Non-Farm Payroll Data Failure

News

|

Posted 12/09/2025

|

1719

Donald Trump recently came under fire for dismissing the head of the US Bureau of Labor Statistics (BLS) following drastic job revisions for May and June—initially reported at 144,000 and 147,000, later revised down to just 19,000 and 14,000, respectively. While critics accused him of attempting to manipulate labour market data, the sheer scale of these revisions highlights a deeper issue: the data is critical, yet increasingly unreliable, and reform appears overdue.

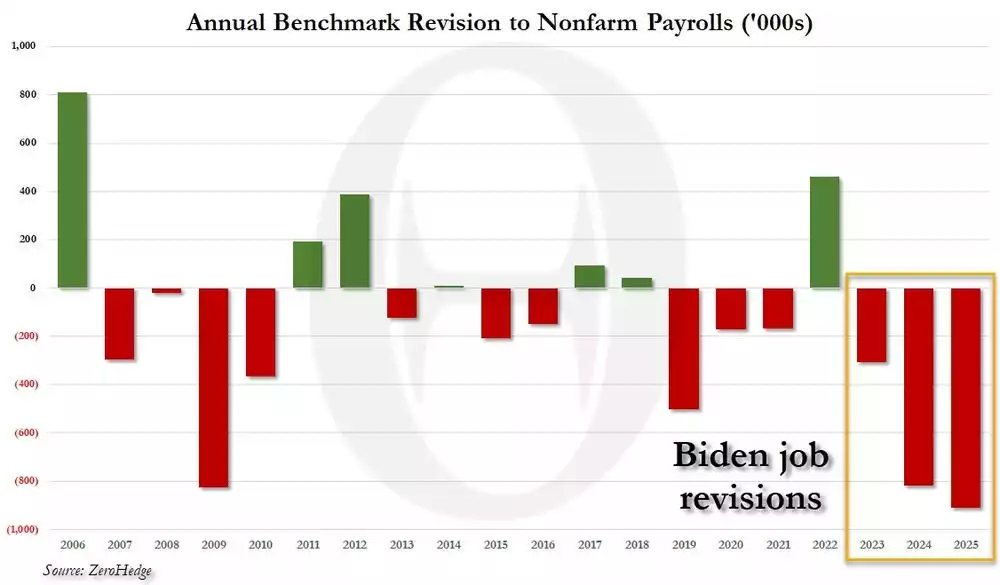

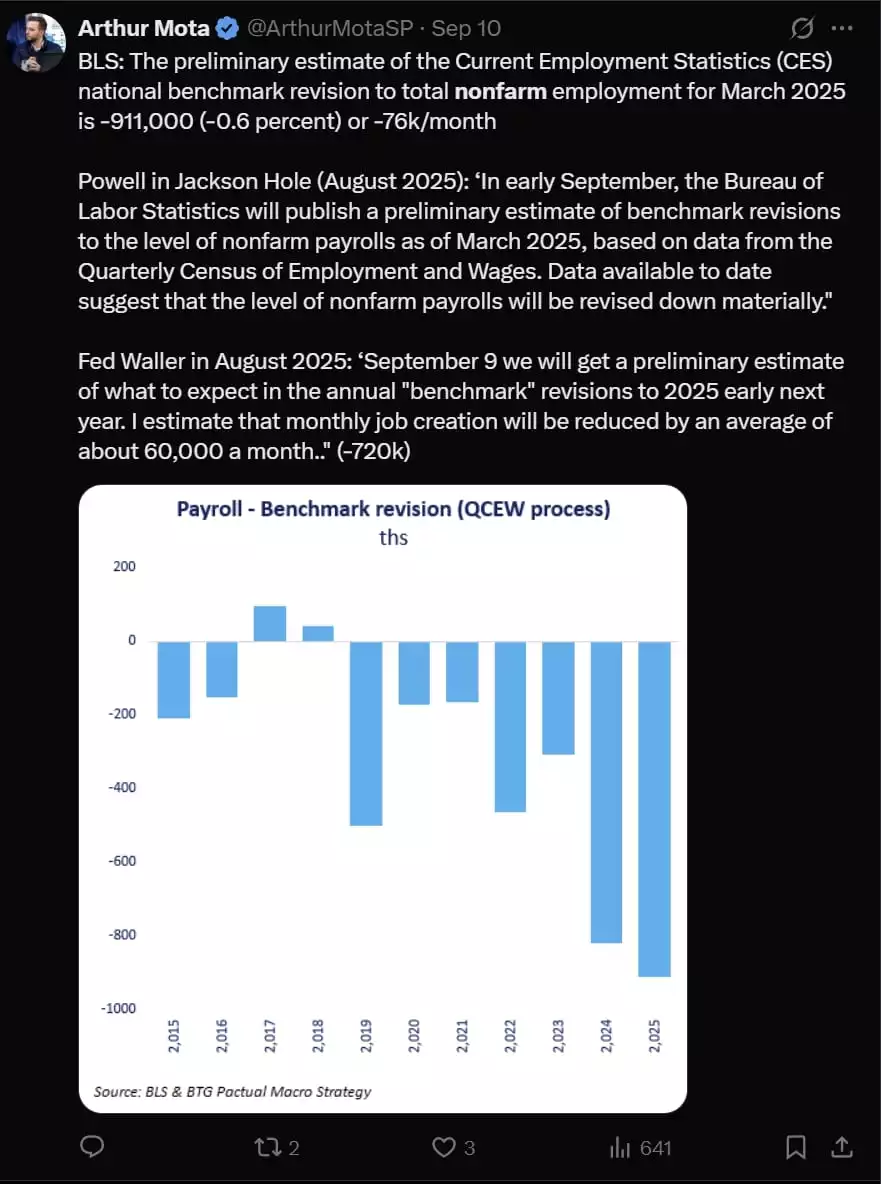

This month saw the release of the annual revision—separate from the typical monthly updates issued in the two months following an initial report. The latest annual revision, covering April 2024 to March 2025, showed a net adjustment of 911,000 jobs. That’s the largest revision since 2009, in the aftermath of the GFC. Given the weight Non-Farm Payroll (NFP) data carries in moving markets and guiding monetary policy, these discrepancies raise serious concerns about the accuracy of data underpinning Federal Reserve interest rate decisions.

Why is the data so inaccurate?

The BLS compiles its figures from two main sources: the Household Survey and the Establishment Survey, which together cover around 60,000 households and 122,000 businesses. Data collection includes mail, email, phone calls, and even door-to-door visits. However, the initial NFP release is based on incomplete inputs—typically around one-third of businesses have not responded by the deadline, and up to 60% of individuals remain unaccounted for.

Those who don't respond are often the ones facing difficulties, which may skew the results toward a more optimistic outlook. Revisions occur one and two months after the initial release, and finally, a yearly benchmark revision is made using more comprehensive sources—such as unemployment insurance records, business data, and birth/death models for businesses.

During periods of heightened business closures—like those seen in the GFC and potentially again now—these benchmark revisions tend to be sharply downward. This supports what many US commentators have argued: the economy has been weaker than headline data suggests for at least a year.

In fact, over the past two years, more than 2 million jobs have effectively been revised out of existence. In 2024, job growth has been overstated—about 1 million jobs created versus 3.3 million new immigrants—suggesting unemployment should have risen significantly more than reported.

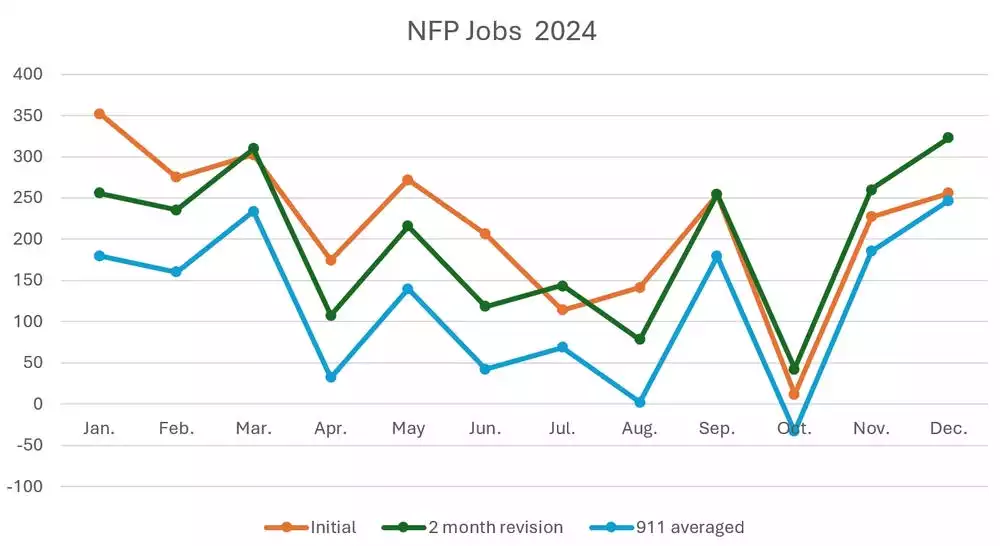

Looking at January to December 2024 data, the disparity between initial job estimates, two-month revisions (green line), and the final benchmark revision (a drop averaging 76,000 jobs per month) shows how volatile and unreliable the numbers are.

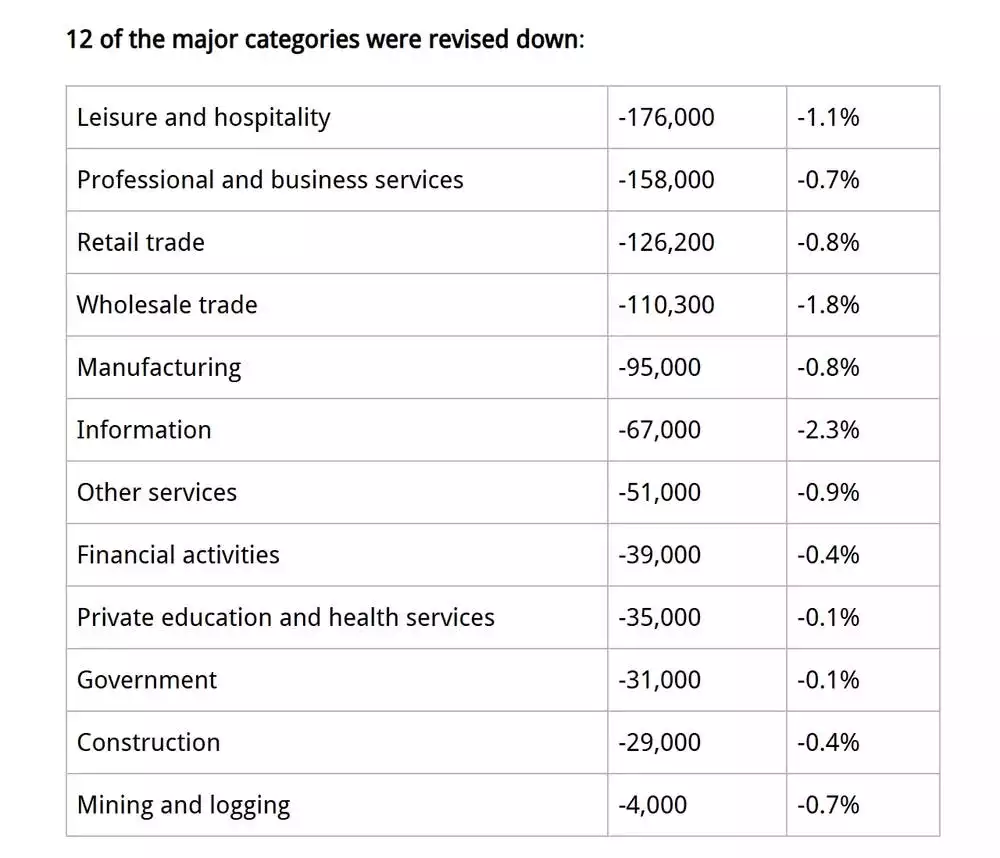

The largest downward revisions were in leisure, hospitality, and retail trade—further pointing to a consumer spending recession. Of the 911,000 jobs revised away, 880,000 came from the private sector, with only 31,000 from government employment.

Federal Reserve Under Pressure

With both of the Fed’s mandates—stable inflation and full employment—under pressure, all eyes are now on the central bank. In light of this "supersize" data failure, could we see a supersize rate cut of 50 basis points?