Official Central Bank Statistics – The Gold Spree Continued

News

|

Posted 07/01/2025

|

3315

The latest official statistics from the World Gold Council show that central banks around the world continue to play a leading role in the demand for gold. November represented another solid month of gold buying as central banks collectively added a net 53t to global official holdings. This extends the broader trend observed throughout this year where central banks – mostly from emerging markets – have remained keen buyers of gold, driven by the need for a stable and secure asset amid global economic uncertainties.

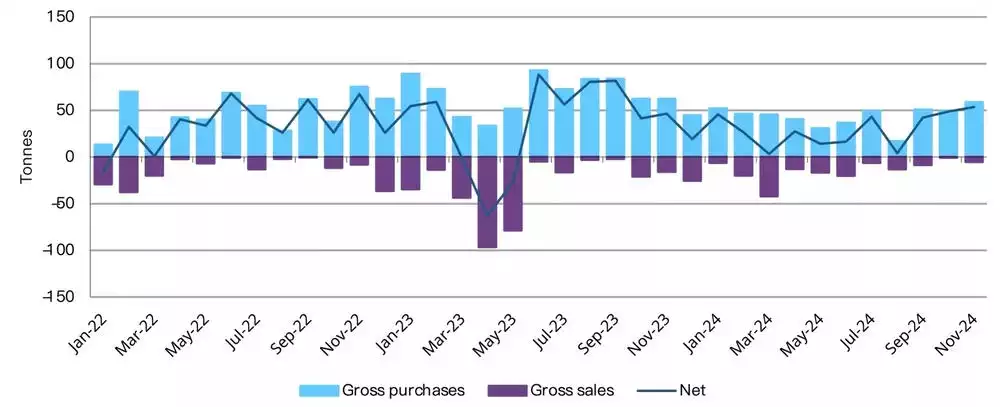

Chart 1: Official gold reserves rose by a further 53t in November 2024

Source: IMF IFS, respective central banks, World Gold Council

Central banks were seemingly happy to take the opportunity to buy the dip following November’s cooling off in price after the U.S. election. At a country level, much of the buying was limited to those who have been active in recent months, plus the People's Bank of China, who officially resumed buying gold after a six-month break. Some of the highlights and key numbers from the month include:

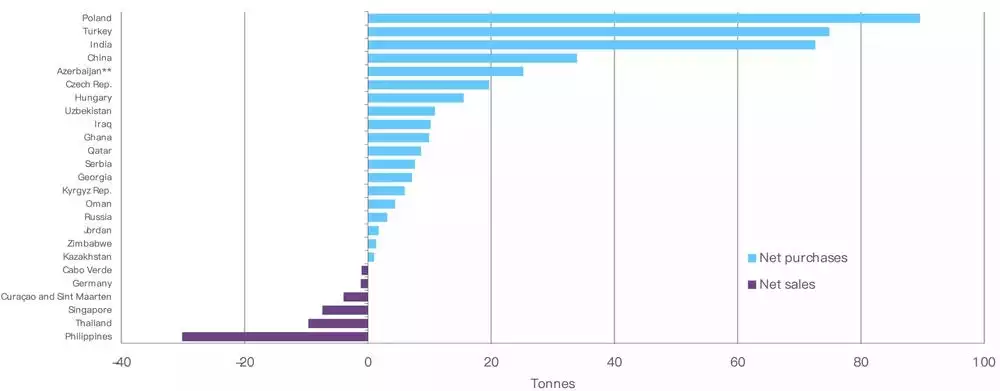

- The National Bank of Poland (NBP) was once again a major buyer. It increased its gold reserves by 21t in November, to 448t. Gold now accounts for almost 18% of its total reserves and this purchase made the NBP the leading gold buyer YTD with 90t

- Data published by the Central Bank of Uzbekistan shows its gold reserves rose by 9t during the month – the first monthly addition since July.

- The Reserve Bank of India continued its 2024 buying streak, adding 8t to its gold reserves in November. This lifts YTD buying to 73t and total gold holdings to 876t, maintaining its position as the second largest buyer in 2024 after Poland

- The National Bank of Kazakhstan increased its gold reserves by 5t, the second successive month of buying that brings its total gold holdings to 295t

- One of the most notable developments during the month was the announcement that the People's Bank of China (PBoC) had resumed gold purchases. After a six-month hiatus, the PBoC added 5t of gold to its reserves, increasing its y-t-d net purchases to 34t and its total reported gold holdings to 2,264t (5% of total reserves)

- Data published by the Central Bank of Jordan shows its gold reserves rose by over 4t in November - the first monthly increase since July. Y-t-d net purchases now total nearly 2t, lifting gold holdings to 73t

- The Central Bank of Turkey increased its gold reserves by 3t during the month. The central bank also entered into reverse swap agreements (gold for lira) with domestic commercial banks to manage liquidity

- Gold reserves held by the Czech National Bank rose by almost 2t in November – the 21st consecutive month of buying. YTD net purchases now total almost 20t, lifting gold holdings to just above 50t

- The Bank of Ghana continued its gold accumulation programme, adding 1t. YTD net purchases now sit at 10t and total gold holdings are 29t. The bank also launched a Ghana Gold Coin to the public during the month as part of its “efforts to stabilise the economy and promote investment in Ghana’s gold reserves”

- The Monetary Authority of Singapore was the month’s largest seller, reducing its gold reserves by 5t, bringing YTD net sales to 7t and overall gold holdings to 223t.

It was also announced in December that gold reserves at the Bank of Finland had been lowered by 10% to 44t with the sale most likely taking place during that month. The bank noted that: "Exchange rate risk is the most significant of the Bank of Finland’s financial asset risks. Increasing the size of its foreign exchange reserves elevates the Bank’s exchange rate risk considerably, and so the Bank is strengthening its foreign exchange rate provision by selling about 10% of its gold reserves". This brings the bank’s gold reserves to their lowest level since December 1984.

Chart 2: Net purchases continue to heavily outweigh net sales in 2024

YTD central bank net purchases and sales, Source: IMF IFS, respective central banks, World Gold Council

Although we await the remaining 2024 data, the broad sustained interest in gold from central banks this year has clearly highlighted the metal’s enduring appeal. With only December data yet to be revealed, central banks will no doubt be substantial net purchasers for the 15th consecutive year.

This ongoing demand sends a clear message to investors: gold isn’t just a relic of the past—it’s the foundation of the future. Central banks, the custodians of global financial systems, are putting their trust in gold as a safeguard against inflation, currency fluctuations, and geopolitical uncertainty. For everyday investors, the opportunity is obvious: follow the lead of these major institutions.

As central banks continue to stockpile gold, its long-term outlook remains bright. Whether you’re looking to protect your wealth or invest in an asset with a proven track record of resilience and growth, gold is the standout choice.