PART 2 Eye Roll – USD debt is unsustainable and will break

News

|

Posted 19/10/2022

|

12025

‘USD debt is unsustainable and will break the Global Economy’ The number of times in the last 20 years we have heard this quote would be innumerable, and let’s be honest the US has a current account deficit of 140% and Japan sits around 266% would seem to say that there’s still room to grow. But the Yen is not the World Reserve Currency and Japanese politics do not seem to play Squid Games with the members of the Global Economy. Also the Japanese predominately exporters and are avid savers so their public debt is largely offset by private savings as the holders of Yen Bonds are predominately the Japanese, with only 14.3% of debt foreign owned, compared to the US where around $7.6 trillion of the $24.3 trillion (31%) US Treasuries are foreign owned. By the way, the Fed owns an eye watering $8.9 trillion (37%) itself – all paid for with freshly created USD….

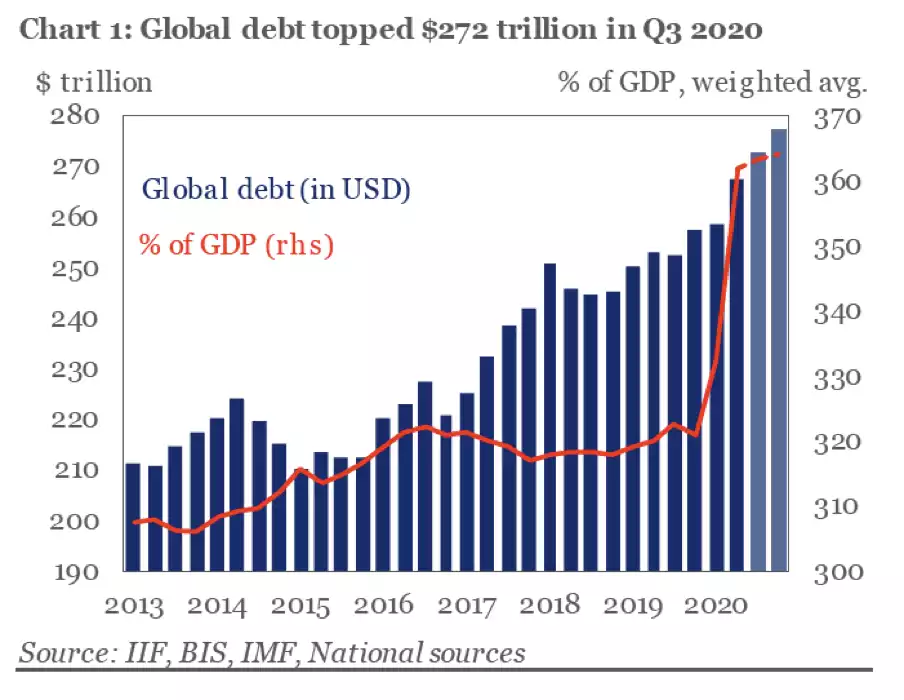

But exponential growth in a closed system must always end and the USD debt (and world debt) are currently following this trajectory.

*source: bne IntelliNews - Attack of the Debt Tsunami: global debt soars to a new all-time high

Bretton Woods Collapse

In part 1 we examined the last transition from gold standard to the Petrodollar… what we didn’t talk about was how this happened. The USD was pegged to a $35 per ounce gold price, in a growing economy with inflation growth, and finite gold supply. Other currencies were also pegged to the USD and therefore due to inflationary growth in a normal economy, and inflation in price of goods, gold became cheaper against other goods creating constant deficits for the US and an overvaluation of the USD.

Why gold wasn’t revalued at an inflationary rate, either worldwide or some quasi estimate deceives most people but we’ll leave this to a person with a better economic (or political?) understanding to explain. However due to the devaluation of gold relative to other goods, the US starting issuing gold promissory notes (ultimately US debt) and then the French coming to collect their gold, Nixon put a stop to the window of gold collection from Fort Knox and collapsed the system. By the end of 1974 the gold price had jumped to $183/oz. 1973 led to the collapse of the gold standard and the birth of the Petrodollar. So you see it was ultimately an ability of the US to print promissory notes, namely the US dollar that collapsed the system.

Going back to our new favourite quote from a country that seemed to understand what was going on at the time, George Pompidou French Prime Minister of 1965, “The international monetary system is functioning poorly, because [the USA] can afford inflation without paying for it.” Fast forward 2022…

FED vs the US Government

This time the FED is battling external factors such as the Ukraine War and energy prices, climate change and floundering agricultural output and their own government spending. Most of these cannot be directly controlled through raising interest rates – all this will achieve is crashing the US and World economy by ensuring there is no money to spend on anything so inflation will drop.

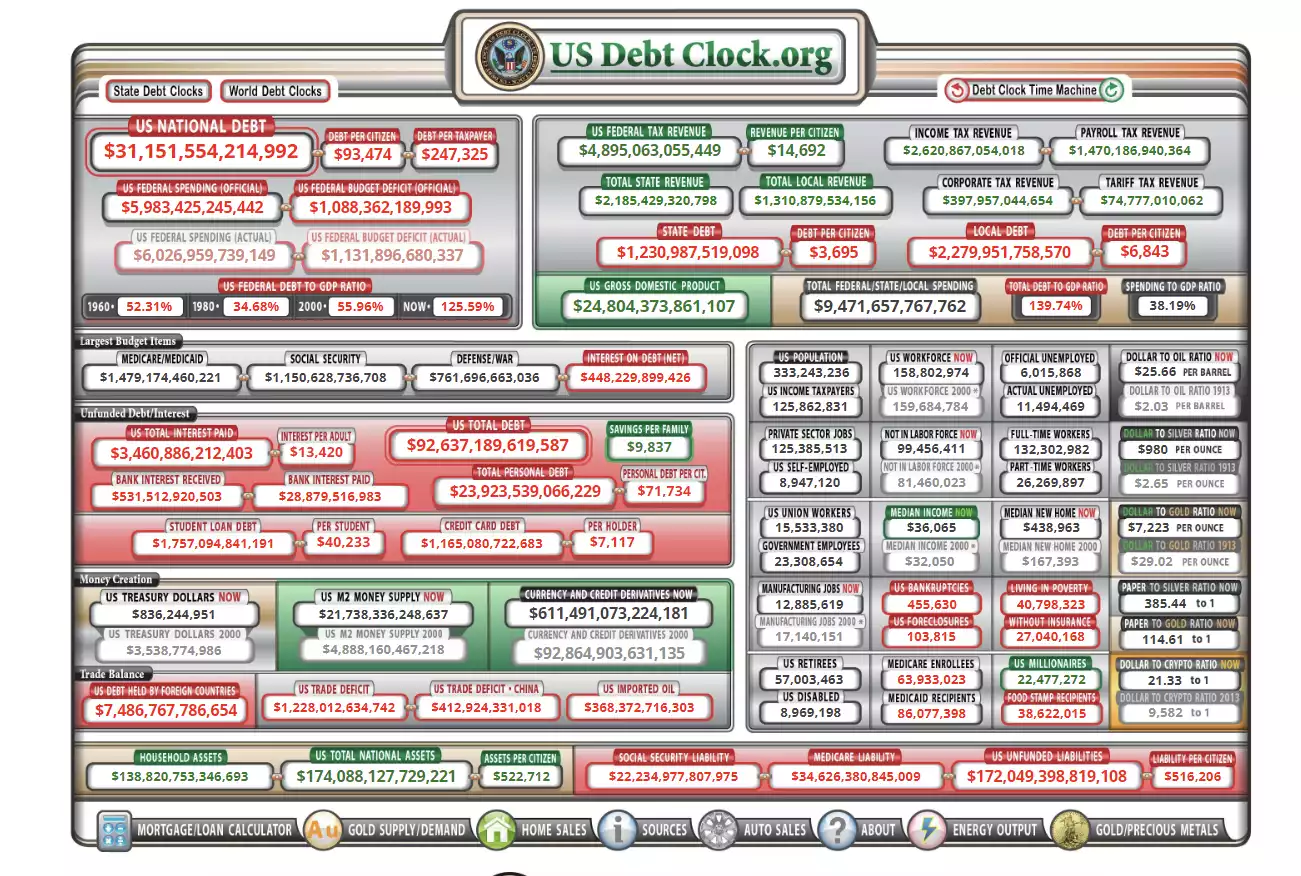

Delving into the current US debt policies from the Biden Government debt has grown from $28.4 trillion to $31.2 trillion an increase in 2 years of $2.8 trillion. The debt ceiling was raised to $31.4 trillion at the end of 2021 which was meant to see out the 2022 year, however with the milestone of $31 trillion being hit on the 3rd of October, and the current US Debt clock currently (below) showing $31.15 trillion (16 days later) at this rate the mid terms will only just be over before the ceiling needs to be raised again (probably a coincidence yeah?..). Just yesterday the student loan forgiveness policy was enacted, though still facing some legal headwinds, which will add an additional $400 billion in debt to the national deficit, with Biden stating in his speech ‘The country is ‘on track’ to reducing the federal deficit by $1 trillion this fiscal year’ – was this fact checked?

What’s different this time?

Despite what commentators in the US like to tell themselves and the public, the US is in recession and their GDP is shrinking. The only thing that appears to be going against this idea is the Labour rate, but ask anyone living in the US in the last month there’s been a rapid change in direction on this, Microsoft laid off 1,000 employees yesterday and you don’t need to search much further for other companies doing the same: Hello Fresh, Oracle, Bed Bath and Beyond just to name a few.

In the first quarter of 2022 GDP fell by half, at an annualized rate of 0.6%. GDP cannot continue to fall with interest payments going up at an exponential rate due both to government policy and FED intervention without something breaking. You can’t just keep promising money and not be making it.

Steeply rising debt (highest ever), steeply (steepest ever) rising cost of that debt, and falling growth to pay for it. What happens next?