the Paris Climate agreement should also bolster momentum and accelerate hydrogen adoption.

The rapid growth of the PEM electrolysis market clearly has the potential to benefit platinum demand, albeit modestly in the short- to medium-term. What is more, expansion of hydrogen production capacity and associated infrastructure will facilitate the adoption of PEM fuel cell electric vehicles. The combined impact on platinum demand as these two PEM technologies take off will be significant over the longer term.”

Platinum, now at $1624, had been on a continual albeit choppy downward trend since hitting $2375 in 2008, bottoming out like gold in late 2015 but then generally sideways in a $200 band until it peaked with gold in March last year then got hit harder than any other in the liquidity squeeze on the COVID crash. If you bought then, congratulations you’ve made about 60% so far. Platinum, like silver has a dual role of industrial and monetary metal. The moribund ‘recovery’ after the GFC saw relatively subdued demand in both and hence that sideways band. As we sit here now with the prospect of reflation and more concerningly, inflation, there are dual catalysts before we then consider the paradigm shift that the fiscal stimulus fuelled green agenda becomes. This recent surge could be the penny dropping for investors.