Not Since The Great Depression…

News

|

Posted 06/10/2023

|

2818

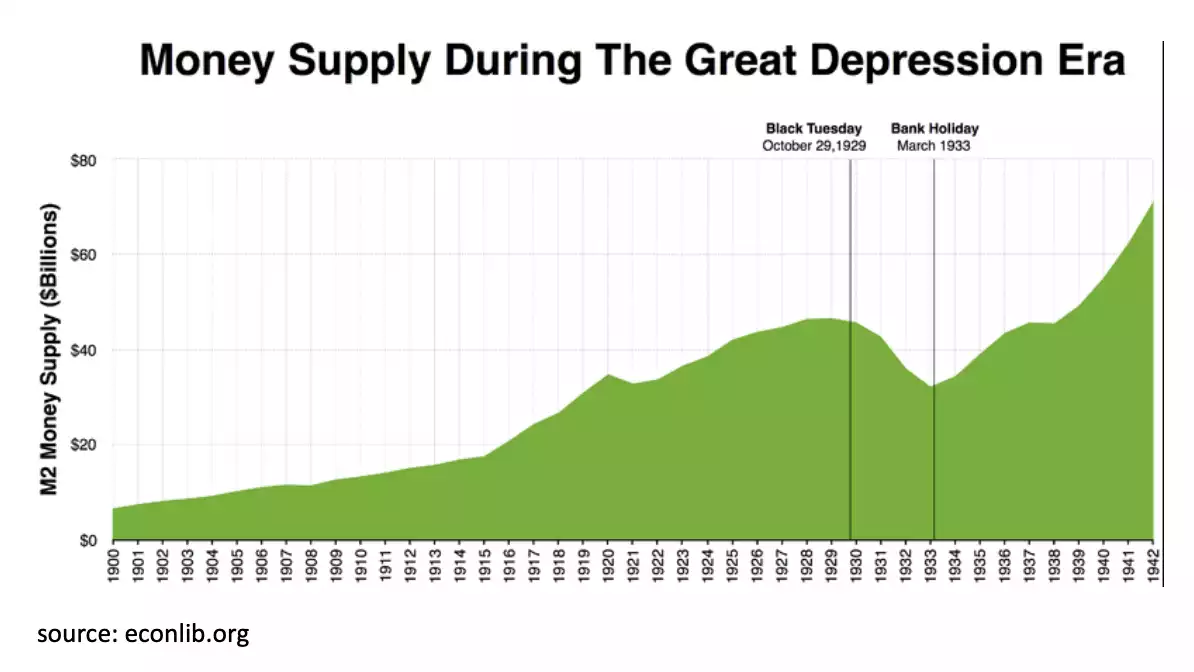

For more than one year, the M2 money supply has been stuck in negative territory, meaning the supply of money in USD has been shrinking. The only similar drop in money supply of this magnitude was in the 1930s during the Great Depression.

One of the main differentiators this time around is that the reduction of money supply in the 30s was able to significantly tackle high-prices. The current reduction of M2 has not had the same effect and we are still seeing certain prices rises, hence the repeated need to recalibrate consumer price index reports.

source: econlib.org

According to Federal Reserve data, surveys show that most Americans (the bottom 80% of earners) are stuck with less savings than they had before March 2020. The top 20% of income earners are also due to follow them in the next 12 months. Savings has been drawn down on the bare necessities, such as food, rent, mortgage payments, and utilities. Savings alone cannot provide a clear picture of the squeeze on average earners. As previously covered, American's total credit card debt broke a record this year by passing the $1 trillion mark.

50%+ Chance of Recession

A newly-created model by Bloomberg has just shown that there is a more than 50% chance of a recession and that it could begin this year. This is despite Biden's denial of the last recession by trying to change the actual definition of what a "recession" is. According to their predictions, it is expected to begin near the end of this year (there are less than 3 months left!) and be declared in 2024.

Some major factors tipping the scale may be not just high fuel and cost of living expenses, but also student loans. The restart of student-loan payments this month is likely to nab $8 billion per-month from consumers. Student debt in the US often has its significance understated, not just by its sheer size, but also the collection process which can include intercepting wages.

A declared weakness of models like this is that they do not particularly consider new developments. Put simply, they are not able to predict the future, just roughly anticipate it with indicators based on past recessions. Some major surprises that could come could be one more rate hike, and this would be heavily based on employment numbers.

Employment Data Could be the Decider

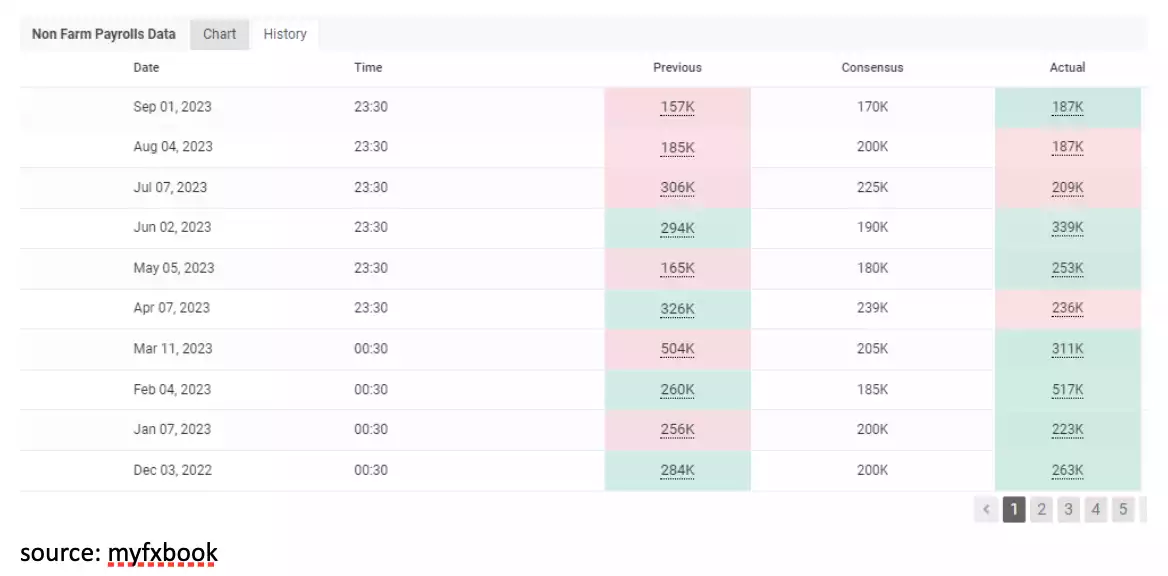

source: myfxbook

The Non-farm Payrolls will be released tonight at 11:30PM Sydney/Melbourne time. This is a measure of all new jobs created in the previous month (apart from agricultural businesses) and is one of the most-traded data releases each month. The currently fragile markets are looking hungry for data to support their direction. In the past, 60% of September NFP reads have been worse than expected. A bad reading could spell a shock to markets, meanwhile a good reading would also hinge on the Fed not using it as an excuse to call for one more rate hike.

On the topic of timing of market events, we will again remind you of the old saying when it comes to defensive assets like gold…

“Better a year too early than a day too late”

Bloomberg et al are trying to warn you it may be considerably less than a year…