Panic Amid Global Markets — Has the 18.6-Year Cycle Peaked?

News

|

Posted 10/04/2025

|

2675

The reaction to U.S. tariffs and subsequent retaliatory tariffs has crashed financial markets worldwide. Meanwhile, U.S. bond market volatility has skyrocketed — as major players appear to be selling U.S. government bonds.

With many scrambling to figure out whether this crash marks the top of the macro (18.6-year) land cycle, market participants are tempted to price in total financial armageddon. However, zooming out tells us to be calm amid the chaos — with the current conditions being nothing out of the ordinary for this phase of the macrocycle, and with volatility expected to increase in both directions as we approach a macro peak.

While there isn’t enough evidence to suggest that the peak is in, this could change as new data comes to light every day. Luckily for precious metals investors, timing this peak isn’t necessary — as gold and silver benefit from both the final phase of the uptrend (amid increasing liquidity), as well as the recovery phase which follows the collapse. During the recovery phase — while gold gains value as a flight-to-safety asset — silver benefits from speculation entering the precious metals space, as investors react to gold outperforming while most other markets struggle to recover. During this recovery phase, the gold-to-silver ratio tends to reduce dramatically, as silver takes centre stage.

While precious metals investors can take a long-term approach and simply ignore the challenges of timing this cycle transition, timing the cycle peak is necessary for market participants who hold land or stocks with a shorter-term view — for example, those with Super Funds in stocks and approaching retirement age.

With the 18.6-year land cycle peak expected between 2025 and 2028 (with an average timing of late 2025), let’s reflect on where we sit today.

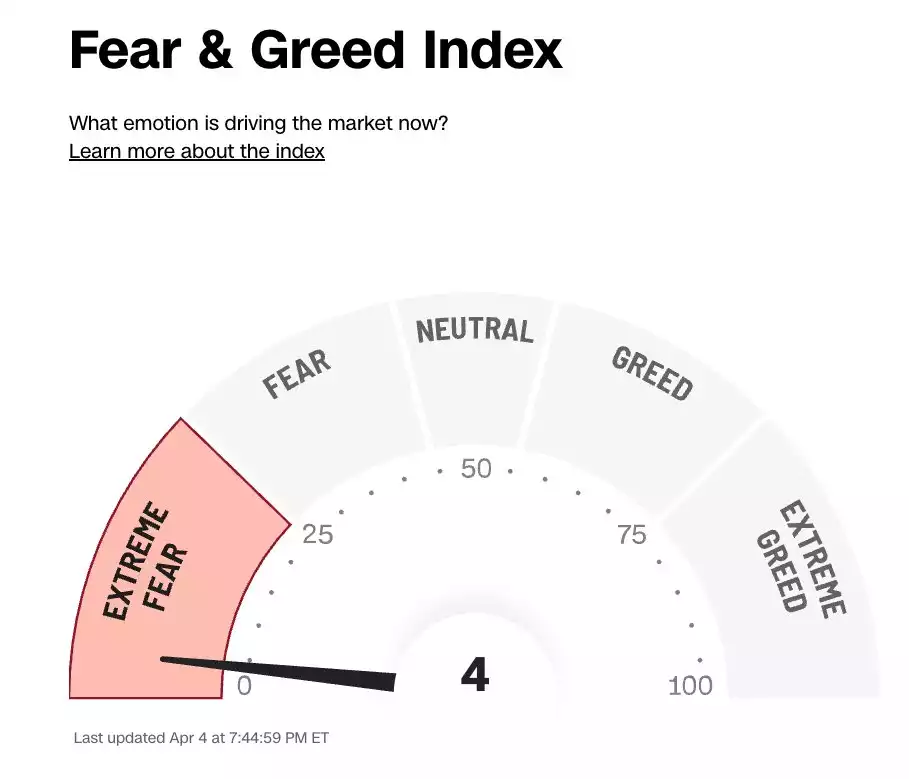

As we enter the final phase of the 18.6-year cycle — known as the Winner’s Curse — with more exaggerated swings to the upside and downside, we can also expect stronger emotions among market participants, swinging from extreme fear to extreme greed. The current low marks one of the most fearful readings in recent history.

While markets price in a recession due to global tariffs, we are cautiously on the lookout for a final flood of liquidity—likely driven by global central bank intervention. This could cause most markets to go parabolic in the medium term, while worsening underlying inflationary pressures in the long term—ultimately catalysing the bursting of the bubble down the track.

In the short term, with the 10-year yield spiking, we could see bond volatility and rising yields drain global liquidity. However, in the medium term, this may prompt central bank intervention.

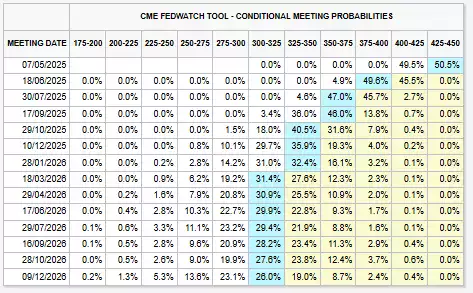

Additionally, with “Truflation” at 1.34% and market sentiment at rock bottom, the FedWatch metric indicates a 95% chance of rate cuts in June—with five rate cuts expected in total this year. Meanwhile, the RBA is positioned with a 96% probability of a 0.5% rate cut next month.

It is important to note that while tariffs—unless resolved—could have disastrous ramifications for the U.S. economy, these effects would take time to manifest into a recession. However, markets, being forward-looking, are already pricing in the worst today.

The reason for the spike in the U.S. 10-year yield is under speculation—from over-leveraged hedge funds covering their positions amid recent market volatility, to some citing China possibly dumping U.S. bonds in retaliation to tariffs as a potential scenario.

Looking at technical analysis, we can see both the Homebuilders ETF (used to track land values) and the S&P 500 are currently holding above their macro 50% Gann levels—signalling that the macro bullish structures are still valid.

With sentiment at rock bottom, macro 50% levels intact, the U.S. 10-year yield spiking, Truflation down, and Fed rate cuts being anticipated, it appears that the current correction is forming a set of conditions conducive to a liquidity-driven blow-off top phase. While the amount of liquidity injected by central banks is yet to be seen—and with serious cracks in the system emerging—keeping a close eye on conditions is essential at this phase of the macrocycle.

If the current landscape of fear gives way to much higher prices for a sustained period, this parabolic phase is what will trap most investors—lulled into complacency. Any genuine corrections that follow become increasingly difficult to believe. This is the level of complacency required among market participants for a long, drawn-out recession and bear market to take hold.

In this bear market, while most assets struggle to recover, precious metals are among the few investments that continue with sustained bull runs—as flight-to-safety assets—after already benefiting from increased liquidity into the peak.

This positions both gold and silver as vehicles to navigate this phase and the next—achieving both sustained growth and safety—while most investors struggle to navigate the generational transition.

Watch the insights video inspired by this article here: https://www.youtube.com/watch?v=Q5KNO0ZssNk