No bullets left

News

|

Posted 06/09/2018

|

8862

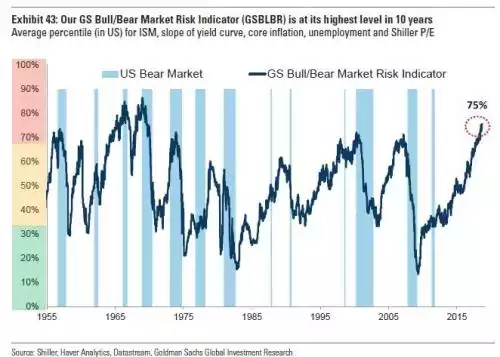

Goldman Sach’s have just updated their Bull/Bear Market Risk Indicator and it’s now deep into ‘red’ territory and higher than just before both the dot.com and GFC crashes.

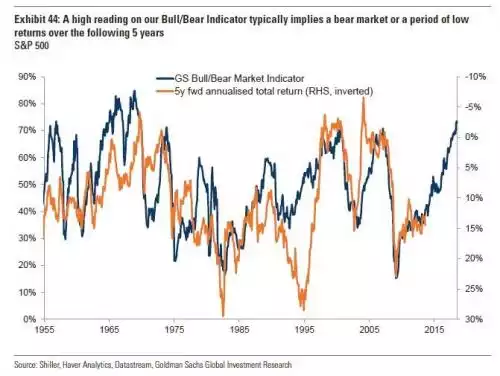

Goldmans then take this chart and apply 5 year forward annualised returns (inversely of course) with remarkable correlation. What this indicates is that the market is expected to see negative returns over the next 5 years.

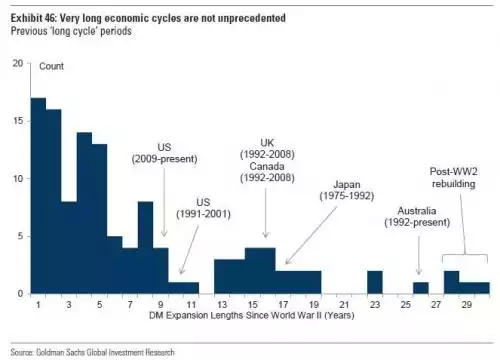

Since the news that the S&P500 entered the record books as its longest bull run in history, those still bullish about this market point out that whilst long, it’s not seen the biggest returns, and certainly the broader economic returns of the US have also not been particularly great. We include the chart by Goldmans below not just to put that into context but to highlight to you where Australia’s current economic expansion sits.

This chart highlights a few things. That the US Sharemarket has achieved this record without a particularly strong economy talks as much to the influence of monetary stimulus (and hence the question of what happens when it is removed?) as it does to perma bulls suggesting there is little risk of recession when things aren’t overheated. You will note too that the US has never experienced an economic cycle longer than 10 years when the current one is 9 years old. Is this time different?

Also you will see how Australia stands out as the longest non post war economic expansion amongst any Developed Market (DM). How long can that last?

Goldmans then warn of something we’ve spoken at length about in the past, the ability of central banks to come to the rescue next time. The GFC was prevented from getting worse by massive drops in interest rates and printing of money (QE). The aforementioned poor economic recovery has seen only very limited unwinding of that stimulus, with the US really the only one making any real attempt, and even that very slowly and only relatively recent. So where do you go if the crash happens now? From Goldmans:

"even if the next economic downturn turns out to be mild, it may prove difficult to reverse." Why?: “

- The US has already expanded fiscal policy and its debt levels and budget deficit are rising, which could make it difficult to find room for significant easing. The federal deficit will increase from $825bn (4.1% of GDP) to $1,250bn (5.5% of GDP) by 2021. By 2028, it is expected to rise to $2.05 trillion (7.0% of GDP). This would leave federal debt at 105% of GDP in ten years, 9pp higher than CBO’s latest projections.

- There may be room for US interest rates to be cut in the next downturn but less so than in other downturns. Also, European interest rates may still be at or close to zero when the next US downturn hits. The same would be true for Japan.”

Concluding: "the combination of constrained fiscal policy headroom in the US and limited room to cut interest rates in Japan and Europe may well dampen the ability to generate a strong coordinated policy response to any downturn, and also make it harder to get out of such a downturn."