PART 3 - US DEBT LIQUIDITY SHOCK

News

|

Posted 24/10/2022

|

11823

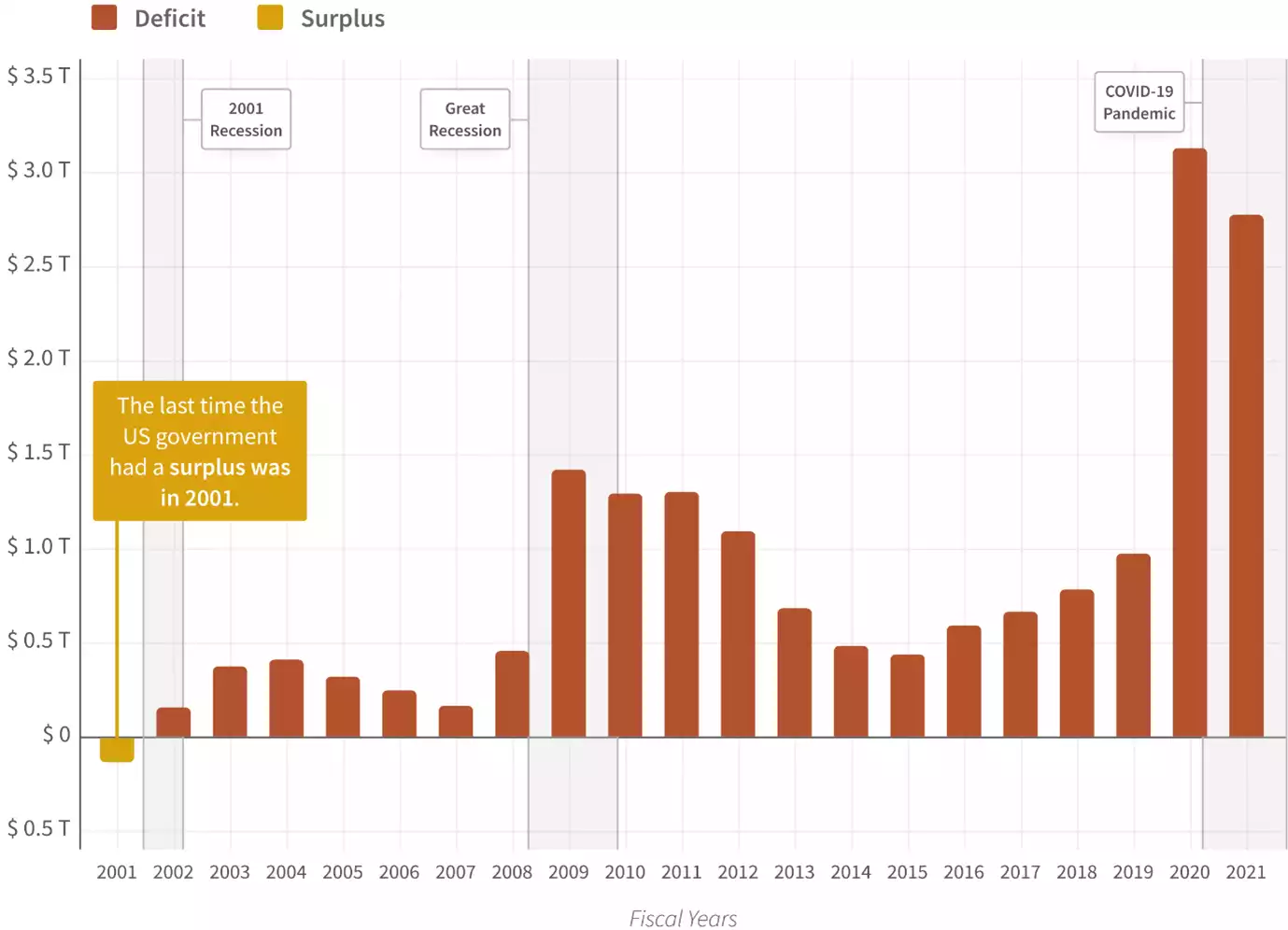

The USD government account was last in surplus in 2001, throughout the GFC they ran deficits of over $1 trillion USD though these deficits reduced in the proceeding years. With the onset of Covid and the Worldwide liquidity injection, the US saw their deficits reach unprecedented highs, in 2020 US government debt increased by over $3 trillion USD. In fact as Yellen recently pointed out since 2019 the US deficit, and therefore demand for debt, has been over $7 trillion.

*Source: Can the FED Engineer a Soft Landing? (rcrsv.xyz)

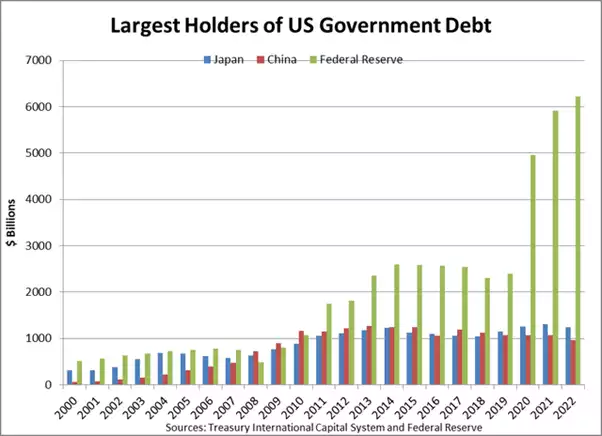

During this time the total foreign ownership of bonds as a percentage started reducing dramatically from a high of 47% now at 31%, it appears the only major buyer of US debt has been the Federal Reserve increasing their holdings from $2.4 trillion in 2019 to $6.2 trillion in 2022, meaning they have absorbed $3.8 trillion or 54% of the increase in US Treasury debt.

Source: Who Will Buy Our Treasury Debt? | Seeking Alpha

On June 30th the Federal Reserve started Quantitative Tightening, reducing their Treasury exposure by $30 billion per month recently increasing to $60 billion. With the US deficit running at $1.4-$17 trillion in 2022 (depending on who you believe) and the Fed adding an additional $0.7 trillion per year to this through QT, the question becomes who will be the buyers decreasing bond value.

Putting this in perspective, since 2019 the total US debt increase was $7.0 trillion (approximately $2.3 trillion per year), the Federal Reserve purchased approximately $1.3 trillion per year, meaning there was $1.0 trillion per year in either Foreign, US Financial Institution or other buyers. This pool of available bonds is about to double…..

US FINANCIAL INSTITUTION ROLE

The other major buyer of US debt is US Financial Institutions, this group hold around $10.2 trillion, up from $9.5 trillion at the end of 2021. During this period, 10 year T-Note yield has grown from 1.55% to 4.22%, due to the inverse relationship between interest rates and bond prices, these institutions have seen the values of their bonds decrease significantly.

LIQUIDITY SHOCK

So as the Federal Reserve reduces holdings, foreign purchasers continue to reduce exposure and the US Financial Institutions find it more difficult to justify bond purchases, recent activity in the bond market shows a loss in liquidity. This can be seen in the GVLQUSD which basically measures the buy sell spread in the Bond market.

Source: Who Will Buy Our Treasury Debt? | Seeking Alpha

US TREASURY PIVOT

Now that the Federal Reserves hands are tied – Treasury is stepping in to see how they can sure up this liquidity crisis. It is apparent the only ‘out’ they see is for US Financial Institutions to increase their holdings, as they recently sent a survey to most major banks to see what Treasury and the Federal Reserve could do to ensure continued and liquid buying. Some of the proposed solutions are

- Treasury buying back older more illiquid securities and swapping these for more liquid options – this was last done in April 2002 when the US was running close to surplus.

- The Fed could adjust the repo facility terms meaning treasuries could be more attractive to hold – Yellen has recently indicated that this is the case saying that the Fed now has a standing repurchase facility to provide a liquidity backstop to the Treasuries market; that "can be helpful."

- And finally reducing the SLR (supplementary leverage ratio) so that it becomes less capital intensive for banks to hold these bonds

In summary Treasury is looking at how the Federal Reserve and US government can move their debt crisis and liquidity squeeze onto the banking market. It’s probably coincidental but we have rarely seen the number of new clients looking to get their “money” out of banks and into real money… gold.