Outgoing U.S. Treasury Secretary Highlights Debt Debacle, Urges Congressional Action

News

|

Posted 21/01/2025

|

3469

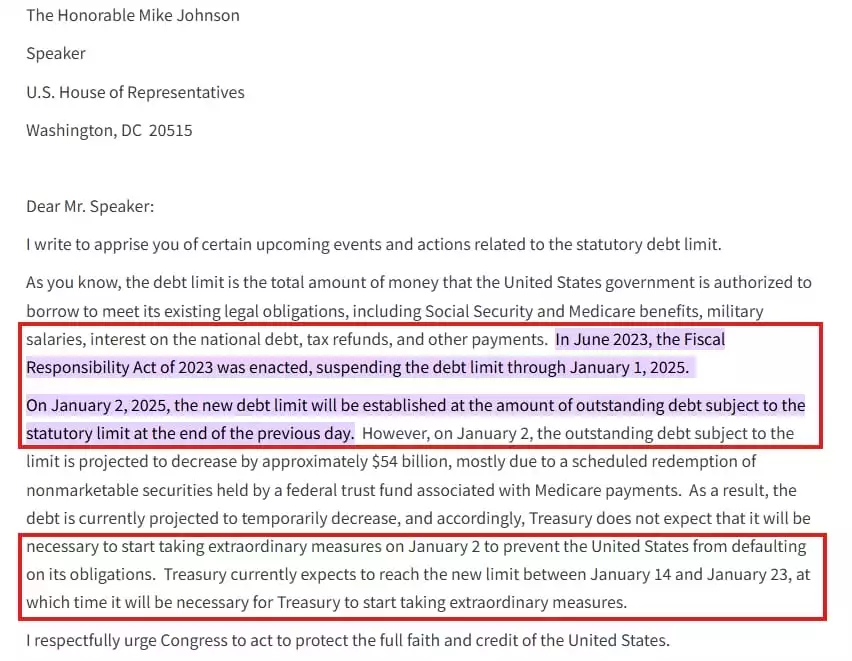

Earlier this year, the outgoing U.S. Treasury Secretary, Janet Yellen, penned a troubling letter to Congress regarding the U.S. debt situation. In her letter, shared below, she expects that the U.S. debt limit will be reached sometime between January 14 and January 23, when extraordinary measures will be needed. She implores Congress to take action to “protect the full faith and credit of the United States”.

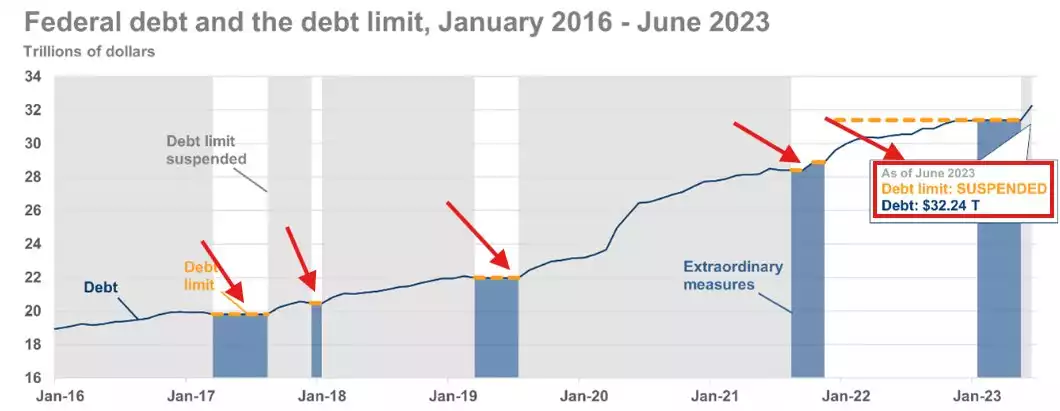

For some background, the U.S. debt crisis is not new. Since 2020, total U.S. debt has grown from $23.2 trillion to $36.2 trillion. That's a $13 trillion increase in five years, a 57% increase since the pandemic which included an additional $1 trillion in debt in just 105 days.

The U.S. debt ceiling is a self-imposed limit to the amount of debt the U.S. government can take on to pay for legal obligations such as welfare payments, military salaries, tax refunds and interest payments on national debt. When the limit approaches or is hit, Congress must raise the ceiling to continue borrowing and meet these payments. In June 2023, we saw a similar situation that nearly resulted in a U.S. default, however, the debt ceiling was suspended altogether until January 2025, which meant that Congress wasn’t required to contend with an arbitrary self-imposed limit when it wanted to up its borrowing. Nice.

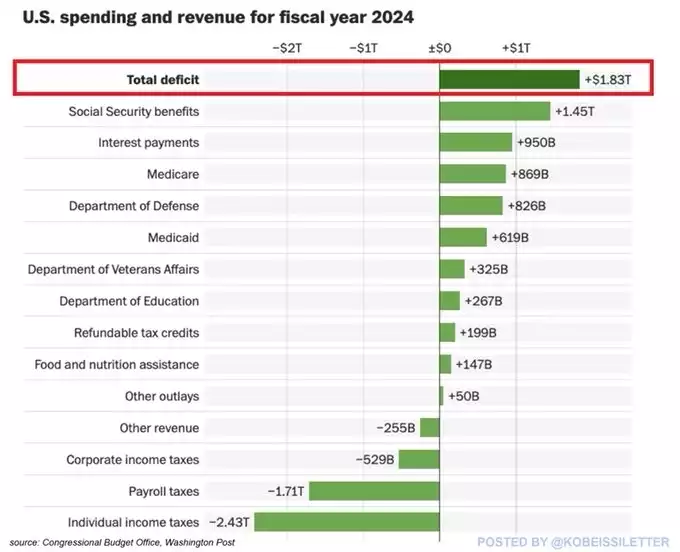

The numbers behind the need to borrow money are staggering – in 2024, deficit spending reach $1.8 trillion, representing 6.4% of GDP. That equates to a borrowing interest expense of over $1 trillion annually.

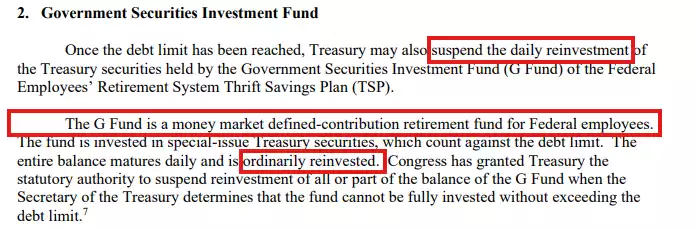

With the debt ceiling set to be reached any moment now, the U.S. has begun "extraordinary measures." This tactic suppresses the level of intragovernmental debt, which creates more space for public debt through a variety of measures. One of the biggest ways they do this is by suspending daily reinvestment of certain funds. The government can pause investments in certain funds to create room for more borrowing. In 2021, this strategy was used to borrow $262 billion, which it repaid later that year.

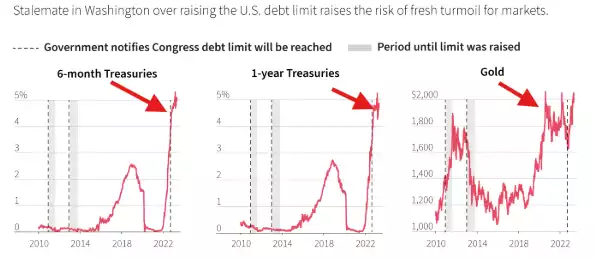

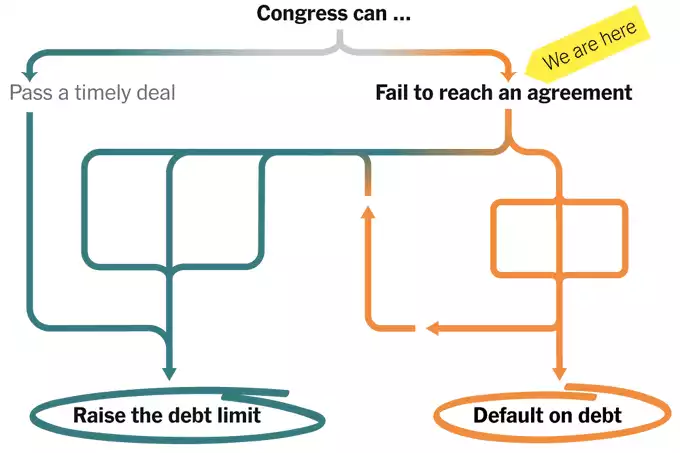

However, these measures simply buy time. They don’t increase the debt limit or change government spending. The longer these extraordinary measures go on, the closer the U.S. government gets to defaulting. As seen in June 2023, this causes severe volatility.

What happens if the U.S. Congress doesn’t raise the debt ceiling? It will be unable to meet all its obligations, so the Treasury would have to choose which bills to pay. Social Security would collapse, and the U.S. would be unable to make interest payments. This results in a U.S. bankruptcy.

Like June 2023 and all the previous iterations of this crisis, it’s reasonable to expect Congress to raise the debt limit. However, this doesn't solve the crisis we are facing, it simply kicks the can further down Pennsylvania Avenue. The real crisis is deficit spending which is now at WW2 levels as a percentage of GDP.

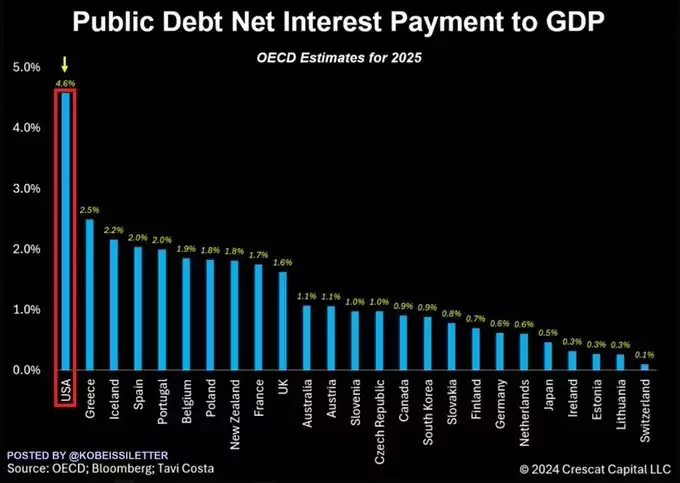

The likely outcome of this crisis is that it will begin again in 1-2 years. U.S. net interest payments as a % of GDP are set to reach a record 4.6% in 2025, double the levels seen in World War 2. With each iteration of the crisis and without a sustainable solution in sight, America edges closer to bankruptcy.

Returning to a gold-backed currency could stabilise the monetary system and reduce reliance on debt. In the meantime, you can take control of your own financial security by investing in a safe haven asset like gold and silver, ensuring a hedge against economic uncertainty and currency devaluation.