New Data Release: U.S. Job Openings Fall The Lowest in Two Years

News

|

Posted 06/12/2023

|

2679

The U.S. JOLTS (job openings and labor turnover survey) October data was revealed this morning and shocked the market by hitting a two year low.

For months, there have been warnings about the inaccuracies in the U.S. Department of Labor's JOLTS report, which provides data on job openings. Many critics argue that the numbers are clearly manipulated and heavily politically influenced. Despite expectations of a modest decline in job openings from the reported 9.553 million in September, the Bureau of Labor Statistics (BLS) shocked observers by revealing a significant drop of 617,000 to 8.733 million, the lowest since March 2021.

The situation would have been even more dire if the BLS had reported the original September figure of 9.553 million, indicating a potential monthly plunge of over 800,000 – the fourth-largest on record. As we have discussed in the past, the BLS has consistently revised job openings lower, suggesting a pattern of downward adjustments to seemingly strong data.

The BLS attributed the largest decrease in job openings to sectors such as health care and social assistance, finance and insurance, and real estate and rental and leasing, while job openings increased in the information sector.

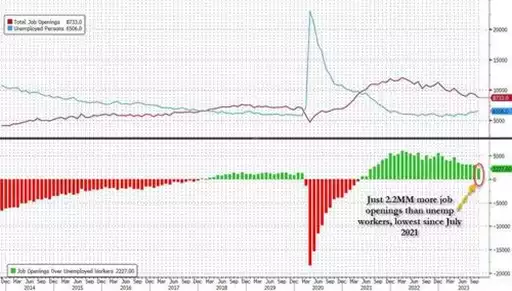

The alarming drop in job openings led to a situation where, in October, the number of job openings was only 2.227 million more than the number of unemployed workers, the lowest since July 2021.

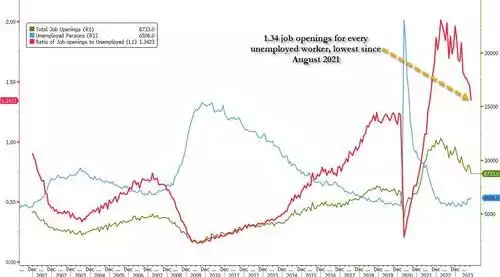

This resulted in a job openings to unemployed ratio of 1.34, nearing pre-COVID levels and a significant decline from the record 2.0 reached in early 2022.

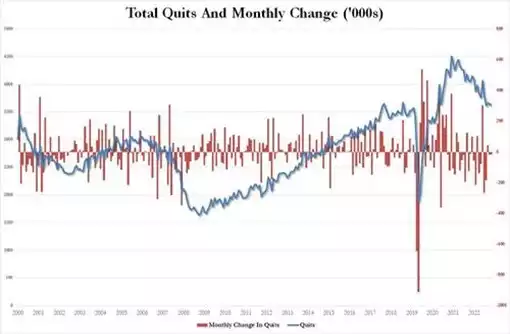

As job openings hit a two-year low, the number of people quitting their jobs, an indicator of labour market strength, also decreased. Hiring dropped by 20,000 to 5.886 million in October, with the hire rate falling to 3.7%, below the 10-year average of 3.9%.

Despite the substantial decline, sceptics argue that the real number of job openings remains uncertain, as around 70% of the data is estimated. The BLS acknowledges a record-low response rate of 32% to the JOLTS report, emphasizing that a significant portion of the final job openings figure is based on guesswork.

This grim economic data, flagged by various entities like UBS, NFIB, Opportunity Insights, and Goldman Sachs, raises clear concerns about the strength of the labour market.

The Federal Reserve, faced with a cracked labour market and a looming recession, may now be the primary driver for economic recovery, as other aspects of the Biden administration's economy face challenges.

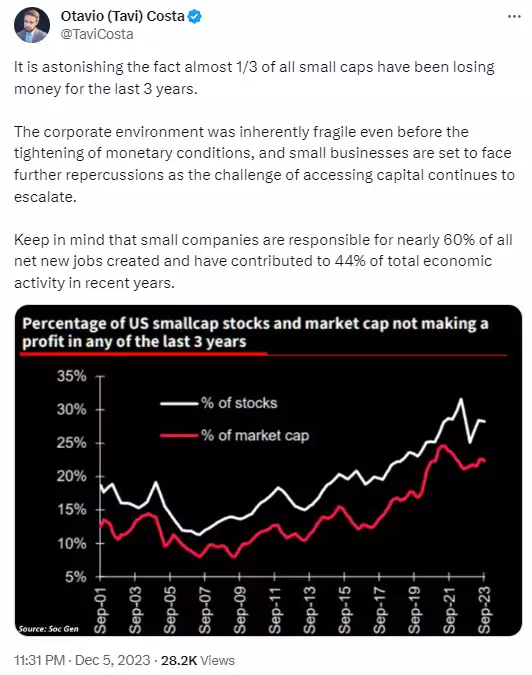

The following tweet (especially the last paragraph) tells a very compelling story around what sits behind these figures:

This development has triggered a market response, with stocks originally rallying this morning in the face of what is traditionally considered bad news, highlighting the market's dependence on Federal Reserve intervention amid economic uncertainties. In other words, we are back into the “bad news is great news” for the market mode.