Negative Real Rates & Inflation

News

|

Posted 23/08/2016

|

6540

Yesterday we floated the concept of us heading toward stagflation, where inflation rises against a week economic back drop – lose lose. Yesterday and overnight there was fresh talk of the US Fed readjusting their target inflation rate from their current 2% to 4%. Such a move would (in their mind) justify maintaining monetary stimulus policies now that they have hit their original target whilst clearly the economy is still very anaemic. The same can be said for their hitting their unemployment target whilst the details behind the headline show that the low rate is helped hugely by people simply giving up (and not being counted – ‘non participants’) combined with full time jobs being replaced by lower paying part time jobs. They clearly need new ‘targets’ to keep the ruse going.

In part the concept is - let inflation go ‘too’ high then you can justify raising rates and so then have the ability to lower them again should it all fall apart again. Ingenious stuff…. IF you can reign in that inflation snow ball rolling down the hill.

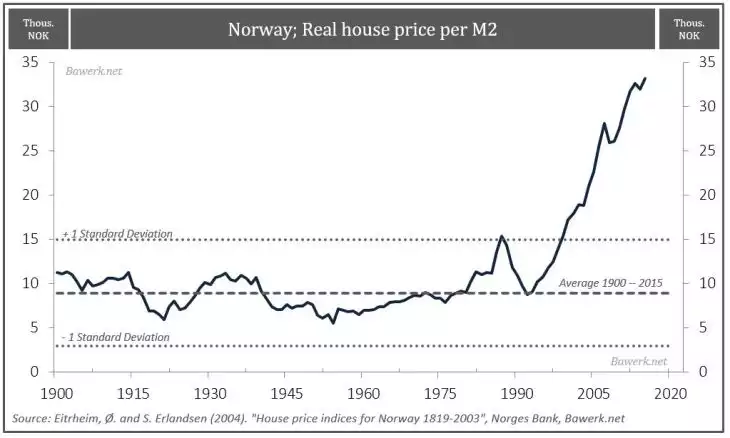

Like Australia, Norway is a country that rode the commodity boom fuelled by China’s money printing response to the GFC. Like Australia that saw Norway enjoy a remarkable property boom. The following charts (courtesy of ZeroHedge) paint a path that Australia could well follow. First the property boom:

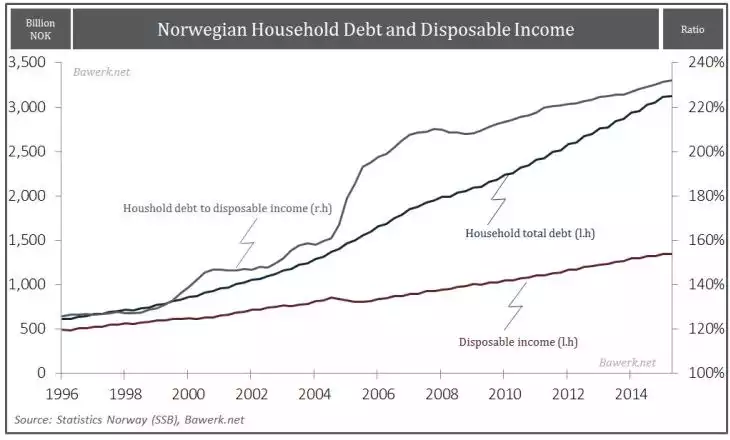

But when property prices run away from fundamentals you get the situation where the debt needed to buy that property far exceeds wage growth (using all that lovely cheap debt available because the rest of the world is not doing so great). Now ask yourself if the trajectory of this chart looks sustainable?

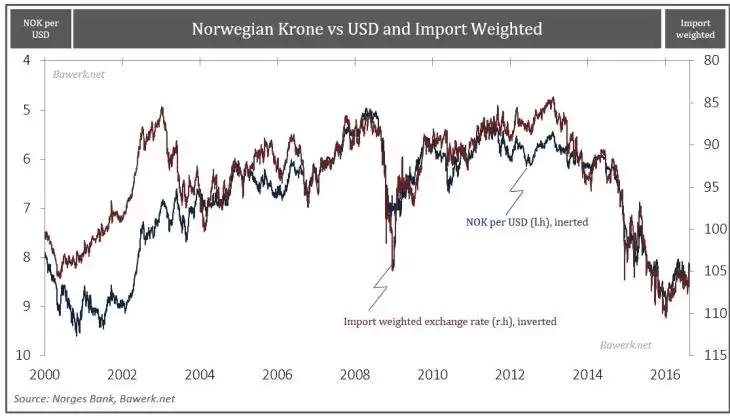

Like Australia, Norway imports (for consumption) more than it exports (for income). When your dollar weakens against the US, things become more expensive (on top of that growing loan interest bill):

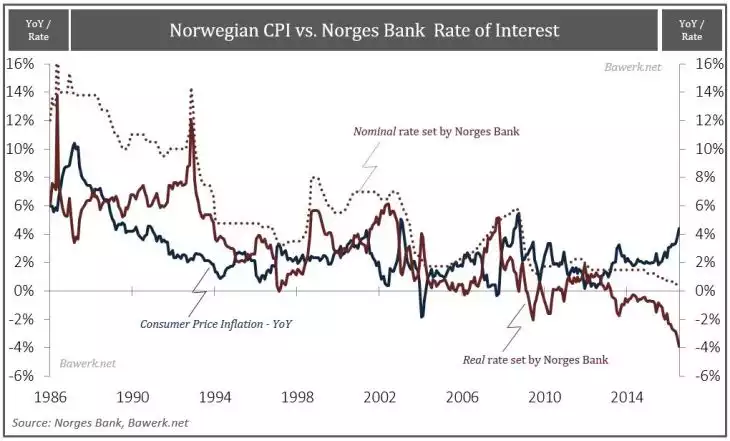

And finally because your central bank lowers interest rates to compete in the global currency war you start to see your real interest rates, that is nominal interest rates less inflation, head lower into negative territory. Our nominal rate just got lowered to 1.5%, Norway is down to 0.5%, a number we are likely headed towards. In Australia, whilst we are already just in negative real rates territory, we haven’t yet seen that surge in inflation, however the Norway / Australia story indicates we may be on the way…

PS – gold and silver LOVE negative real interest rates.