Nowhere to Hide

News

|

Posted 22/05/2025

|

1693

If there is a chance of a recession, most banks and investors will typically recommend buying US or Japanese bonds to ride out the storm. However, that narrative is changing quickly, as the safe-haven assets that have underpinned the world financial system for the past 60 years—since the petrodollar replaced the gold standard—are suddenly being perceived as higher risk. This shift is most apparent in the long-duration bond market.

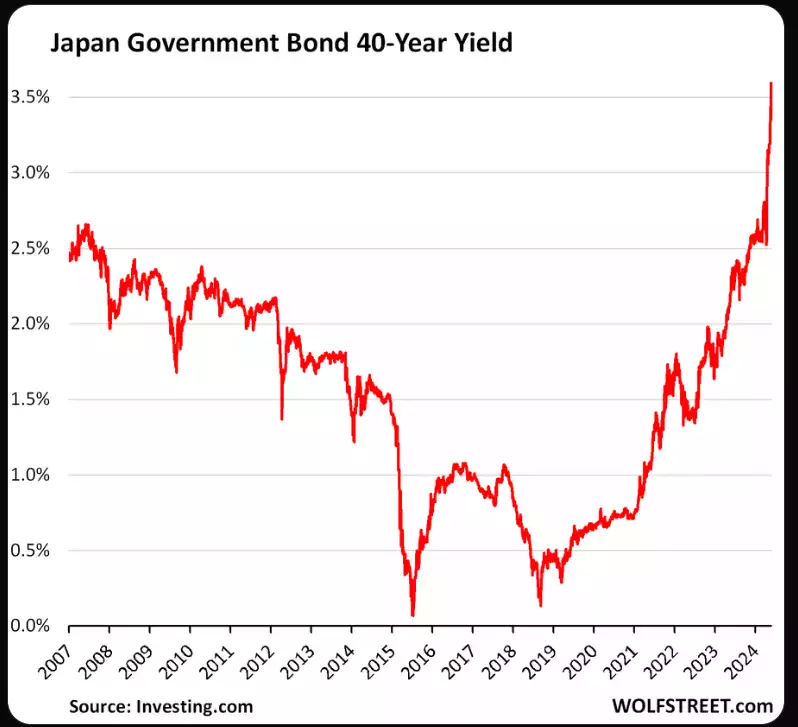

Last night, the US held a 20-year bond auction for US$16 billion, with the bond coupon rate rising to 5.047%. In after-market trading, it reached 5.117%. The previous night, Japan’s bond auction saw a lack of buyers drive the 20-year JGB yield to 2.575% from 2.535%—the highest level since October 2000.

“For demand for super-long bonds to rebound, the market wants to get greater assurance that there will be a reduction of new bond issuance, which is technically possible within this fiscal year,” said Naoya Hasegawa, chief bond strategist at Okasan Securities.

While a reduction in issuance may be technically possible, especially with Japan’s current fiscal conditions, political realities often complicate such moves. Successive governments frequently prioritise short-term tax relief to maintain voter support, sometimes at the expense of longer-term financial stability.

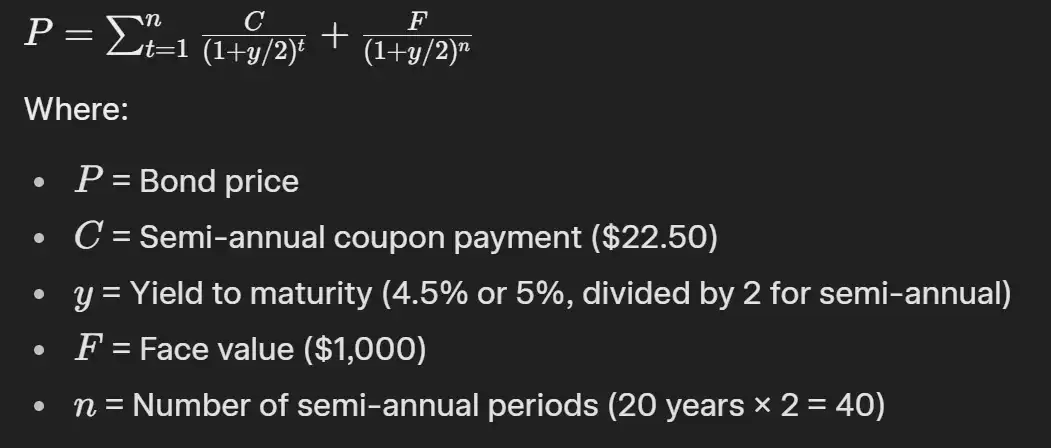

Calculating Bond Value Changes

US 20-year Treasury Bonds pay interest twice a year. To calculate the value loss as yields rise, the following formula is used:

At a 4.5% yield, the bond value is US$1,000. If investors perceive increased risk or anticipate higher inflation, they demand a higher yield. A 0.5% rise in yield (as recently observed) reduces the bond's value to US$937.26—a decline of US$62.74 or 6.27%.

Japan’s 40-year bond has seen yields increase by approximately 1.5% over the past 18 months. For a bond with a full term to run, this has resulted in a 32.15% decline in value.

Japan’s Situation Compared to Greece

Prime Minister Shigeru Ishiba has resisted political pressure to loosen fiscal policy through tax cuts funded by additional debt. His minority government is maintaining a firm stance, noting similarities to the Greek debt crisis. Between 2009 and 2017, Greece’s GDP fell while debt rose, leading to an increase in debt-to-GDP from 127% to 179%, despite tax increases and bailout support from European institutions.

Greece’s GDP stands at US$218 billion, and it had the European Union—albeit reluctantly—offering support. Japan, with a GDP of USD 5 trillion, does not have similar external backing.

As Prime Minister Ishiba stated in Parliament this week:

“Japan is seeing interest rates turn positive and its fiscal state is not good.”

Finance Minister Katsunobu Kato echoed these concerns:

“A loss of market trust in our finances could lead to sharp rises in interest rates, a weak yen and excessive inflation that would have a severe impact on the economy.”

The situation is being viewed by some observers as potentially more volatile than the Greek crisis.

Similar Story in the US

Despite the US Federal Reserve cutting interest rates by 0.75% in the past month, mortgage rates continue to rise. This is because banks borrow based on 20- to 30-year bond markets, where yields are still climbing. Last night’s 20-year bond auction saw rates increase from 5.02% to over 5.12%, resulting in a potential 1.2% overnight decline in bond value—even for what are traditionally considered the most stable assets.

Jamie Dimon, CEO of JPMorgan Chase, recently stated he is not currently buying credit, labelling it a “bad risk.” He voiced concerns about market complacency and the potential for a major downturn, pointing to risks such as inflation, widening credit spreads, and geopolitical tensions. Dimon also noted that those unfamiliar with major downturns may underestimate associated risks, although such downturns could offer opportunities for firms prepared to act..

Gold and Bitcoin

As investors re-evaluate traditional safe havens, both the US and Japanese central banks face a complex policy dilemma—either raise short-term rates and increase taxes to stabilise bond markets (risking economic slowdown), or pursue the path of least political resistance, potentially leading to greater instability in the long term.

In either case, alternative reserve assets like gold, silver, and Bitcoin appear underpriced in a rapidly evolving global financial environment.

Watch the insights video inspired by this article here: https://www.youtube.com/watch?v=yXtL9ur4ruc