Outcomes of Jackson Hole & BRICS Great for Aussie Gold

News

|

Posted 28/08/2023

|

2389

The much anticipated Jackson Hole global central bank gathering delivered little of any real surprise. The US Fed continued a careful ‘higher for longer’ narrative, though less ‘hawkish’ than last year’s, Euro ECBs LaGarde didn’t really address the Euro-zone’s current woes rather spoke to the longer term, and Japan’s BoJ continued to buck the trend by saying their inflation was still too low and would continue their ‘dovish’ yield curve control easing policy. The elephant in the room for the global economy, China, literally wasn’t in the room. Coincidence or not, the conference clashed with (more) anticipated BRICS meeting.

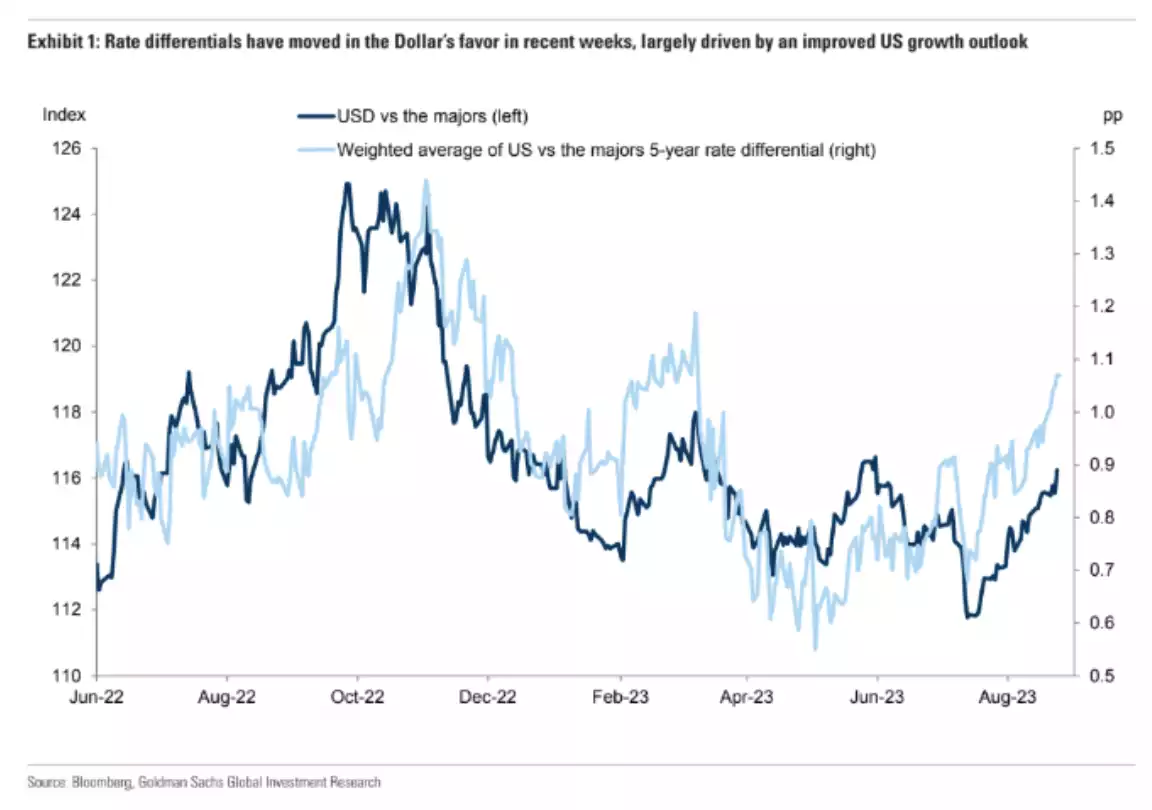

The result was further pressure on US Treasuries keeping bond rates at unsustainable levels and the US dollar strength maintained. In the world where everything is relative, the US remains the least dirty shirt in the global economy basket and currencies weaker against it. The Aussie dollar continues to be pushed low as it competes with the USD and is the defacto Chinese Yuan trade at a time where deep China weakness pervades the global economy. The following chart indicates we could well see more relative strength from the USD as the Eurozone and China continue to look weak.

Of course a lower Aussie Dollar sees those holding gold, silver and platinum enjoy further upside to the already bullish US Spot gold price fundamentals. A higher USD has historically been a headwind for the spot gold price but we have seen fundamental changes to the demand equation in more recent times with the huge buy up of gold by the BRICS and other central banks as they prepare for what’s coming for the USD.

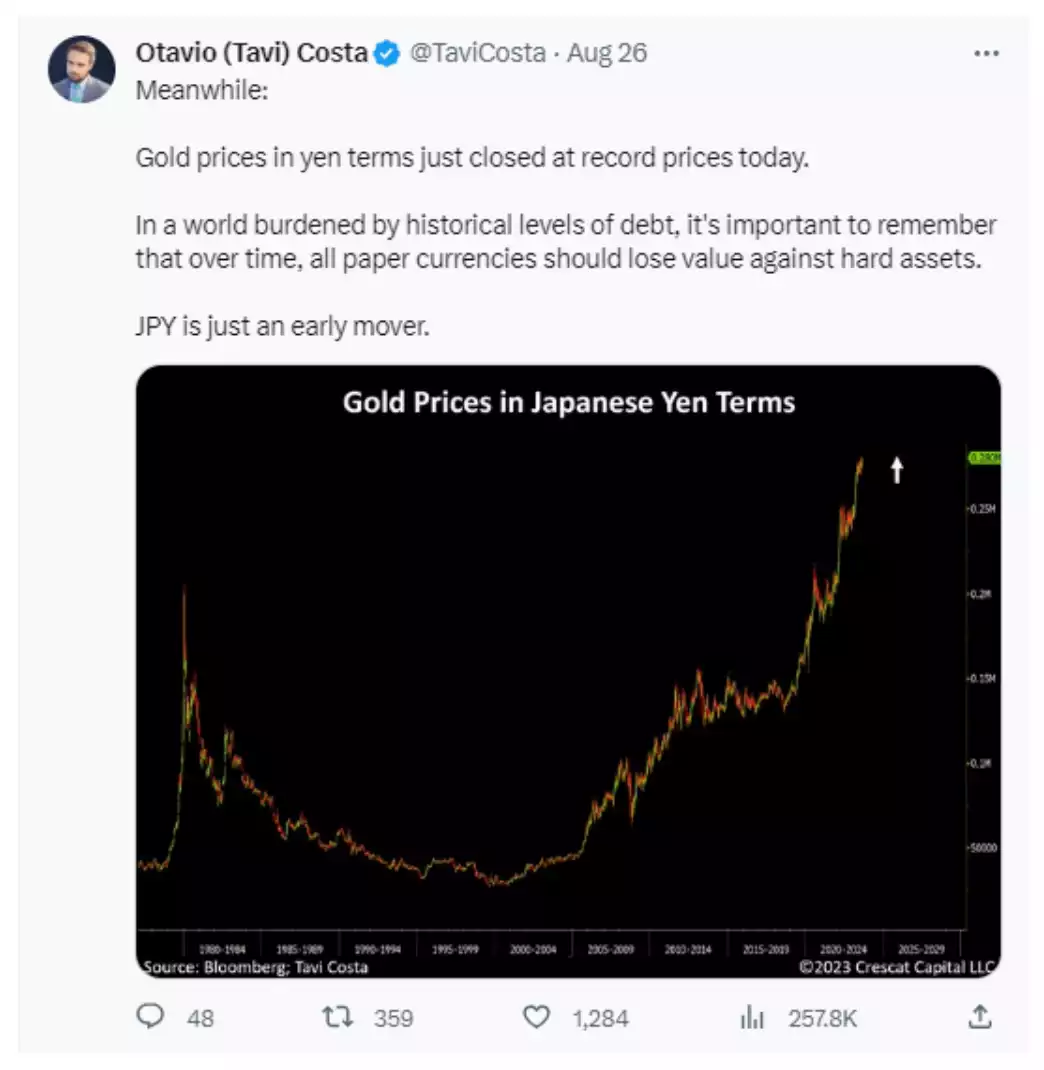

Whilst much of Jackson Hole was dominated by central bank talk around monetary policy (their remit) the opposing monster force of fiscal policy keeps the tension very live. As an example, Japan with its easy monetary policy through the BoJ continues to keep the Yen relatively low and, like for AUD, that is both structural and great for gold in Yen terms:

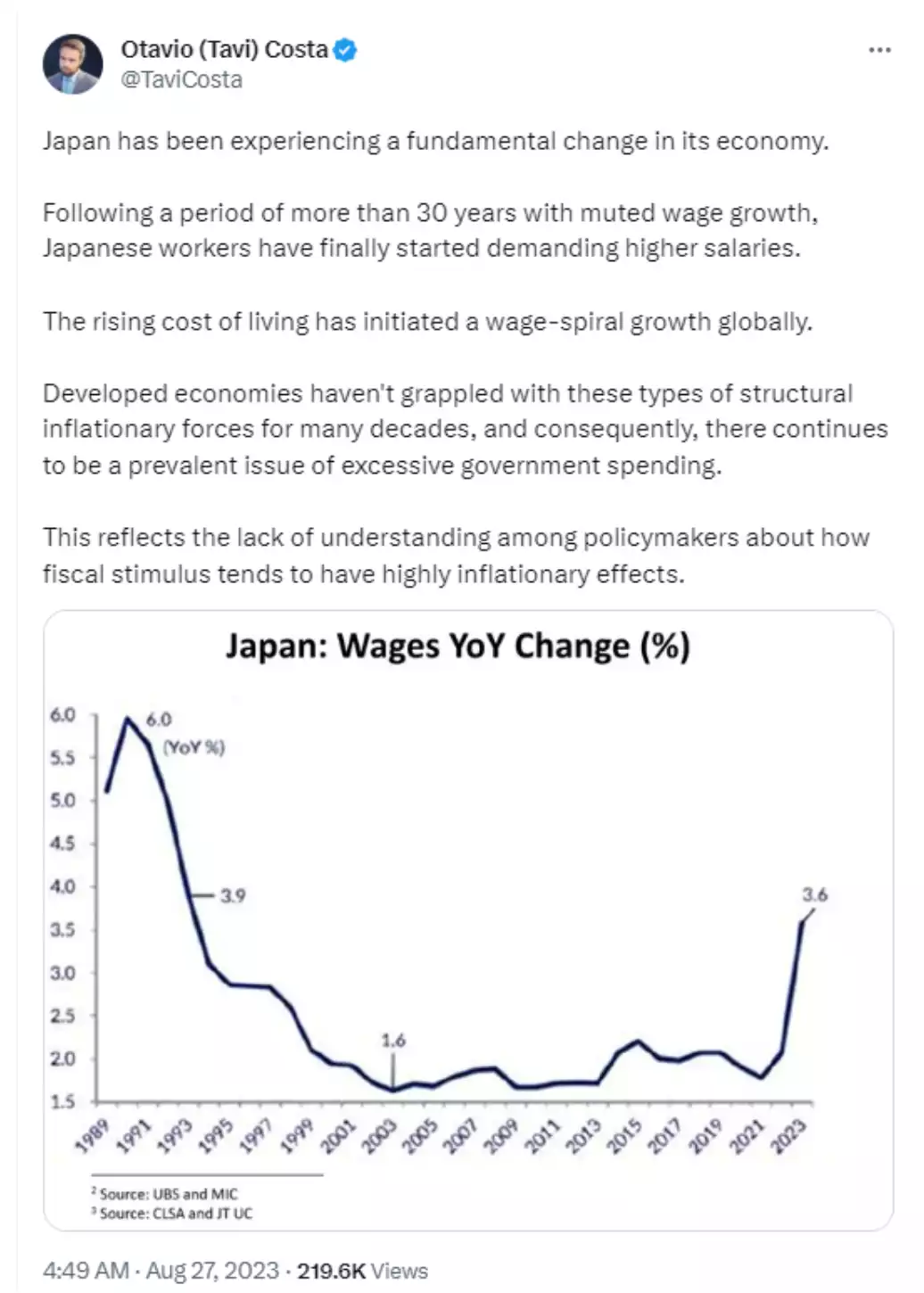

However Japan is not immune to the effects of fiscal policy either and is now experiencing the pressures borne of excess government spending:

The BoJ are dancing a fine line of artificially suppressing rates through yield curve control which keeps the cost of debt down, but amassing more debt to spur on inflation which helps inflate away their debt. We remind you there are only 3 ways to reduce debt – 1. Pay if off through growth (GDP) greater than debt, 2. Inflate it away with inflation seeing the value of assets increased relative to the debt, or 3. Default. Option 2 is often thought of as a stealth tax. Ask the 100’s of thousands of Aussies currently trying to service their mortgage about this stealth tax… The BoJ is picking its inflation metric carefully. From Reuters in relation to Jackson Hole:

“Underlying inflation in Japan remains "a bit below" the Bank of Japan's 2% target, BOJ Governor Kazuo Ueda said at a Federal Reserve research symposium on Saturday, and as a result the bank will maintain the current approach to monetary policy.

"We think that underlying inflation is still a bit below our target," Ueda said. "This is why we are sticking with our current monetary easing framework."

Japan's core consumer inflation hit 3.1% in July, staying above the central bank's 2% inflation target for the 16th straight month, as companies continued to pass on higher costs to households.”

As a reminder, Japan has the highest debt to GDP ratio in the developed world at 263%. That is public debt by the way, total debt sits at a staggering 1330%. Of the public debt total of USD9.2trillion, 43% of that is held by the BoJ alone!

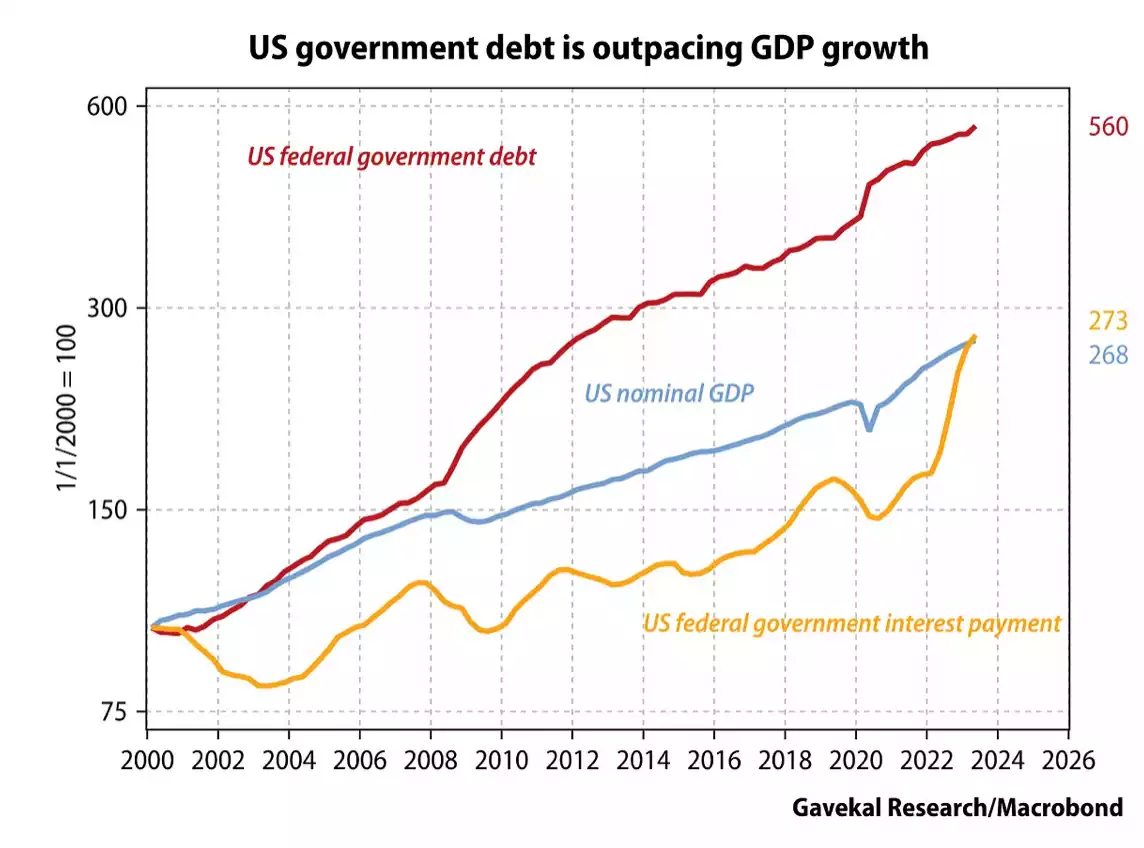

As a reminder, the following is the situation for the issuer of the world’s (current) reserve currency. See if you can spot the problem brewing….

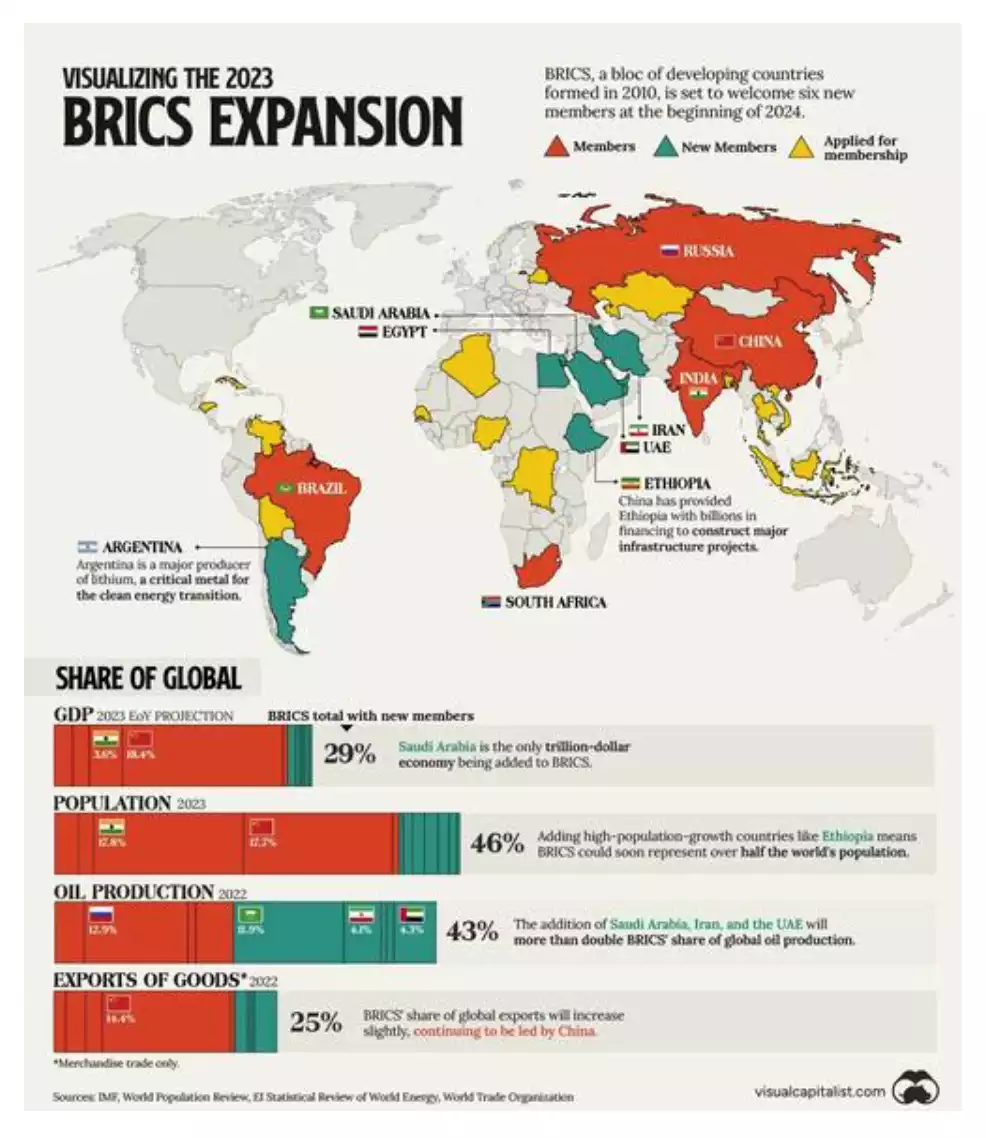

Is it no wonder than, that the line up to join the BRICS is growing as the world looks for an alternative. Last week the BRICS (Brazil, Russia, India, China, and South Africa) formally accepted 6 new nations - Saudi Arabia, Iran, Ethiopia, Egypt, Argentina, and the United Arab Emirates (UAE). Most noticeable of course is the Saudi’s who have underpinned the PetroDollar status of the USD for decades, arguably the most powerful foundation of the reserve currency. They have now left that behind. The following infographic illustrates clearly the force that thus group has become and there are 40 other countries expressing a desire to join, one of which is our biggest neighbour Indonesia.

So let us leave you with the reminder that this bloc has openly discussed establishing a gold backed currency and have absolutely dominated the gold purchasing in the world for a number of years. 2 of the biggest 3 gold producers are in the club. They don’t care about USD relative strength, and so the spot gold price now has a major new and bullish force in the face of it.