Negative US GDP & the end of the business cycle

News

|

Posted 29/04/2022

|

12803

Last night’s shock news of the US falling into recessionary territory with a negative GDP print was a salient reminder of both the precariousness of the world’s biggest economy and the farce that is a sharemarket RALLYING on the news likely because they think it will force a reversal of the Fed’s tightening! Importantly gold rallied (despite an also stronger USD) as it called BS on the shares’ “bad news is good news” hope rally. As we reported yesterday Crescat Capital released their latest monthly research letter late last week and today we look further into it.

When people think of safe haven assets they inevitably think of bonds and gold. Crescat point out that in what they expect going forward, bonds may not be the best vehicle..

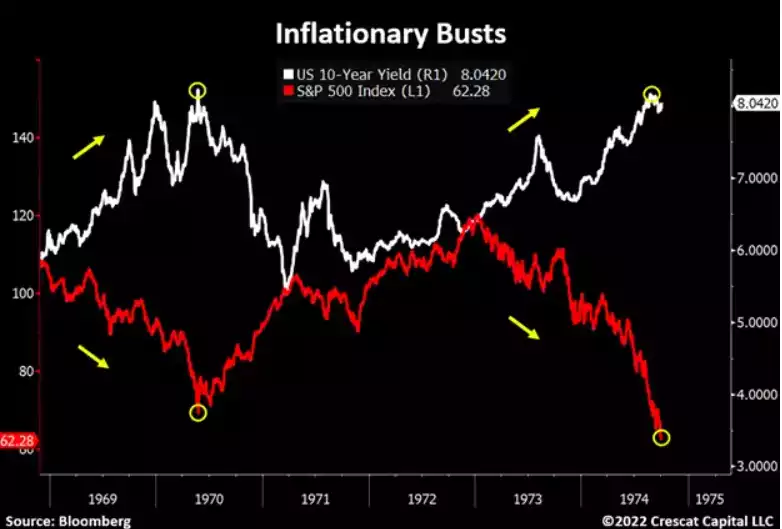

“Bonds have served as incredible hedges during the last several downturns in equity markets. The rising inflation environment that led up to the tech and housing busts proved to be a cyclical force as the economy entered a significant downturn and nominal yields collapsed as a result. Inflation also decelerated drastically during the Covid crash in March 2020 and long-term rates declined in tandem. We fear investors are “fighting the last war” in expecting the same correlation to play out in the next major equity downturn. The structural changes in inflation today are causing this relationship to change drastically. Market participants are conditioned to think of sovereign bonds as safe havens, but that was not a reality during other inflationary regimes.

In 1968-69 and 1973-74, as equity markets collapsed and the economy entered a recession, long-term nominal yields increased instead. Such market developments are consequences of an economy facing long-term inflationary pressure rather than cyclical forces. We think Treasury yields and equity market correlations will look similar in the next recession.”

“Contrary to today’s conventional wisdom, note how gold miners increased 5-fold while the stock market declined 50% during the 1973-74 inflationary recession. We think a similar development will follow in the next economic downturn.”

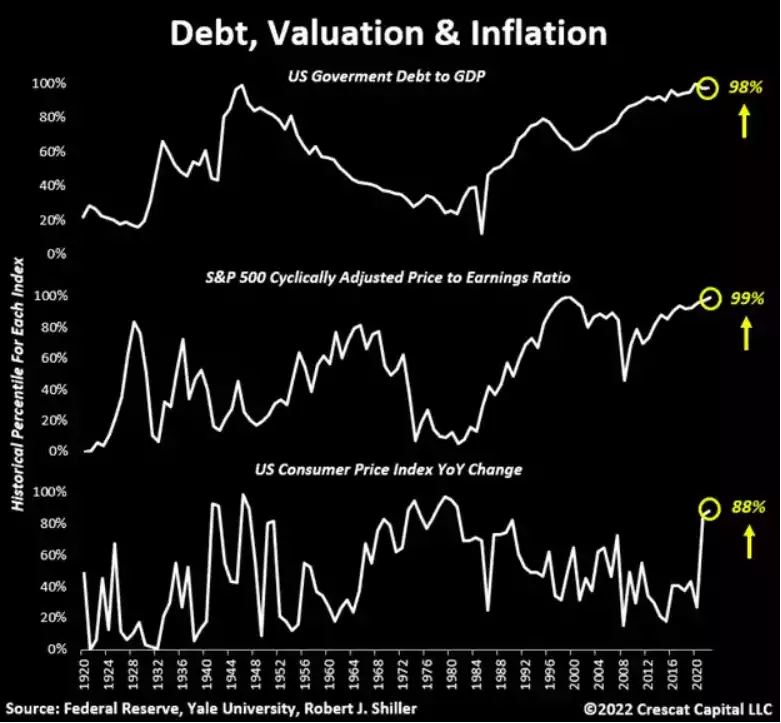

“But does today’s macro setup really resemble the 1970s?

As tempting as it can be, the use of any one point in history as a guide may offer an incomplete assessment of what is likely ahead of us. For the first time in 120 years, the US economy is facing a trifecta of economic extremes. We need to combine the debt problem of the 1940s, the structural commodity shortages of the 1970s, and the speculative equity valuation environment of the late 1920s and 1990s in order to get a more complete picture of the macro setup that we have today. These imbalances create true political constraints to governments and central banks. It is hard for us to believe how inflation will not continue to be one of the major forces infiltrating the economy over the next several years to reconcile these imbalances.”

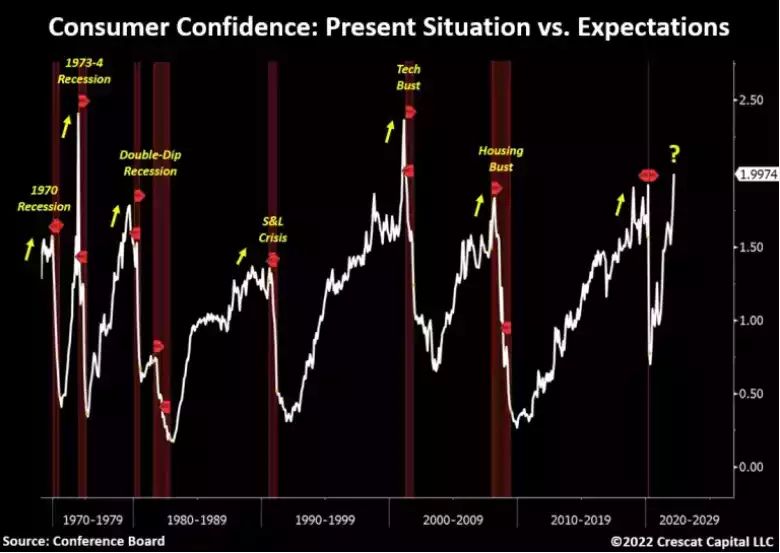

“Peak of the Business Cycle

We are seeing a list of recession indicators flashing warning signals today. Beware of times when the spread of consumer confidence “present situation” vs. “expectation” is at cyclical highs. Last time this spread was as extreme as today was right before the tech bust and the 1973-4 recession.”

“Eerie Resemblance

The US 2-year yield just re-tested its multi-decade resistance. This move happened four other times in the last 40 years, and all of them were followed by significant economic downturns.

We are likely at the peak of the business cycle. While we think the 2-year yield could easily break out above this trend, finally, it won’t change our view about a major deceleration of growth after inflation ahead. Given the current political constraints, it is a 1973-74 setup on steroids.”

“Insanely Speculative

Easy-money policies and excess liquidity have created one of the worst asset valuation distortions in history. Almost every fundamental multiple that we track is currently at historically expensive levels. To put into perspective, US market cap to GDP needs to fall another 15% just to reach peak Tech Bubble levels.”

“US Stocks vs. Gold

Not to be overlooked, US stocks in gold terms are just as expensive as they were at the 1929 peak prior to the Great Depression.”

Their base case of a massive rotation out of growth shares into hard assets, particularly in light of their data presented yesterday, is a compelling one. Last night’s US GDP print and recent historically high inflation prints reinforce this view. That gold is playing beautifully to the cup and handle technical set up makes it all the more exciting.